- Analytics

- News and Tools

- Market News

- European session review: the euro rebounded against the US dollar

European session review: the euro rebounded against the US dollar

The following data was published:

(Time / country / index / period / previous value / forecast)

7:30 Switzerland decision of the Swiss National Bank's base rate -0.75% -0.75% -0.75%

07:30 Meeting of Switzerland Swiss National Bank on Monetary Policy

8:30 UK Retail Sales m / m 1.9% Revised August from 1.4% -0.4% -0.2%

8:30 UK Retail sales, y / y in August to 6.3% Revised 5.9% 5.4% 6.2%

9:00 Eurozone Consumer Price Index m / m in August -0.6% 0.1% 0.1%

9:00 Eurozone Consumer Price Index y / y (final data) August 0.2% 0.2% 0.2%

09:00 Eurozone Consumer Price Index, the base value, y / y (final data) June 0.9% 0.8% 0.8%

9:00 The Eurozone trade balance, without seasonal adjustments in July 29.2 25 25.3

11:00 UK program volume BoE decision on asset purchases 435,435

11:00 UK Bank of England Minutes of the meeting

11:00 UK Bank of England Interest Rate Decision 0.25% 0.25%

The euro rebounded to the opening level against the US dollar after data on inflation and trade balance. Eurozone annual inflation was 0.2% in August 2016, stable compared with July. In August 2015, this figure was 0.1%. In the European Union annual inflation was 0.3% in August 2016, compared with 0.2% in July. A year earlier the rate was 0.0%. These figures are from Eurostat In August 2016 were reported negative rates in twelve Member States.

The lowest annual rates were recorded in Croatia (-1.5%), Bulgaria (-1.1%) and Slovakia (-0.8%). The highest rates were recorded in Belgium (2.0%), Sweden (1.2%) and Estonia (1.1%). Compared with July 2016, annual inflation fell in seven Member States, remained stable in six and rose in fifteen. The largest upward impact on the annual inflation in the euro area came from restaurants & cafés (+0.10 percentage points), fruits and vegetables (+0.07 percentage points), while fuels for transport (-0.35 p. n.), heating oil and gas (-0.12 percentage points) were the biggest downward impacts.

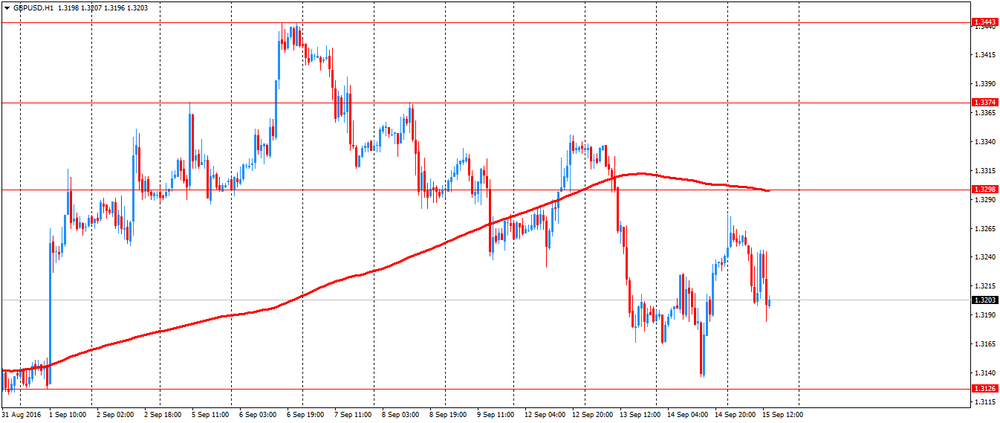

The British pound declined with delay after the Bank of England kept interest rates and quantitative easing program unchanged.

The statement was ambiguous, as the central bank's leaders recognized that a number of short-term economic indicators in some ways turned out to be stronger than expected. Also, they expect at least a significant slowdown in economic growth in the second half of the year.

The Bank of England left its key interest rate unchanged, but signaled its readiness to reduce it again later in the year if the UK's economic growth will continue to slow in line with expectations.

According to the text of the monthly statements of the Bank of England, all nine members of the Monetary Policy Committee at the September meeting unanimously voted to keep the key rate at 0.25%. In August, the rate was reduced to 0.25%.

The decision on lowering rates was part of a package of measurea to which the bank has resorted to support the economy after the unexpected results of the referendum on the UK's membership of the EU. The Bank of England also renewed an invalid bond purchase program and corporate securities included in the list of allowed for purchase.

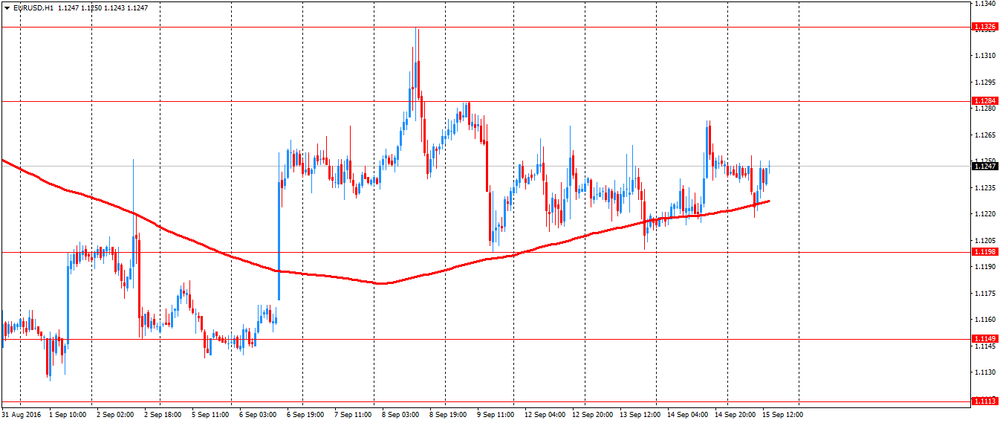

EUR / USD: during the European session the pair fell to $ 1.1218 and retreated

GBP / USD: during the European session, the pair fell to $ 1.3184

USD / JPY: during the European session, the pair rose to Y102.54

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.