- Analytics

- News and Tools

- Market News

- Asian session review The dollar reversals on Brainard's comments

Asian session review The dollar reversals on Brainard's comments

The Australian dollar fell slightly, despite the more positive-than-expected economic data from China and Australia. Today was published the monthly report on the index of business sentiment from Australian National Australia Bank. It is based on a survey of top managers of more than 500 green companies on the continent. It turned out that in August, the index fell 2 points to 7.0. However, the index of business sentiment rose to six, after a decline of one point in July. Also, increased sales and profits of companies and the employment index showed growth above the average by 4 points.

Also, today's report, published by China's National Bureau of Statistics showed that the volume of industrial production in August, year on year increased by 6.3%. Analysts had expected an increase of 6.1%. During the period from January to August of last year this indicator increased by 6.0%. Production growth was recorded in 33 of 41 industries. The highest growth rates showed the automotive and electronics industry.

Also today was reported that retail sales in China increased in August by 10.6%, after rising by 10.2% previously. Analysts had expected an increase of 10.3%. The volume of investments in fixed assets in China, with the exception of agriculture, grew by 6.1%, lower than the previous value of 8.1%, and experts forecast of 8.0% in January-August 2016.

At the end of eight months of this year the volume of investments in the Chinese mining industry grew by 21.5%. The inflow of investments in the manufacturing sector increased by 3%.

The US dollar traded in a narrow range against the major currencies, as investors continue to analyze the comments from the Fed before the meeting of the US central bank, which is scheduled for September 20-21.

Fed official Lael Brainard said yesterday that the grounds for preventive rate hikes seem less convincing, and improvement in the labor market has not had the desired impact on inflation. "Right now, the impact of external negative shocks stronger than before, focusing on downside risks than pre-emptively raise rates". According to the futures market, the likelihood of a hike in September is 12% against 24% before Brainard's speech. Meanwhile, the probability of rate increase during the December meeting of the Fed declined to 56.8% from 59.3% the previous day.

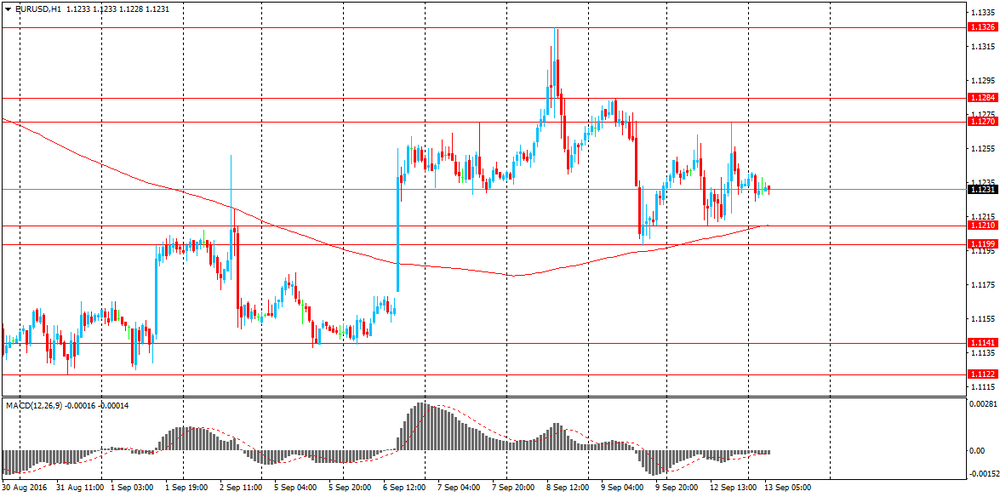

EUR / USD: during the Asian session, the pair was trading in the $ 1.1225-40 range

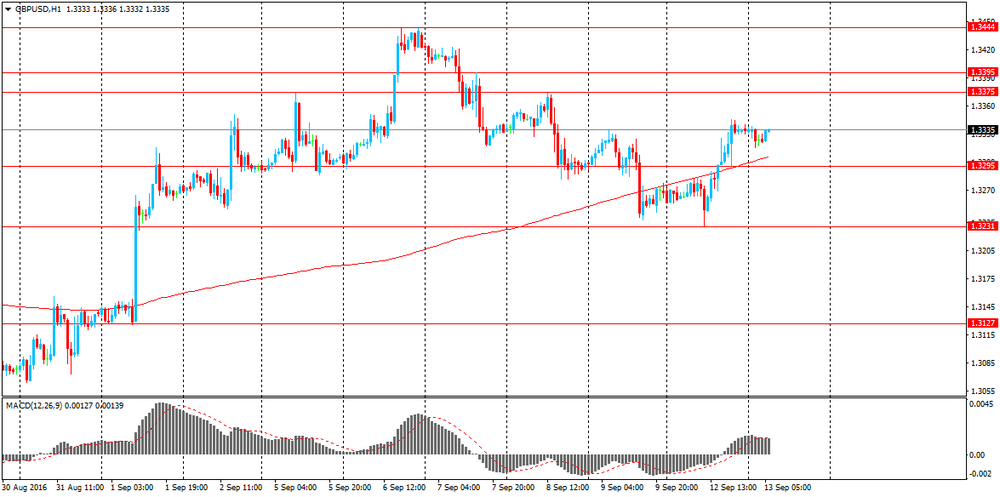

GBP / USD: during the Asian session, the pair was trading in the $ 1.3315-40 range

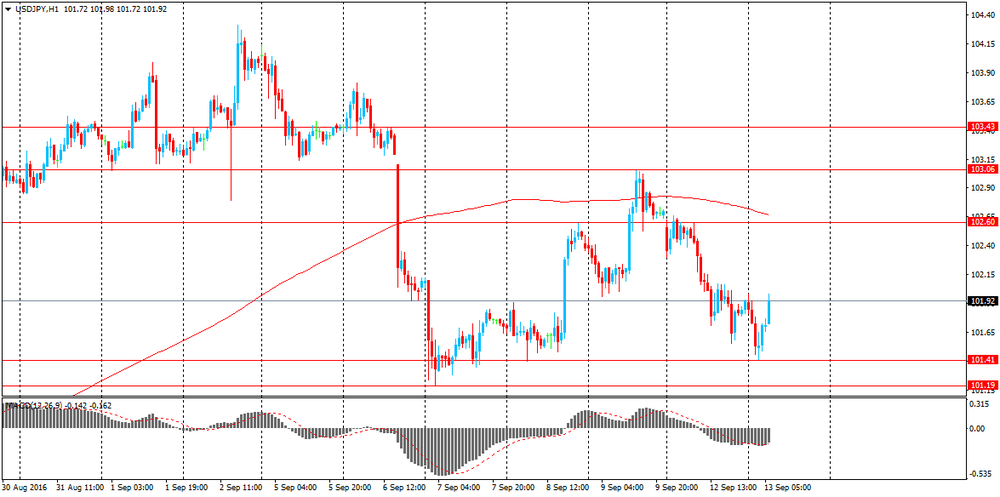

USD / JPY: during the Asian session, the pair was trading in the Y101.40-00 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.