- Analytics

- News and Tools

- Market News

- European session review: the US dollar lower against the yen

European session review: the US dollar lower against the yen

The following data was published:

(Time / country / index / period / previous value / forecast)

-------

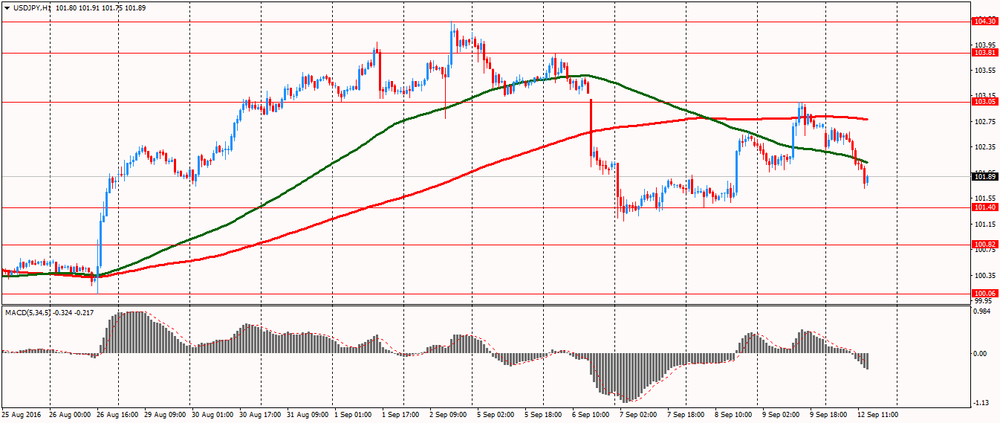

The US dollar was lower against the yen and is trading almost unchanged against the euro and the British pound. Against commodity currencies and emerging market currencies the dollar was trading higher.

According to analysts, investors tend to avoid risk, which leads to a drop in stock indices, the growth in demand for the yen, perceived as an asset of refuge, and the weakening of currencies which are considered a risky investment.

Market focus is now on the speech of the Fed Board of Governors member Leil Brainard - this will be the last Fed official commenting before FOMC meeting on 20-21 September.

In addition, traders are waiting for the next meeting of the Bank of England, which will be held September 14-15. In August, the British Central Bank lowered the interest rate from 0.5% to 0.25%, a new historical minimum. Previous level of the rate remained unchanged from March 2009. The Bank of England also increased its asset purchase program by 60 billion pounds to 435 billion pounds.

Danske Bank said that market participants fear "arguments in favor of a rate hike by Brainard, which had previously always been in favor of keeping them at a low level." At the same time the market feared a soft rhetoric from the Fed representative.

The UK data on consumer prices for August, which will be released on Tuesday, show whether the British began to pay more for everyday purchases. In addition, analysts also await the release of labor market data on Wednesday. In July, the number of applications for unemployment benefits fell, signaled that immediately after the referendum the situation on the labor market was quite acceptable.

Thursday data on retail sales is expected, which immediately after the referendum were good. In addition, on Thursday, the Bank of England will announce its decision on rates. According to analysts, the Central Bank will leave rates unchanged at 0.25%

EUR / USD: during the European session fell to $ 1.1210 from $ 1.1263

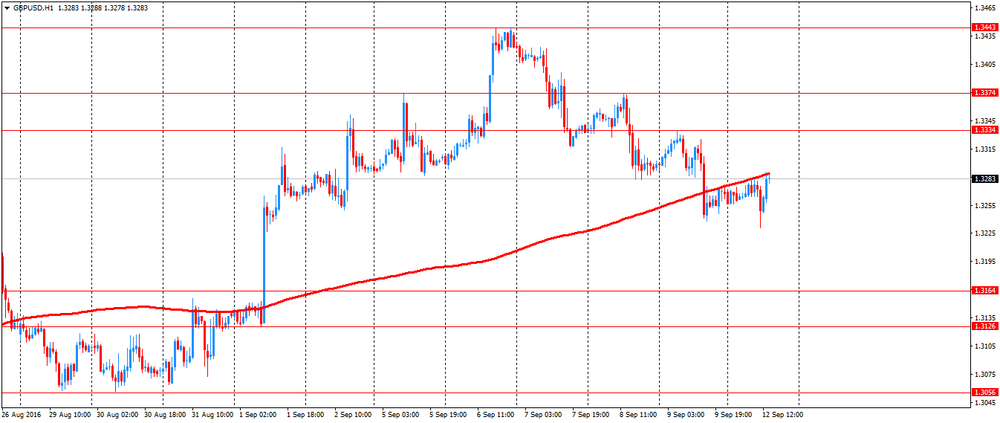

GBP / USD: fell to $ 1.3231, but then recovered to $ 1.3290

USD / JPY: during the European session, the pair fell to Y101.71

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.