- Analytics

- News and Tools

- Market News

- Asian session review: The Australian dollar traded without significant changes

Asian session review: The Australian dollar traded without significant changes

The Australian dollar traded almost unchanged in spite weaker data from Australia and China. According to data released today by the Australian Bureau of Statistics, the number of approved housing loans in July fell by -4.2% compared to June. At the same time, the June value was revised upward and reached +1.7% instead of 1.2%. It is also worth noting that the July value was much worse than economists forecast (-1.5%). At the same time, the consumer price index published by the National Bureau of Statistics of China, in August was 0.1%, below analysts' expectations of 0.3% and the previous value of 0.2%. In annual terms, the indicator rose by 1.3%, after rising 1.8% in July, a year earlier. The report of the National Bureau of Statistics says that a slowdown in the growth of food prices was the main factor that put pressure on the overall rate of inflation. The growth index of consumer prices was the lowest since October 2015 and well below the maximum target for this year of 3%, which gives Chinese authorities the opportunity to continue easing monetary policy against the backdrop of slowing economic growth.

Today, the markets expects the speech by the President of the Federal Reserve Bank of Boston Eric Rosengren. His comments can be a stimulus to the growth of the dollar.

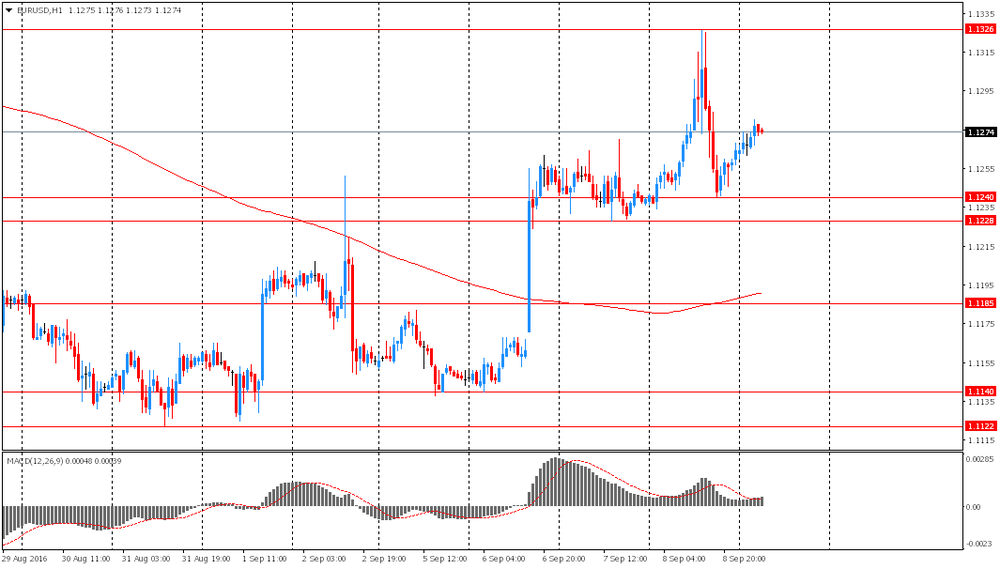

The euro traded moderately higher after ECB. The central bank that the expansion of the quantitative easing program was not discussed. Draghi confirmed that the Committee decided to maintain the interest rate at a record low 0.0%, in line with market expectations. The central bank also left unchanged the deposit rate at 0.4% and kept the margin rate at around 0.25%. Draghi said that the current monetary policy is still effective, and changes in the bank's forecasts are not so essential to decide on additional measures.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1265-85 range

GBP / USD: during the Asian session, the pair rose to $ 1.3335

USD / JPY: it fell to Y101.95 in the Asian session

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.