- Analytics

- News and Tools

- Market News

- Asian session review: the Australian dollar rose after RBA holds rate as expected

Asian session review: the Australian dollar rose after RBA holds rate as expected

The Australian dollar traded higher after the Reserve Bank of Australia decided to maintain the cash rate unchanged at around 1.5%. It is worth noting that the decision coincided with forecasts of most economists. The Central Bank pointed out that the decision to keep rates unchanged meets the objectives in relation to GDP and inflation. "With regard to the labor market, indicators of employment remain somewhat ambiguous and point to the growth of this sector in the short term," - said the Reserve Bank of Australia. In addition, analysts say that low interest rates are supporting domestic demand in the country. The RBA also commented on the Australian dollar, saying that the strengthening of the national currency may complicate the transition and recovery in the economy. At the same time, a lower rate of the Australian dollar has supported the trade sector.

Previously, data on the balance of payments have been published. Australia's current account deficit amounted to $ 15.54 billion in Q2 vs A -$ 19,75 mlrd forecast. In the first quarter a deficit of A -$ 20.8 was recorded. It also became known that the net external debt of Australia in the second quarter increased by 2.0%. The contribution of net exports to GDP growth fell by 0.2 percentage points in the 2nd quarter

The pound rose slightly despite the publication of weak statistics on retail sales in the UK. According to the poll of the British Retail Consortium (BRC), retail sales in the UK declined in August after rising in July by 0.9% compared to the same period of the previous year. In July, this indicator increased by 1.1%. Total sales decreased by 0.3% vs +0.1% in August 2015.

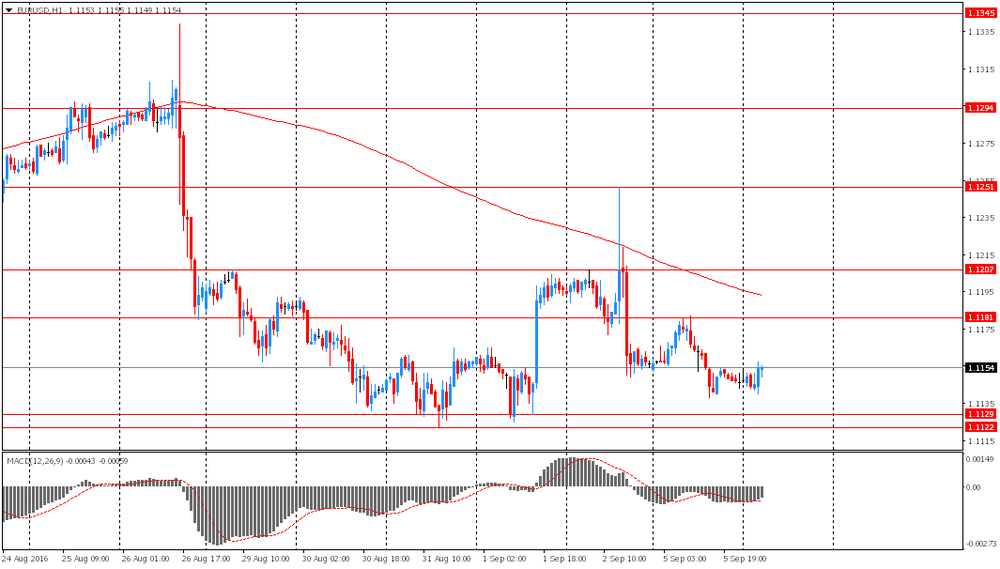

EUR / USD: during the Asian session, the pair was trading in the $ 1.1140-55 range

GBP / USD: during the Asian session, the pair rose to $ 1.3325

USD / JPY: during the Asian session, the pair was trading in Y103.35-80 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.