- Analytics

- News and Tools

- Market News

- The yen strengthened

The yen strengthened

The yen strengthened despite the dovish statements by the Bank of Japan. During his speech today the head of the Central Bank, Haruhiko Kuroda said that there is still room for easing monetary policy, and that the negative interest rates introduced in January are starting to have a positive impact. In addition, signaled that the benefits of further policy easing exceed its costs.

The US dollar traded in a narrow range after the publication of US labor market data on Friday. Recall, the Ministry of Labor said that the number of people employed in non-farm payrolls rose by 151,000 after a gain to 275,000 in July. The unemployment rate remained at around 4.9%, as more people entered the labor market. Economists had forecast a rise in the number of employees by 180 000 and the reduction in unemployment to 4.8%. Lowering employment growth came after the economy created a total of 546,000 jobs in June and July. Given the fact that the labor market has almost reached full employment and economic recovery from the recession years of 2007-09, the slowdown in job growth seems normal.

The Australian dollar rose after the publication of positive data on the index of China's service sector business activity and growth in operating profits of Australian companies. The Index of purchasing managers Caixin, published by Markit Economics, which is a leading indicator of China's state sector services in August was 52.1 points higher than the previous value of 51.7 and analysts' expectations of 51.9. Published by the Australian Bureau of Statistics the measure of profit from operations of the companies, in the second quarter grew by 6.6%, after declining by -4.4% in the first quarter. Analysts had expected an increase of 2.0%. This indicator reflects the total amount of pre-tax profits derived from commercial activities, excluding the cost of interest payments on debt and the cost of adjustment.

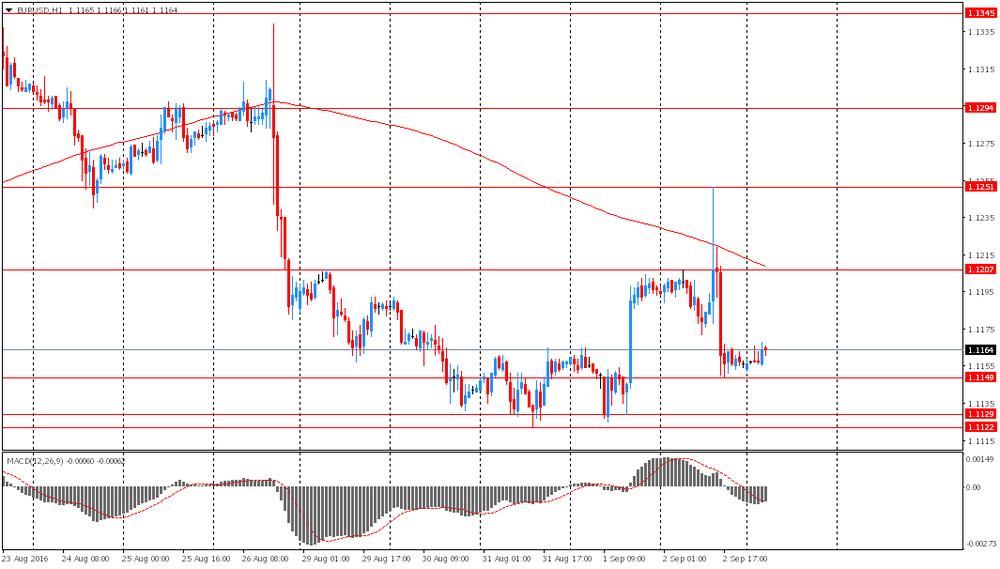

EUR / USD: during the Asian session, the pair rose to $ 1.1180

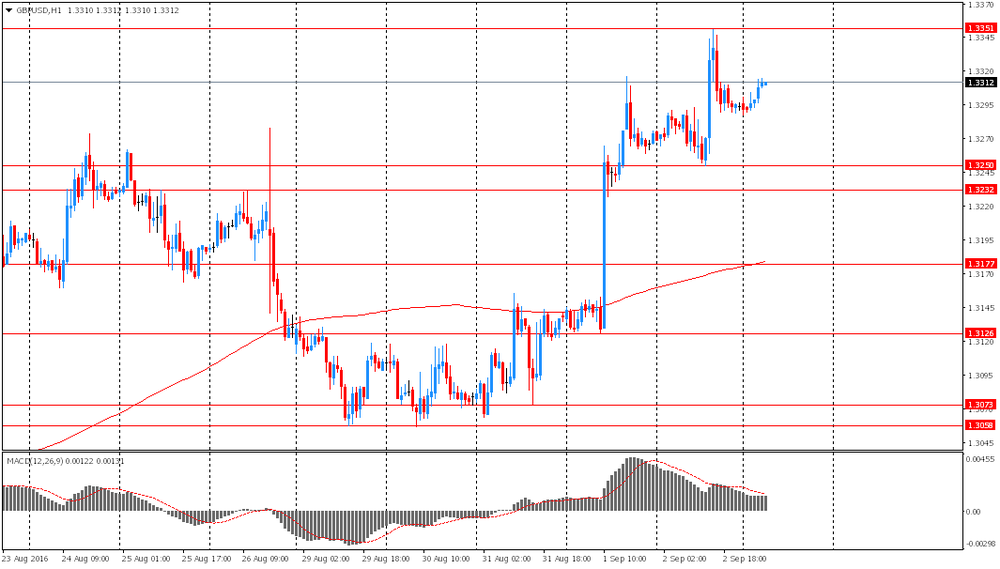

GBP / USD: during the Asian session, the pair rose to $ 1.3325

USD / JPY: it fell to Y103.25

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.