- Analytics

- News and Tools

- Market News

- European session review: The markets are waiting for a very important NFP

European session review: The markets are waiting for a very important NFP

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 UK index of business activity in the construction sector, m / m in August 45.9 46.1 49.2

9:00 Eurozone Producer Price Index m / m in July from 0.8% Revised 0.7% 0.1% 0.1%

9:00 Eurozone Producer Price Index y / y in July -3.1% -2.9% -2.8%

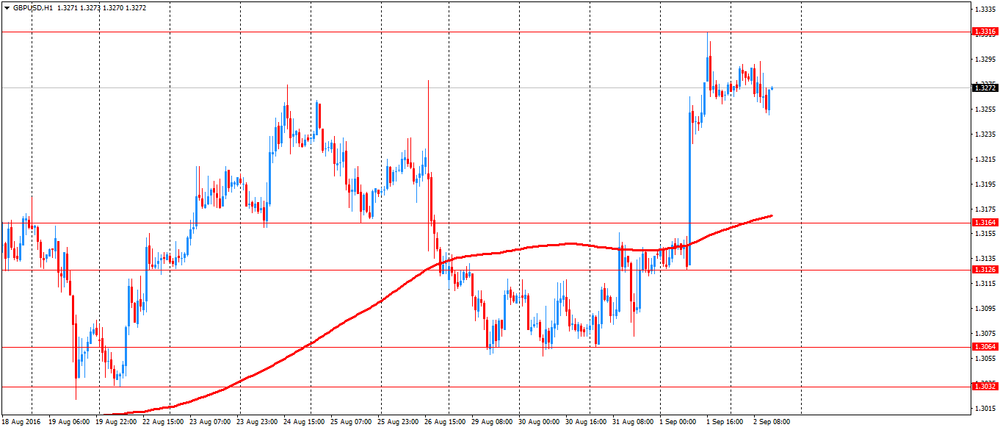

The British pound was trading almost flat against the dollar after a sharp rise the previous day. Today, investors evaluated data on the index of business activity in the construction sector.

UK construction sector registered a sustained reduction of business activity, but the rate of decline was only slight, showed Markit data.

Purchasing Managers Index from the Chartered Institute of Purchasing and Supply / Markit rose more than expected to 49.2 in August compared with a 85-month low of 45.9 in July. Last reading signaled the slowest rate of decline since the recession began in June.

Index value below 50 indicates a contraction in the sector. The index was forecast to rise to 46.1 was.

"The latest survey shows only a partial transition to stabilization, rather than a return to business as usual" said Tim Moore, senior economist at Markit.

The transition to stabilization correlated with more optimistic data on the UK manufacturing PMI for August, and gives us hope that in the short-term adverse fallout from the uncertainty of Brexit will be less severe than feared, Moore said.

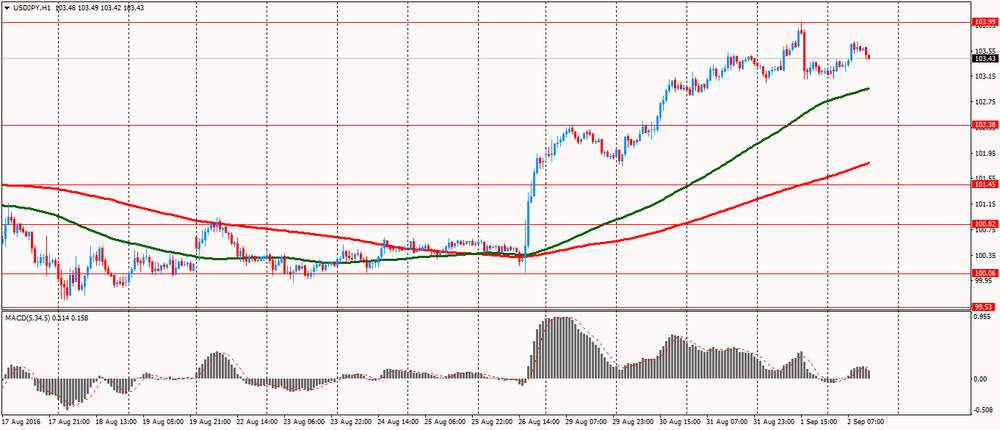

The US dollar is rose slightly on the eve of employment data, which will help to assess the probability of a rate hike in September. Analysts at ING prefer "tactical long positions on the dollar" against the New Zealand dollar, the British pound and the Japanese yen, which are sensitive to changes in interest rates.

According to the consensus forecast of economists surveyed by the WSJ, the number of US jobs outside agriculture rose by 180 000. In August, ING expect an increase in the number of jobs at 150,000 and increase wages by 0.3% compared with the previous month. The consensus forecast assumes growth of wages by 0.2%. That should be enough to "spur the Fed's leadership," they say in ING.

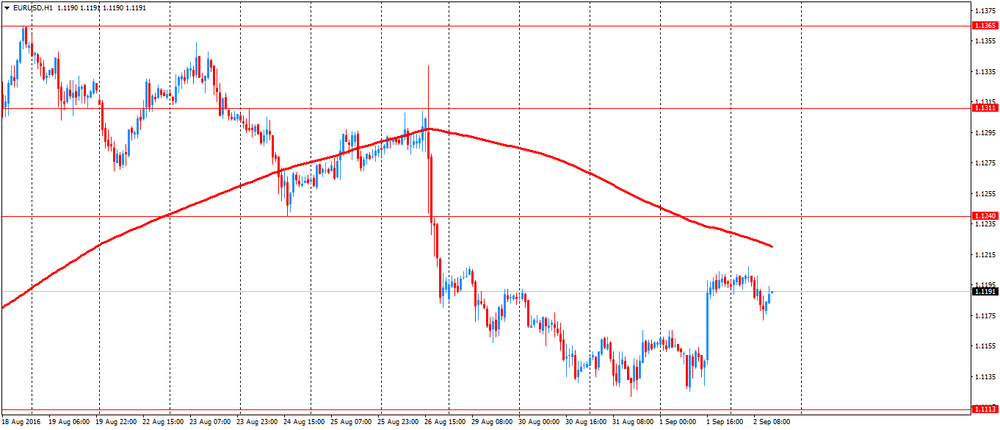

Euro moderately weakened against the US dollar against the strengthening US currency and under the influence of data on producer prices in the euro area.

Eurozone producer prices continued to fall in July, but the rate of decline decreased for the third month in a row, according to Eurostat preliminary data released on Friday.

Producer prices fell by 2.8 percent year on year, after falling 3.1 percent in June. Economists had forecast a decline of 2.9 percent.

Compared with the previous month, producer prices rose 0.1 percent in July, after rising 0.8 percent in June, from a revised 0.7 percent. The last increase was in line with economists' expectations. Prices rose for the third month in a row.

EUR / USD: during the European session, the pair fell to $ 1.1172

GBP / USD: during the European session, the pair fell to $ 1.3250

USD / JPY: during the European session, the pair rose to Y103.70

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.