- Analytics

- News and Tools

- Market News

- Company news: The European Commission requires Apple (AAPL) to pay tax in amount of about 13 billion euros

Company news: The European Commission requires Apple (AAPL) to pay tax in amount of about 13 billion euros

According to the European Commission's material published on the official website of the authority, a thorough investigation, which began in June 2014, found that Ireland has granted Apple's unjustified tax breaks of 13 billion euro. This is contrary to the rules of public support in the EU, as it allowed the American corporation to pay much less in taxes than other companies. Now, Apple is expected to return Ireland unpaid taxes plus interest.

According to the Anti-Monopoly Policy EU Commissioner Margaret Vestager, Ireland showed "selective attitude" to Apple and has enabled the company during the period from 2003 to 2014 to pay from 0.005% to 1% income tax from operations in Europe.

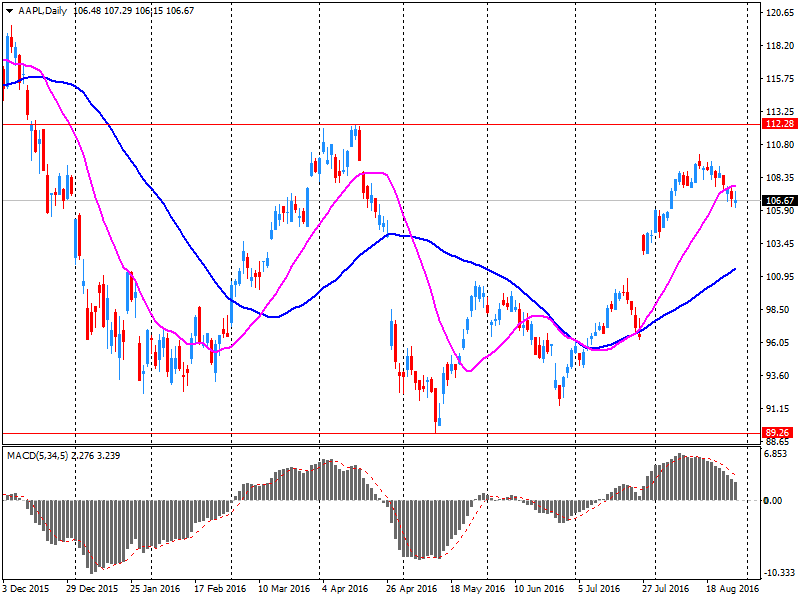

AAPL shares fell in premarket trading to $ 105.74 (-1.01%).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.