- Analytics

- News and Tools

- Market News

- European session review: the US dollar continues to rise

European session review: the US dollar continues to rise

The following data was published:

(Time / country / index / period / previous value / forecast)

The US dollar is rising moderately after the sharp rise on Friday as upbeat comments from US Federal Reserve's Janet Yellen on the state of the US economy have increased expectations of a rate hike.

During the annual conference of the representatives of the world's central bankers in Jackson Hole, Wyoming, Yellen said that the possibility of rate hike has increased in recent months against the backdrop of the recovery of the labor market and the economy.

Yellen not called the timing of rate increases, but the Fed Vice Chair Stanley Fischer said that her comments correspond to the growth expectations of the likely increase in 2016.

"The dynamics of the markets influenced not so much by Yellen as Fisher", - said Ayako Sera of Sumitomo Mitsui Trust Bank.

Futures on interest rates indicate that market participants estimate the probability of a rate hike in September at more than 30 percent instead of 18% before Yellen and Fisher showed FedWatch data from CME Group. The probability of a rate hike has grown to more than 60 percent in December from 57 percent on Friday.

According to analysts, now markets attach great importance to data on the number of jobs in the US (NFP), to be published on Friday.

US Dollar "increased significantly" after "comments that indicate a tendency to tighten policy," said analysts of Danske Bank and added that the employment data in the United States "will have a decisive influence on the short-term prospects for the US dollar."

The pound weakened against the US dollar while investors await important statistics from Britain.

On Tuesday, the Bank of England will publish data on lending to households and businesses in July, which will help understand whether the market disturbances have a negative impact on lending in the UK.

On Thursday, the PMI index will be released for the manufacturing sector. Markets hope that he will clarify how strongly the manufacturers recover.

EUR / USD: during the European session, the pair fell to $ 1.1166

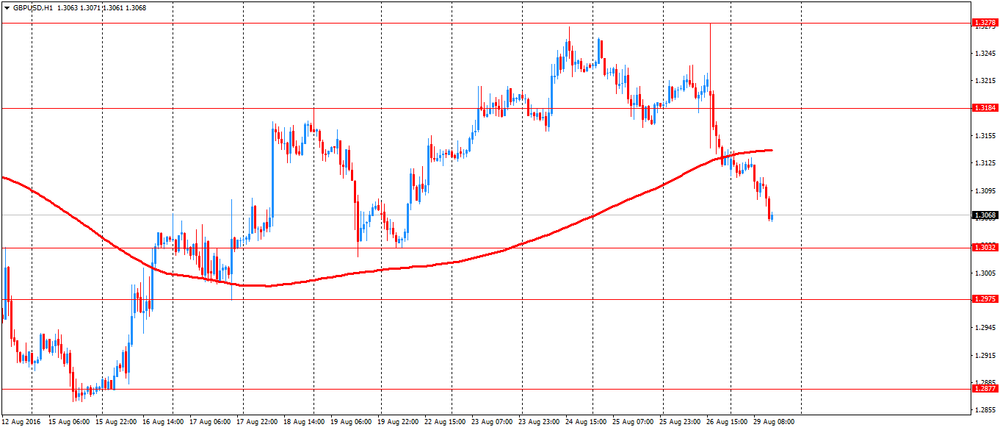

GBP / USD: during the European session, the pair fell to $ 1.3061

USD / JPY: during the European session, the pair rose to Y102.38 and retreated

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.