- Analytics

- News and Tools

- Market News

- Asian session review: the US dollar traded in a narrow range

Asian session review: the US dollar traded in a narrow range

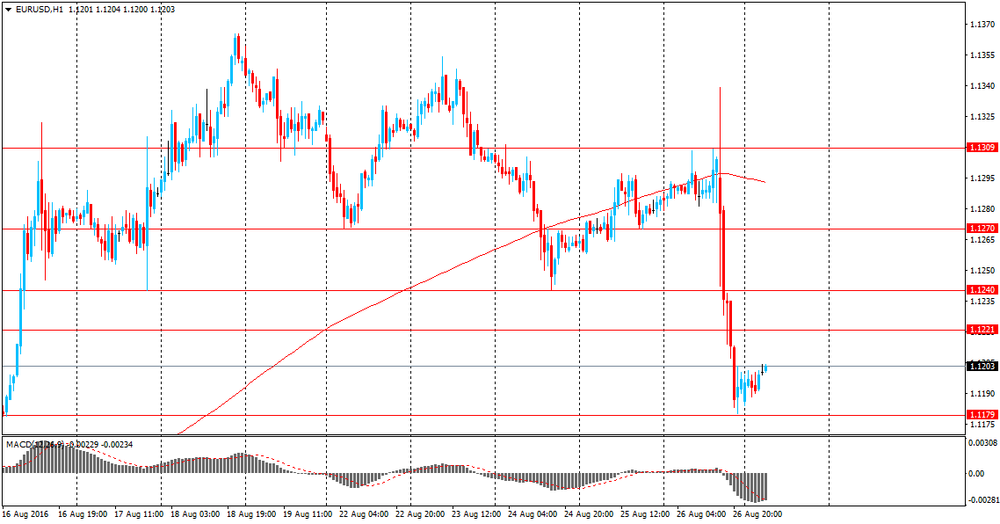

The US dollar traded in a narrow range against the euro. On friday comments by Fed's Janet Yellen caused choppy conditions but eur/usd was traded lower. She did not specify exactly when the rates may be increased, in September or in December, but noted that the grounds for increasing rates increased.

Yellen said that against the backdrop of continuing positive momentum in the labor market and the outlook for economic activity and inflation, the arguments in favor of raising interest rates have increased in recent months. The decision on raising rates, as before, will depend on the extent to which the incoming statistical data confirm this forecast, stressed Yellen.

Other Fed officials also support the rate hike, although, like Yellen, they did not give predictions on the timing of further policy tightening. The next Fed meeting will be held on September 20-21. Some analysts believe that rates will be raised at this meeting.

As reported today by Bloomberg, the probability of a rate hike at the September meeting rose to 42% from 22% a week ago, and the probability of a rate hike at the December meeting rose to 65%.

During today's Asian session, the yen continued to decline after the Bank of Japan's head Haruhiko Kuroda, said that the Bank of Japan will act "without hesitation" to revive inflation.

"The Bank of Japan will continue to closely study the risks and take additional easing measures without hesitation"

The Australian dollar fell against the background of the widespread increase in the US dollar and, to some extent, on the negative data on new home sales. Sales of new homes published by the Association of the housing industry, fell by -9.7% in July, after rising 8.2% in June. This indicator expresses the volume of new home sales in Australia and assesses conditions in the housing market.

EUR / USD: during the Asian session, the pair was trading in 1.1190-1.1210 range.

GBP / USD: during the Asian session, the pair was trading in the $ 1.3110-40 range.

USD / JPY: during the Asian session, the pair was trading in Y101.80-102.40 range.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.