- Analytics

- News and Tools

- Market News

- Asian session review: tight ranges as "hawkish" comments from Fed not enough

Asian session review: tight ranges as "hawkish" comments from Fed not enough

The following data was published:

23:30 Japan Consumer Price Index in the region of Tokyo y / y in August -0.4% -0.5%

23:30 Japan Consumer Price Index with the exception of the price of fresh produce in the region of Tokyo y / y in August -0.4% -0.3% -0.4%

23:30 Japan National CPI y / y in July -0.4% -0.4%

23:30 Japan National Consumer Price Index with the exception of the price of fresh food, y / y in July -0.5% -0.4% -0.5%

06:00 Germany consumer confidence index from the GfK September 10 9.9 10.2

The US dollar continues to decline against major currencies in anticipation of Fed's Yellen speech.

Traders consider a further tightening of monetary policy unlikely in the background of weak data on economic growth and productivity. However, the positive comments from the Federal Reserve's officials in recent days have increased hopes for a rate hike.

Esther George said it is time to change the interest rate. Consumer spending and the labor market - the bright spots of the US economy, but business investment continues to disappoint. George agreed to the plan to gradually raise interest rates.

Fed funds futures indicates that investors see a 54% chance of a rate hike in December, according to the CME Group.

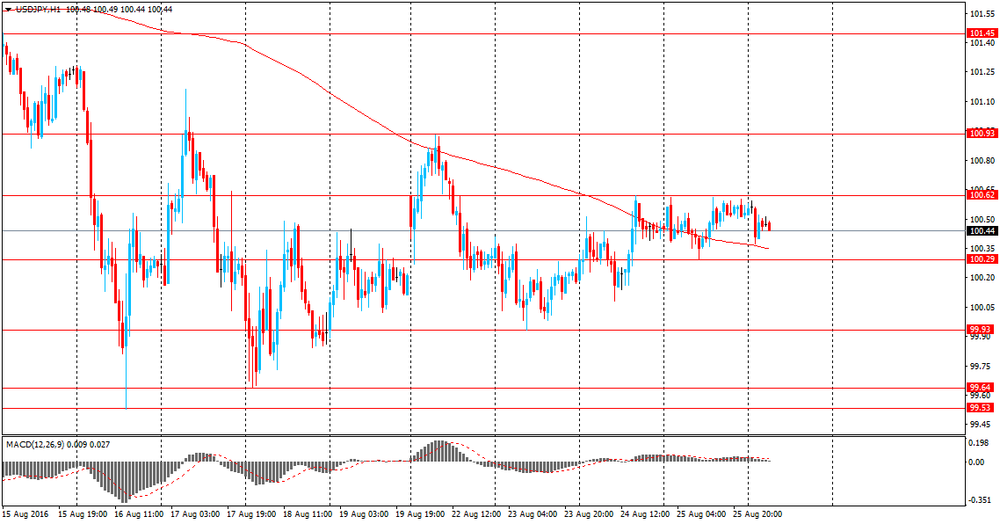

The yen is trading in a narrow range. Data published today show that consumer prices in Japan continued to fall in July, which means that the Bank of Japan may be forced to act to stimulate inflation.

Japan National Consumer Price Index in July, year on year, down by -0.4%, in line with economists' forecast and the previous value. In August, the indicator for Tokyo area fell by -0.5%. The largest drop in July showed prices for electricity and gasoline.

The data are an assessment of price movements obtained by comparison of the retail prices of the relevant basket of goods and services. CPI - the most important barometer of changes in purchasing trends. Inflation reduces the purchasing power of the yen.

National CPI, except for the price of fresh food, decreased by 0.5%, after declining by 0.4% in June. The consumer price index except fresh products in the region of Tokyo, declined by -0.4% year on year, while economists forecasts -0.3%

The national consumer price index excluding food and energy for the period from January to July rose by 0.3% after rising 0.5% in the same period a year earlier

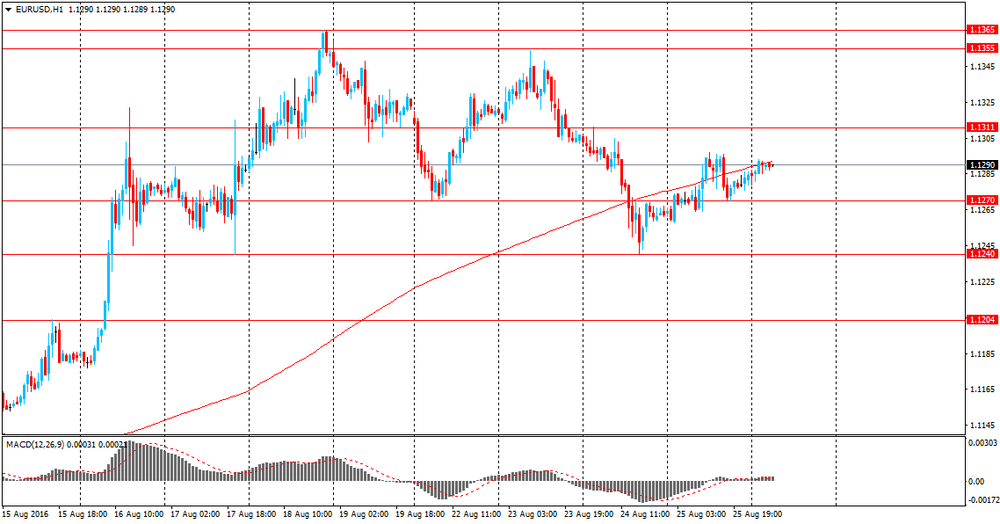

EUR / USD: during the Asian session, the pair was trading in the 1.1280-1.1310 range

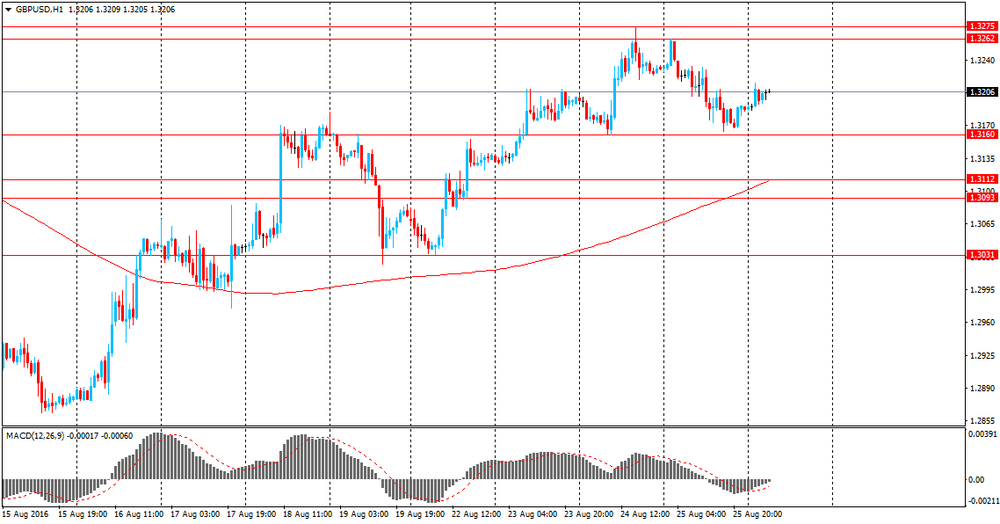

GBP / USD: during the Asian session, the pair was trading in the $ 1.3180-1.3220 range

USD / JPY: during the Asian session, the pair was trading in the Y100.40-60 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.