- Analytics

- News and Tools

- Market News

- WSE: Session Results

WSE: Session Results

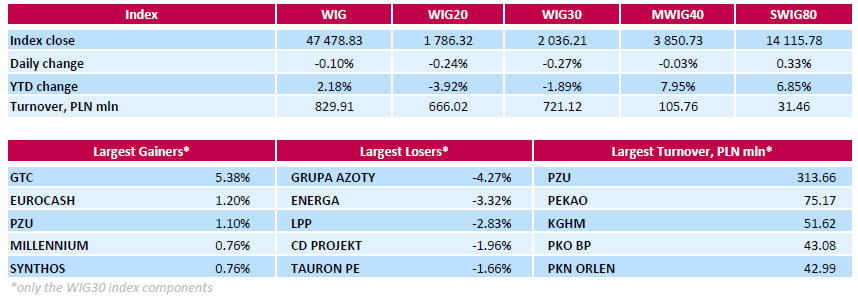

Polish equity market closed lower on Wednesday. The broad market benchmark, the WIG Index, fell by 0.1%. Sector performance in the WIG Index was mixed. Utilities (-1.37%) recorded the biggest decline, while developing sector (+1.53%) outpaced.

The large-cap stocks' measure, the WIG30 Index, lost 0.27%. In the index basket, chemical producer GRUPA AZOTY (WSE: ATT) tumbled the most, down 4.27%, as the company posted lower-than-expected Q2 earnings. Its net income amounted to PLN 44.4 mln in Q2, down 62.6% y/y and well below analysts' consensus estimate of PLN 118.8 mln. Meanwhile, the company's revenues fell by 5.2% y/y to PLN 2.16 bln in Q2, but beat analysts' consensus estimate of PLN 2.04 bln. Given weak Q2 earnings, GRUPA AZOTY cut its FY16 capital expenditure target by 20% to PLN 1.6 bln. Other major decliners were genco ENERGA (WSE: ENG), clothing retailer LPP (WSE: LPP) and videogame developer CD PROJEKT (WSE: CDR), plunging by 3.32%, 2.83% and 1.96% respectively. On the other side of the ledger, property developer GTC (WSE: GTC) led the gainers, climbing by 5.38%, as the company's quarterly financial report revealed it returned to profit in the Q2, helped by lower financial costs and revaluation of assets and real estate development projects. GTC posted net income for Q2 of EUR 18.8 mln, a turnaround from a loss of EUR 1.9 mln for the same three-month period last year. The bottom-line result was generally in-line with analysts' consensus estimate of EUR 18.3 mln.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.