- Analytics

- News and Tools

- Market News

- Asian session review: the Dollar strengthened against major currencies

Asian session review: the Dollar strengthened against major currencies

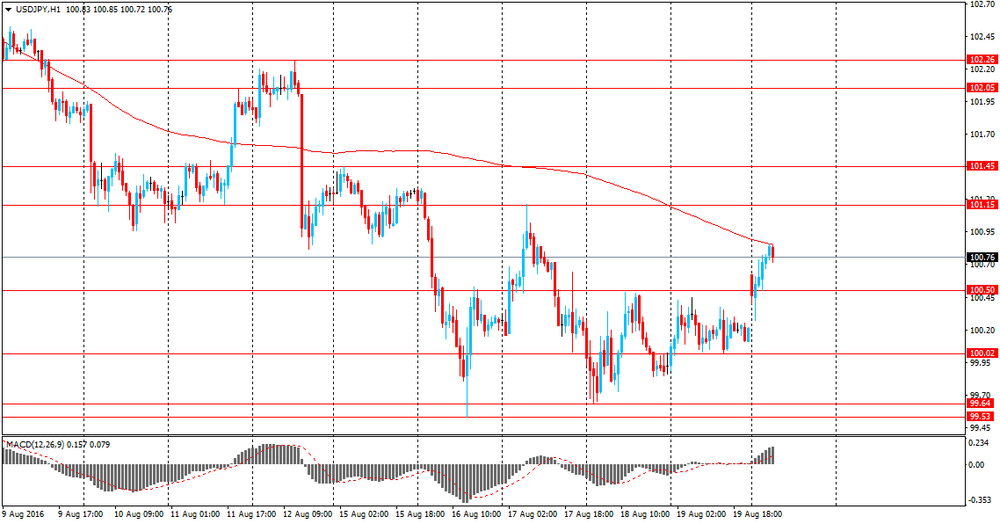

The dollar rose against the yen after the head of the Bank of Japan Haruhiko Kuroda said in an interview with Sankei newspaper that did not rule out the possibility of further reduction in interest rates. He also noted that the change in asset purchases in September will receive a more detailed analysis of the results of the monetary policy.

Also this week, investors will be expecting the Federal Reserve Janet Yellen's speechs at the annual meeting of leading bankers and economists in Jackson Hole, to receive fresh signals on the timing of the next interest rate increase in the United States. After a speech at Jackson Hole in 2014 the dollar changed course and started a long period of apreciation lasting to this day.

The dollar rose against the euro also. Support for the US currency was recent comments by the Fed, which increased the likelihood of a new interest rate hike. The president of the Federal Reserve Bank of San Francisco, Williams said that the Central Bank should hike "sooner rather than later." He added that the US economy is strong enough to withstand the increase in the cost of borrowing, but expressed concern about inflation. According to Williams, the strength of the economy confirms the steady growth of employment, strong consumer spending and improving in the financial condition of households. Meanwhile, the president of the Federal Reserve Bank of New York Dudley also expressed optimism about the US economic outlook, noting that strong data on the number of jobs in the past two months, helped soothe fears that the pace of job creation beginning to slow down. "However, the situation began to change. For the first time in quite a long period the number of new jobs with an average salary was higher than in the categories with the highest and lowest wages"

Futures on interest rates suggest that investors see a 18% chance of a rate hike in September and 43.1% probability of such a move in December.

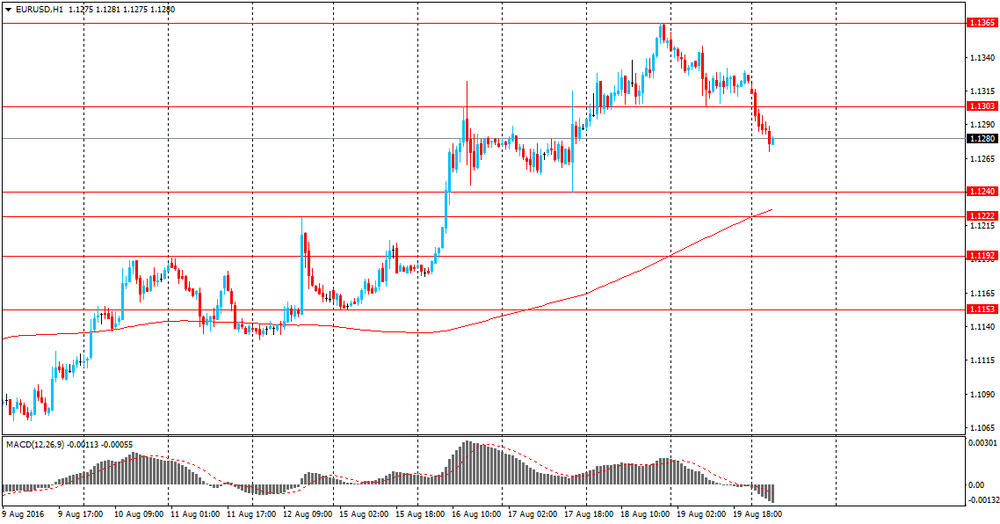

EUR / USD: during the Asian session, the pair was trading in the $ 1.1280-1.1320 range

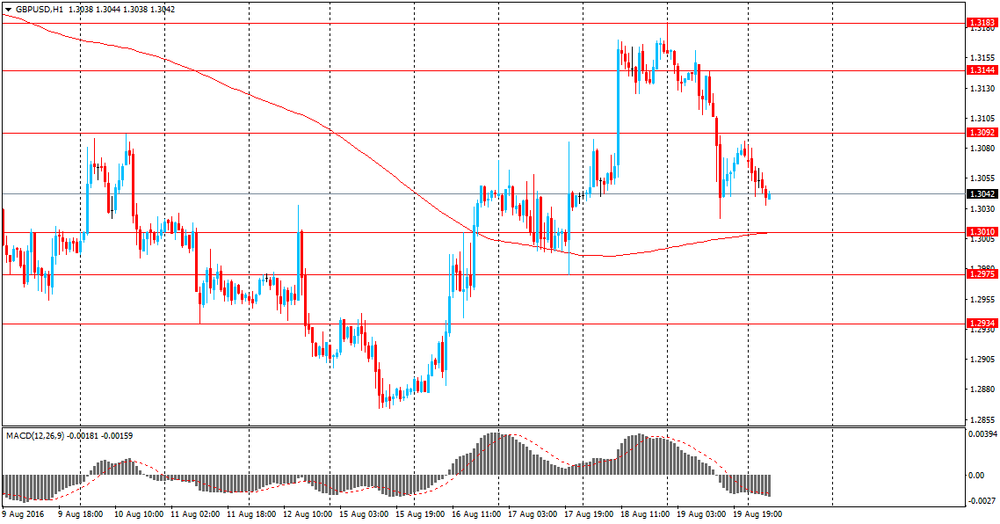

GBP / USD: during the Asian session, the pair was trading in the $ 1.3030-50 range

USD / JPY: during the Asian session, the pair was trading in the Y96.00-40 range.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.