- Analytics

- News and Tools

- Market News

- European session review: the pound rose sharply on strong retail sales data

European session review: the pound rose sharply on strong retail sales data

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Eurozone balance of payments, without taking into account seasonal adjustments, 16.5 billion in June from 15.4 37.6 Revised

08:30 UK Retail Sales m / m in July -0.9% 0.2% 1.4%

8:30 UK Retail sales, y / y in July 4.3% 4.2% 5.9%

9:00 Eurozone construction volume change, y / y in June -0.8% 0.6%

9:00 Eurozone Consumer Price Index m / m in July 0.2% -0.5% -0.6%

9:00 Eurozone Consumer Price Index y / y (final data) July 0.1% 0.2% 0.2%

9:00 Eurozone consumer price index base value, y / y (final data) July 0.9% 0.9% 0.9%

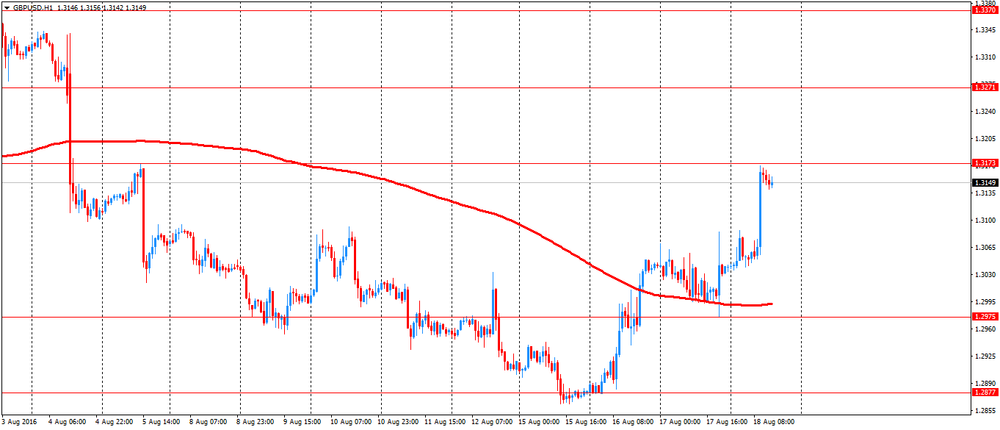

The pound rose sharply against the US dollar afterdata on retail sales exceeded forecasts. In the UK, retail sales rebounded in July, as sales in stores of food and non-food products rose, showed the Office for National Statistics.

Retail sales, including automotive fuel, increased by 1.4 percent for the month, after a 0.9 percent drop in June. Sales were expected to grow by only 0.2 percent.

In the same way, except automotive fuel, retail sales rose 1.5 percent after falling 0.9 percent the previous month. The increase was much faster than expected (+0.3%)..

In annual terms, the growth in the overall volume of retail sales improved to 5.9 percent in July from 4.3 percent. Sales excluding auto fuel advanced 5.4 percent, faster than the growth of 3.9 percent in June.

Economists had forecast that total sales will grow by 4.2 percent, while sales excluding automotive fuel will rise by 3.9 percent.

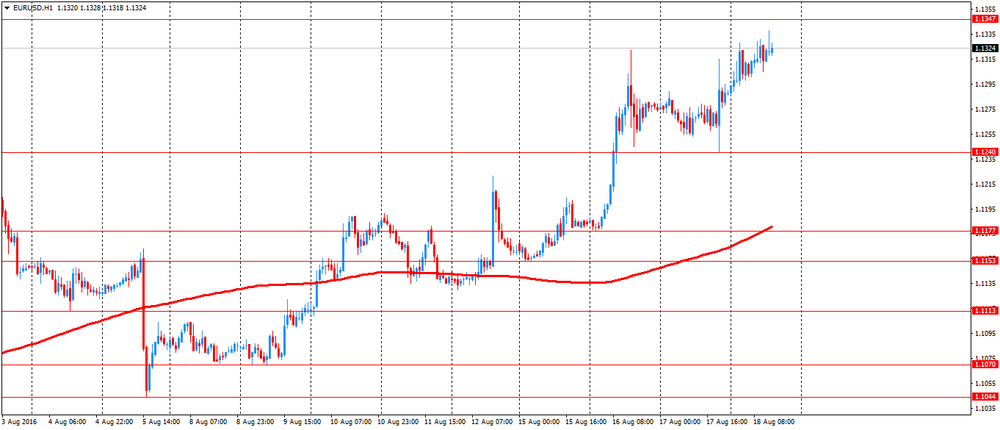

The euro rose moderately against the US dollar, continuing the rise started yesterday. Pressure on the dollar put protocols of the July meeting of the FOMC, which showed that between the leaders of the Fed there is no agreement on the policy tightening. Markets were waiting for the signal of a tight policy, but protocols have been balanced.

FOMC members sought to reconcile views on the economic outlook and the timing of interest rate increases, and sought to leave open all possibilities. Some Fed officials suggested not to tighten policy until there is more confidence in the achievement of the inflation target of 2%, and others said that the US labor market is almost fully recovered.

Today investors focus on euro zone inflation data for July.

Inflation rose to 0.2 percent from 0.1 percent in June. Prices rose for the second month in a row in July.

Inflation remains below the target level of the European Central Bank's.

Core inflation, which excludes energy, food, alcohol and tobacco, remained stable at 0.9 percent in July.

Both the consumer and the main indicators of inflation matched the preliminary estimate published on 29 July.

On a monthly basis, consumer prices fell 0.6 percent in July.

EUR / USD: during the European session, the pair rose to $ 1.1338

GBP / USD: during the European session, the pair rose to $ 1.3170

USD / JPY: during the European session, the pair rose to Y100.49

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.