- Analytics

- News and Tools

- Market News

- Asian session review: RBNZ cuts as expected, New Zealand dollar rose

Asian session review: RBNZ cuts as expected, New Zealand dollar rose

During the Asian session was observed on NZD/USD a "buy the rumors, sell the news" scenario after RBNZ cuts rates by 0.25%, as expected.

The Reserve Bank of New Zealand lowered its key interest rate by a quarter percentage point to a record low of 2.00%, and signaled the likelihood of further policy easing in order to accelerate inflation and curb the growth of the New Zealand currency.

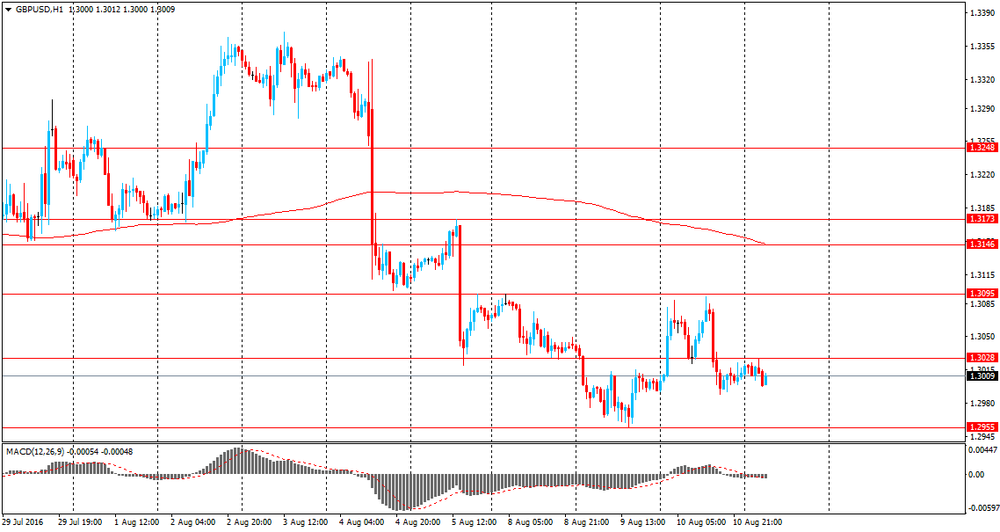

The pound traded in a narrow range with a slight decline after the last Bank of England was unable to acquire sufficient amount of long-term government bonds as part of its quantitative easing program the size of 1.17 billion pounds, Bid to Cover: 0.96. The Bank of England announced its intention to include the missing 52 million pounds in the second half of the six-month program of asset purchases.

Also published today data on the index of housing prices in the UK. According to the Royal Institute of certified real estate appraisers (RICS), UK house price index increased by 5% in June, lower than the previous value of 16% and +6% expectations. According to the RICS report, house prices in the UK grew the slowest pace in three years. The Index decrease was due to the result of the referendum as well as changes in tax legislation.

The New Zealand dollar rose after the Reserve Bank of New Zealand lowered its key interest rate by 25 bps to a record low of 2.00% and signaled further easing of its monetary policy. Central bank's decision coincided with market expectations. RBNZ said in the July economic report that is likely to further easing policies to ensure the stabilization of inflation in the middle of 1-3% range. Currently, the annual inflation rate is only 0.4%, far below the target range. Reserve Bank of New Zealand Governor Graeme Wheeler said the annual inflation is expected to weaken in the third quarter, but to increase in the fourth quarter.

RBNZ also made it clear that the exchange rate remains a source for concern. Wheeler said that the trade-weighted index of the New Zealand dollar is considerably higher than anticipated in the June statement.

Wheeler also said that inflation in house prices remains high, but the planned macroprudential measures should reduce the risks to the financial system.

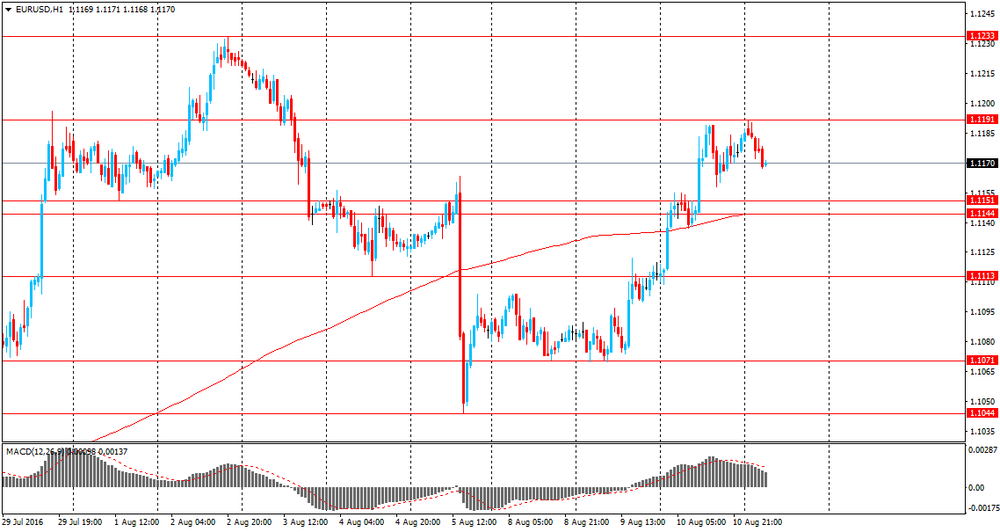

EUR / USD: during the Asian session, the pair was trading in the $ 1.1160-70 range

GBP / USD: during the Asian session, the pair is trading in $ 1.2995-1.3010 range

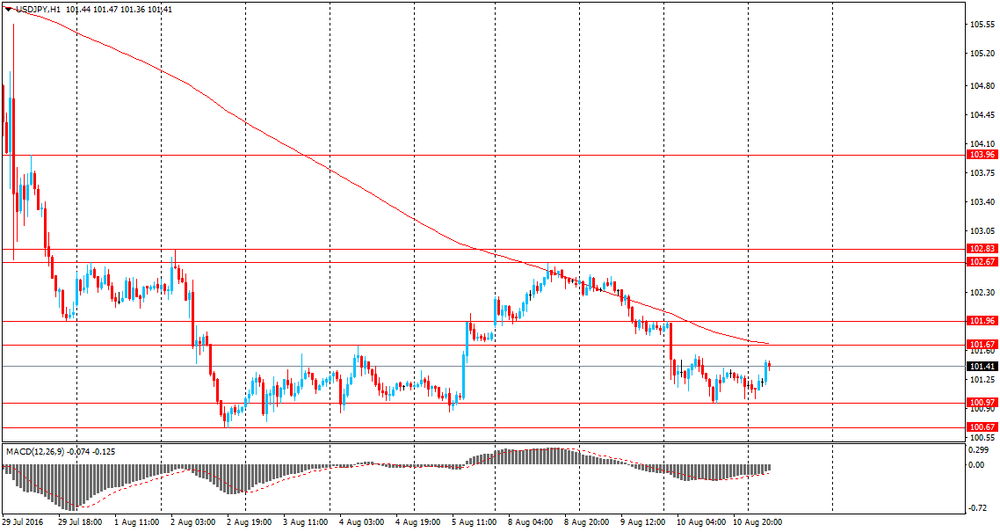

USD / JPY: during the Asian session, the pair was trading in Y101.00-101.40 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.