- Analytics

- News and Tools

- Market News

- Asian session review: US dollar continues to decline

Asian session review: US dollar continues to decline

During the Asian session, the US dollar continued to decline against other major currencies, as yesterday's preliminary data showed that labor productivity in the United States continued to decline this spring to record third quarterly drop in a row, which could jeopardize the acceleration of wage growth and the economy as a whole in the coming years. This was stated by the Ministry of Labour.

The data showed that the level of labor productivity in the agricultural sector - the gauge of production of goods and services for one hour- decreased in the 2nd quarter by 0.5% compared to the first quarter. The reason for this change has been a more rapid growth in hours worked than in output. Recall that in the first quarter productivity fell by 0.6%.

Also today positive data on orders for engineering products, and the index of activity in the Japanese service.

Orders for Japanese machine building products increased by 8.3% in June, higher than economists' forecast of 3.1%. In May the decline was -1.4%.

The index of activity in the service sector, published by the Ministry of Economy, Trade and Industry of Japan, increased by 0.8%, higher than analysts' expectations of +0.3% in June. The index of activity in the services sector reflects the state of Japan's domestic service sector, including information and communications, electricity, gas heating and water supply, services, transport, wholesale and retail trade, finance and insurance, and social security. Typically, a high value of the index is a positive factor for the Japanese currency.

The Australian dollar rose against the weakening of the US currency, as well as positive data on the index of consumer confidence. The consumer confidence index in Australia published by the Faculty of Economics and Commerce at the University of Melbourne, grew by 2% in August, after a decline of 3% in July. This indicator reflects the level of public confidence in the economy by means of ratings respondents into categories such as personal financial situation in the past year and the outlook for next year, expectations about the economic situation in the 1 and 5 year term, as well as the current consumer climate in terms of households readiness to commit large purchases. In general, high levels are considered to be a positive factor for the Australian currency. Westpac survey was conducted during the first four days of August.

Also Today the head of the RBA Glenn Stevens said the central bank's inflation target is flexible, and inflation may remain below target for some time.

Stevens also said that the leadership of the central bank, whose task is to balance the risks in the economy, discussed the risks associated with the preservation of very low interest rates.

"Given the low interest rates around the world, it would be strange to think that Australia will not follow the example of other central banks," - said Stevens and added - "You can not rely solely on interest rates in an effort to accelerate economic growth"

Also the head of the RBA stated the need to increase the efforts to accelerate the growth of the country's GDP.

Earlier, the number of mortgage loans in Australia increased by 1.2% in June, below economists' forecast of 2.3%. The value from May was revised from -1% to -0.8%

Report on mortgages, published by the Australian Bureau of Statistics shows the number of approved housing loans. It also traces the development trend in the housing market in Australia, and the level of consumer confidence, as large loans to purchase real estate are not taken into account. The high value of the index is a positive factor for the Australian currency.

Also, the Australian Bureau of Statistics reported that the volume of approved home loans linked to investments, increased by 3.2% compared to May, when the growth was recorded at 3.9%.

The Australian Bureau of Statistics report shows that the growth of investment loans remained stable at the level of 0.3-0.4% per month, so a bit limited, but not slowing further.

Today's data suggest that financing flows in the housing market continues.

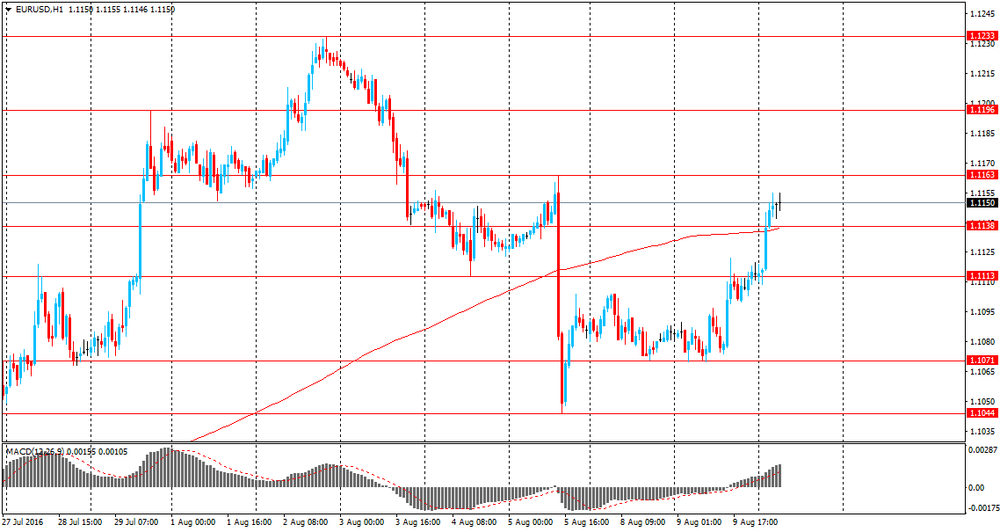

EUR / USD: during the Asian session, the pair was trading in the $ 1.1110-45 range

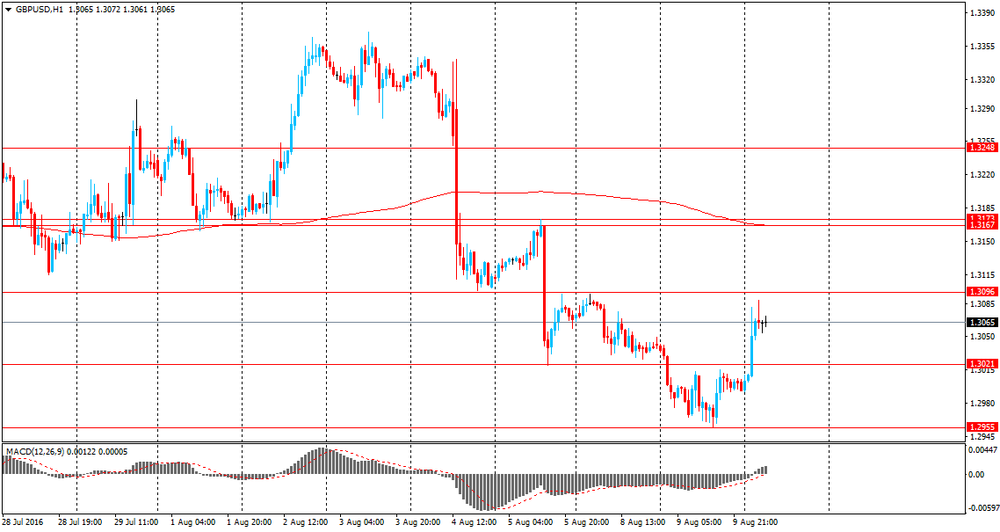

GBP / USD: during the Asian session, the pair is trading in the $ 1.2990-1.3050 range

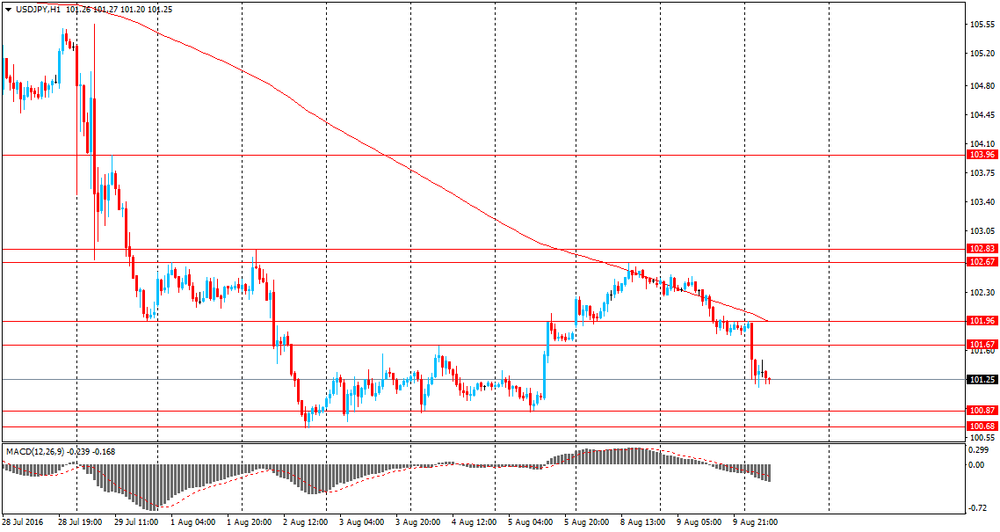

USD / JPY: during the Asian session, the pair was trading in the Y101.10-101.40 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.