- Analytics

- News and Tools

- Market News

- Oil rose today

Oil rose today

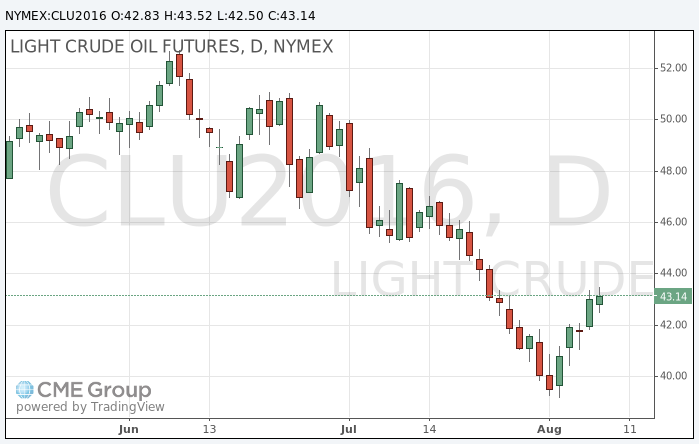

Today, during the American session oil rose while market participants expect the publication of fresh weekly report on US oil and petroleum products.

The American Petroleum Institute is scheduled to release its report on stocks today, while government data expected on Wednesday may show the decrease in inventories by 1.0 million barrels for the week ending 5 August.

Gasoline stocks are expected to decline by 1.2 million barrels, while, according to analysts, distillate stocks, including heating oil and diesel fuel, will increase by 375,000 barrels.

On Monday in New York crude oil futures jumped $ 1.22, or 2.92%, as renewed hopes for an agreement between the exporters supported the market by freezing production.

Despite the recent growth, the market experts believe that increased fuel product inventories amid slowing global demand growth, most likely, will put pressure on prices in the short term.

Futures for WTI crude oil lost nearly 17% this year after falling from highs above $ 50 per barrel reached in early June amid signs of recovery in the US drilling activity combined with higher fuel product inventory.

According to Baker Hughes, the number of drilling rigs in the US increased by 7 to 381 last week, increasing the sixth week in a row and the ninth week of the last ten.

Number of oil rigs in the United States increases the sixth consecutive week, increasing concern about the over-saturation of the oil market.

A day earlier, the price of Brent crude rose $ 1.12, or 2.53%, as sentiment rose amid renewed hopes for an agreement on exporting production freeze.

According to some sources, several OPEC members, including Venezuela, Ecuador and Kuwait, want to revive the idea of limits on oil production in an attempt to stabilize the market this fall.

Qatar's Energy Minister Mohammed bin Saleh Al Sada, who has served as president of OPEC this year, has confirmed that the cartel will hold an informal meeting of 26-28 September at the International Energy Forum in Algiers.

Nevertheless, market participants are still skeptical about this meeting. Earlier this year, an attempt to freeze level of production was not a success because of Iran's refusal to participate in the initiative.

Meanwhile, Venezuela's oil minister Eulogio del Pino said that the meeting of OPEC and countries outside the cartel could take place "in the coming weeks", but Alexander Novak, Minister of Energy of Russia sees no grounds for the resumption of freeze negotiations.

Brent lost almost 15% from the high in early June, $ 52.80, as the prospects for increasing exports from the Middle East and North African countries, such as Iran, Libya and Nigeria, have raised concern that an excess of oil will reduce demand from refiners.

The cost of the September futures on WTI rose to 43.52 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 45.77 dollars a barrel on the London Stock Exchange ICE Futures Europe.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.