- Analytics

- News and Tools

- Market News

- Asian session review: the pound fall in anticipation of manufacturing data

Asian session review: the pound fall in anticipation of manufacturing data

During today's Asian session, the US dollar traded in a narrow range against the euro and the yen, while maintaining stability.

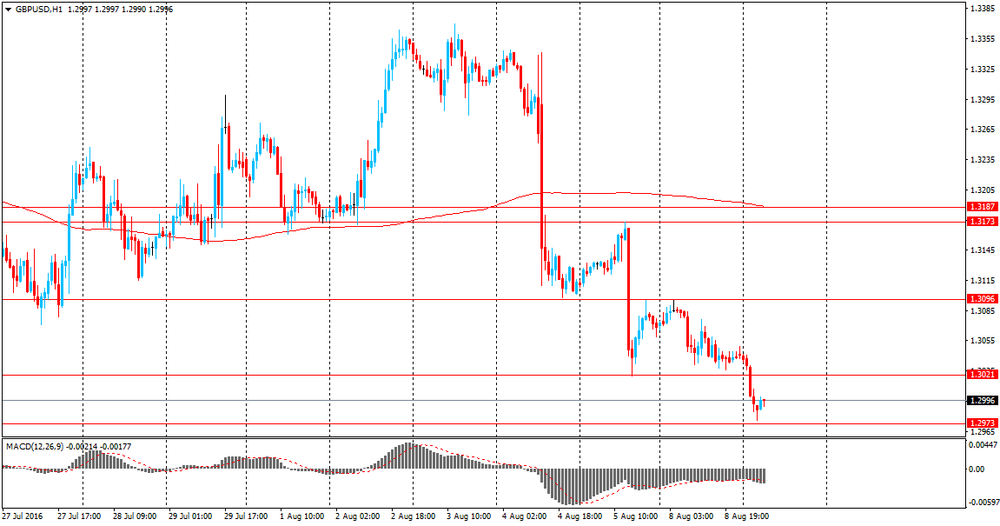

The pound was lower against the US dollar, despite the positive data on retail sales from the UK. According to British Retail Consortium retail sales increased by 1.1% year on year. Analysts had expected a decline to -0.7%. The previous value was also negative and amounted to -0.5%.

A report on retail sales, published by the British Retail Consortium, estimates changes in the actual retail sales companies, members of the consortium on the basis of regularly provided reliable information. This indicator shows the trend in the retail sector.

The BRC report states that recorded growth in retail sales is contrary to the UK talk about slowing consumer spending after Brexit. The growth of retail sales in July was the strongest since January of this year.

Also, the course of trading was influence by pricing in of today's statistics on industrial production in the UK. It is projected that by the end of June, industrial production increased by 0.2% in monthly terms and by 1.6% y/y. Meanwhile, production in the manufacturing sector is likely to contract by 0.2% in the month and increased by 1.3% per annum.

The Australian dollar has weakened since the beginning of the session, as the published results of the latest survey conducted by NAB showed that the index of business conditions in Australia fell in July to 8 with the previous value of 11, and the index of confidence in the business community dropped to 4 from 5 June.

Business conditions and confidence in business circles in Australia worsened amid growing uncertainty over the long-term prospects for the Australian economy.

NAB chief economist Alan Oster said the long-term risks are increasing, and it is likely to force the Reserve Bank of Australia to lower interest rates twice this year. Oster also said that short-term trends in the economy are satisfactory.

The Consumer Price Index of China, published by the National Bureau of Statistics of China, increased by 0.2% in July after falling 0.1% the previous month. This had an influence on commodity currencies. Analysts had expected an increase of 0.1%. In annual terms, the inflation indicator rose 1.8%. The pace of consumer price growth slowed slightly compared with +1.9% in June. The main factor that put pressure on the annual inflation was slowing food prices.

The result is a detailed summary of the data of urban and rural indices of consumer prices. The purchasing power of the Chinese currency is reduced under the influence of inflation. CPI - a key indicator of inflation and changes in purchasing trends. A decline in the consumer price index is a sign that inflation is becoming a destabilizing factor in the economy and could potentially provoke the People's Bank of China to tighten monetary policy and fiscal policy. In general, a high value is positive for China's currency.

Inflation remains well below the maximum target of 3% this year, giving the central bank room for easing monetary policy against the backdrop of the economic downturn.

Yu Qiumei, Senior Statistician at National Bureau of Statistics of China noted that a great influence on prices in the last month had heavy rains and flooding of the Yangtze basin. "Powerful rains significantly affected the processes of production and transport of fresh vegetables, which led to a rather strong increase in their prices in a number of regions".

Also, the National Bureau of Statistics of China released data on producer price index, which in July fell by 1.7% after falling 2.6% in June. Analysts had expected a decline to -2.0%

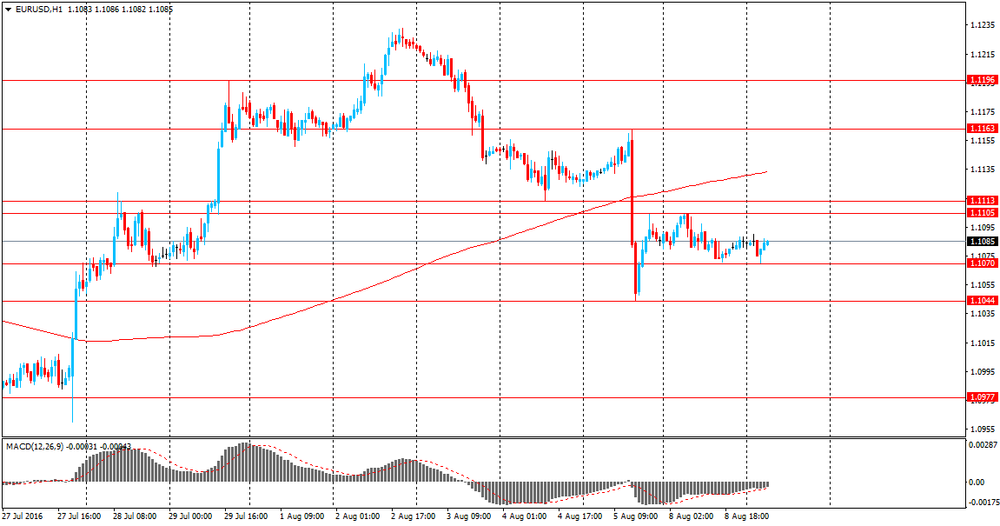

EUR / USD: during the Asian session, the pair was trading in the $ 1.1070-75 range.

GBP / USD: during the Asian session, the pair was trading in $ 1.2965-90 range.

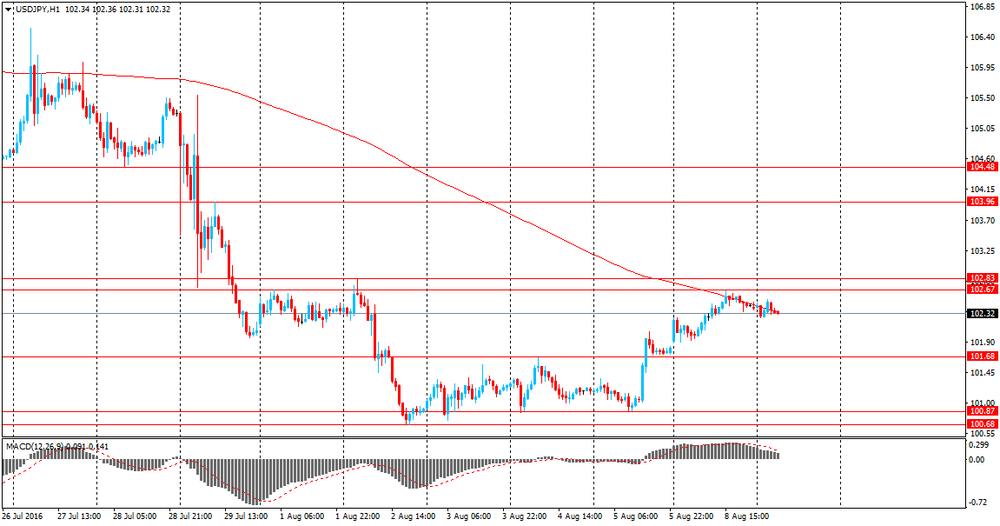

USD / JPY: during the Asian session, the pair was trading in Y102.25-102.45 range.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.