- Analytics

- News and Tools

- Market News

- Asian session review: the dollar consolidates

Asian session review: the dollar consolidates

The US dollar weakened slightly against the euro, but still receives support from positive data on the US labor market, which were published on Friday. As reported by the US Department of Labor, the number of new jobs increased in July 255,000 after rising 292,000 in June. The unemployment rate remained at around 4.9%. It was expected that the number of employees will increase to 180 000 in July and the unemployment rate to fall to 4.8%. The last increase in hiring was enough to increase the share of economically active population to 62.8% from 62.7% in June. The average hourly earnings in the private sector increased by 8 cents compared with June, to 35.69 dollars. The annualized figure rose by 2.6%, exceeding the rate of inflation. Strong job growth should strengthen the Fed's confidence in the labor market, which officials see as at or near full employment. Fed Chair Yellen stated that the economy needs to create a little less than 100 000 jobs a month to keep up with population growth. Second consecutive month of growth for payrolls is a stimulus to the economy after the average annual economic growth reflected an increase of 1.0% over the past three quarters. Most economists expect that against the background of improved economic situation, the Fed may soon hike. Currently, futures on the Fed rate indicate that the market is pricing in a 18% probability of a rate hike in September and a 47% in December.

The Australian dollar fell slightly from the beginning of the trading session, after negative data on the index of the number of vacancies in Australia. As reported today by the Banking Group Australia and New Zealand Banking Group Limited (ANZ), the number of vacancies index fell 0.8% in Jully, after an increase by 0.4% in June. The previous value was revised downward to 0.5%. According to ANZ, in July, the number of vacancies index fell due to uncertainty in the world against the background of Brexit

However, a further decrease in the Australian was stoped by China's trade surplus, which in July was higher than analysts' expectations. The surplus of China's foreign trade in July was $ 52.31 billion, which is higher than the forecast of $ 47.60 billion. The previous value was $ 48.10 billion.

China's exports fell by -4.4% in July, but the reduction was lower than July, when the index fell by -4.8%.Imports of goods and services in China declined in July and amounted to 12.5%, much lower than the previous value of -8.4% and -7.0% of analysts' expectations.

General Customs Administration of China also said that the pressure on exports is expected to fall early in the fourth quarter of this year.

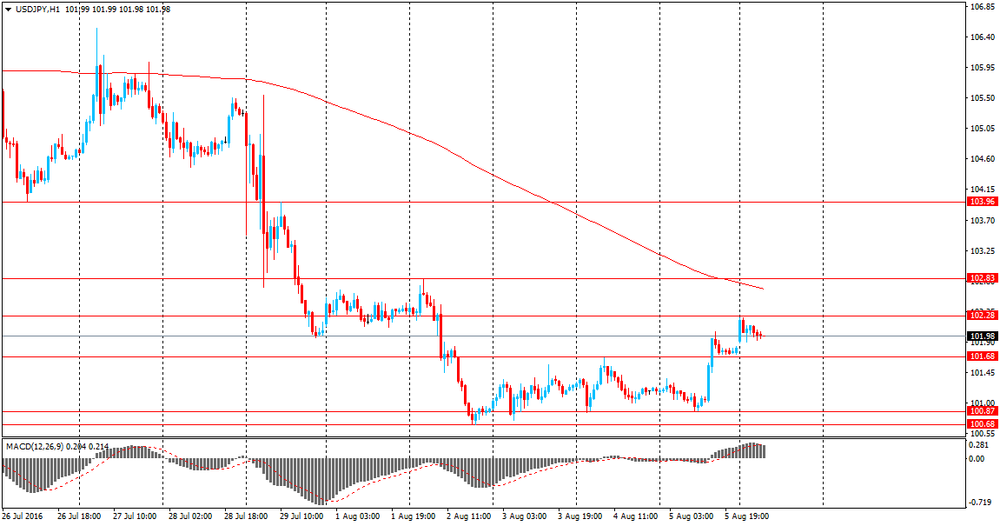

The yen has weakened slightly since the beginning of the Asian session against the dollar amid rising probability of the Fed raising interest rates in September

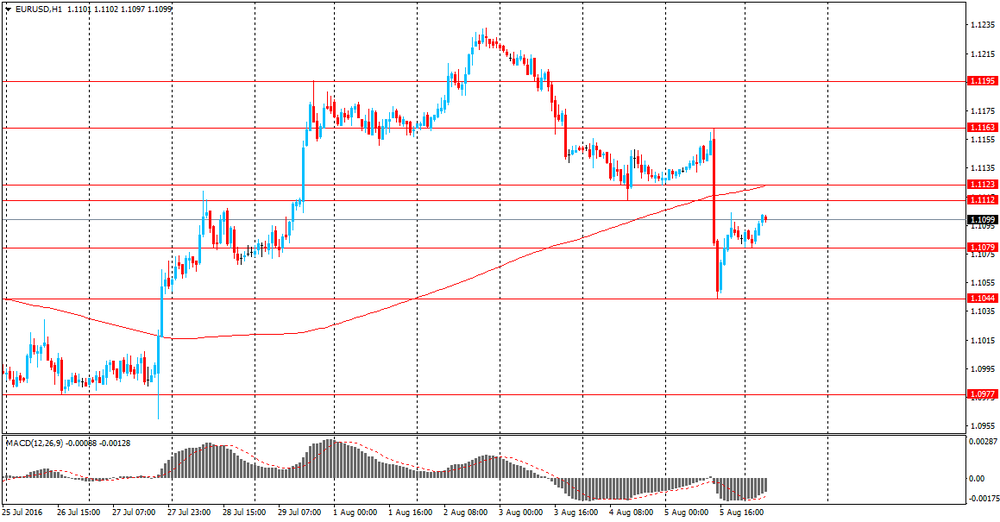

EUR / USD: during the Asian session, the pair was trading in the $ 1.1080-95 range

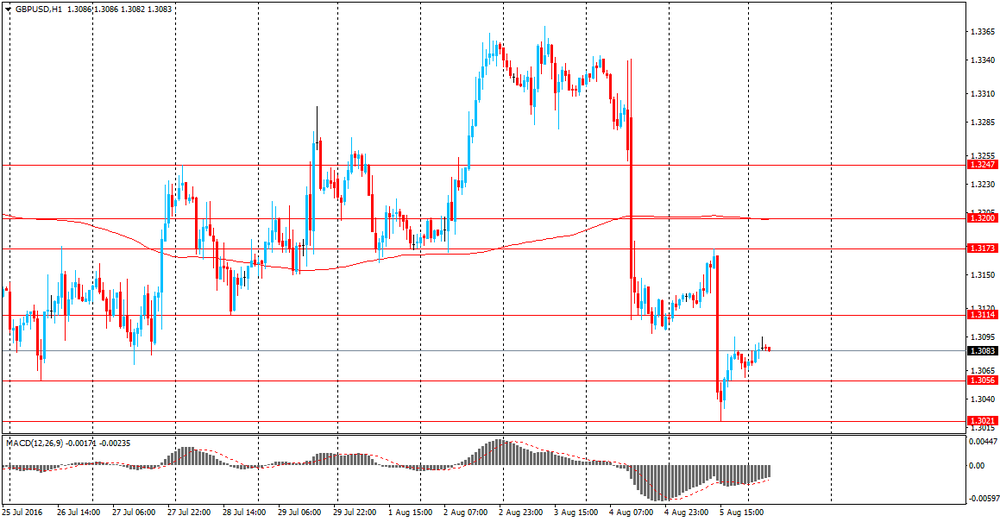

GBP / USD: during the Asian session, the pair was trading in the $ 1.3065-80 range

USD / JPY: during the Asian session, the pair was trading in Y101.90-102.05 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.