- Analytics

- News and Tools

- Market News

- Asian session review: the pound declined

Asian session review: the pound declined

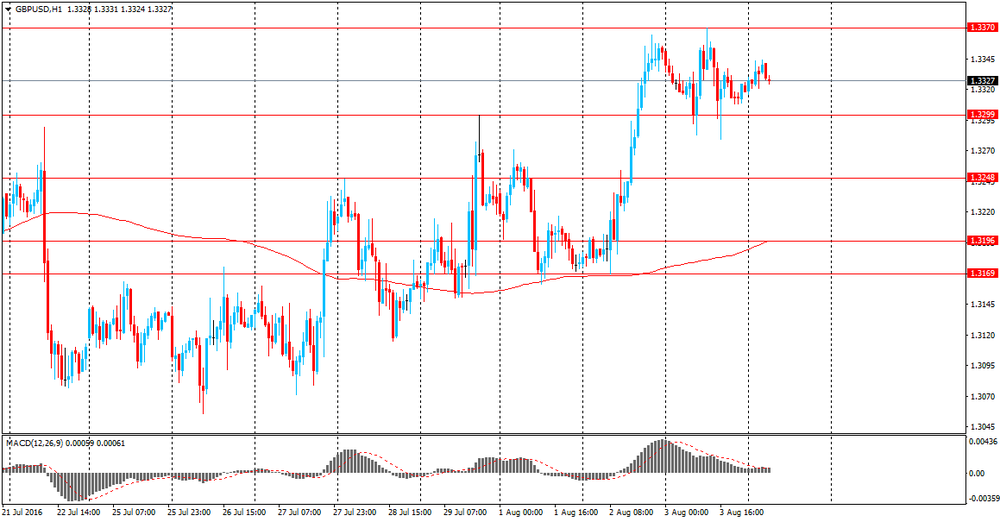

The markets are waiting for the Bank of England interest rate decision and the volume of purchases of software assets. Most economists polled by to Reuters, expect that today the Bank of England to cut rates by at least 25 basis points to a new record low of 0.25 percent. Recall, the UK central bank rate has not changed since the beginning of 2009. However, 17 of the 36 experts said that the program of quantitative easing (QE), which was suspended in 2012, will also be restarted today.

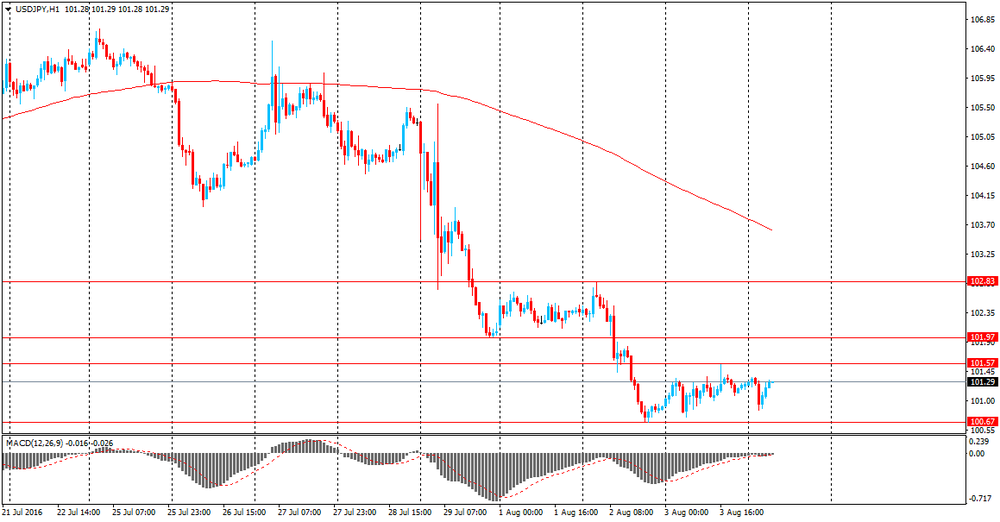

The yen rose slightly after the comments of the deputy head of the Bank of Japan Kiku Iwata that the Bank of Japan does not have a predetermined course of monetary policy. However, during the trading session the Japanese currency fell, reaching yesterday's low.

"We do not have any specific advance the future course of monetary policy", - said Mr. Iwata and added - "the Bank of Japan Politics and government - is not the same thing as" helicopter money". Mr. Iwata also noted that at the September meeting the evaluation of the monetary will be made from a variety of perspectives.

The US dollar traded in a narrow range after yesterday significantly rise against the euro. Some investors believe that Friday's employment data will be strong, so that the Federal Reserve in the next few months will be able to produce a rise in interest rates. Today futures on interest rates Fed suggest a 18% probability of rate hikes in September and 39% probability to increase rates in December.

The Australian dollar rose after data on retail sales in Australia in June. As reported today, the Australian Bureau of Statistics, retail sales rose in June by 0.1%, which is below analysts' expectations of 0.3% and the previous value of 0.2%. In the second quarter, this indicator grew by 0.4%, while analysts had expected an increase of 0.5%. The volume of retail sales - an indicator that assesses the total volume of retail sales through retail outlets of various types and sizes shown on the basis of a representative sample. It is considered an indicator of the rate of growth of the Australian economy.

According to the Bureau of Statistics, the main reason for the decline in retail sales is the cold weather, which was observed in Australia in recent years.

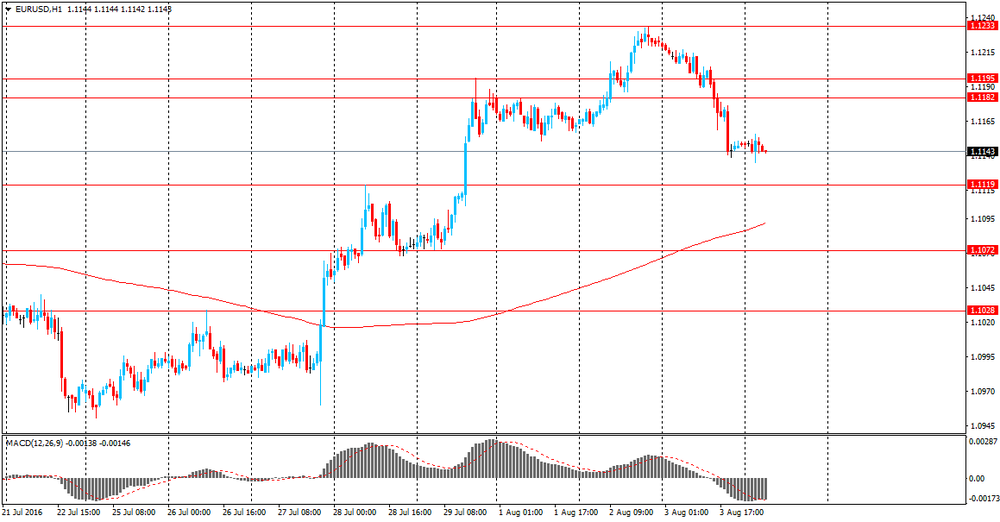

EUR / USD: during the Asian session, the pair was trading in the $ 1.1130-40 range

GBP / USD: during the Asian session, the pair is trading in the $ 1.3285 range.

USD / JPY: during the Asian session, the pair was trading in Y100.85 - 101.55 range.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.