- Analytics

- News and Tools

- Market News

- European session review: US dollar fell against major currencies

European session review: US dollar fell against major currencies

The following data was published:

(Time / country / index / period / previous value / forecast)

Switzerland 7:15 Retail sales, y / y in June -1.7% -1.6% Revised to -3.9%

Switzerland 7:30 PMI in the manufacturing sector in July 51.6 51.7 50.1

8:30 UK index of business activity in the construction sector, m / m in July 46 43.8 45.9

9:00 Eurozone Producer Price Index m / m in June 0.6% 0.4% 0.7%

9:00 Eurozone Producer Price Index y / y in June -3.9% -3.5% -3.1%

The US dollar fell to a fresh five-week low against a basket of major currencies on Tuesday after reports of additional measures to stimulate the economy in Japan, while the lowered expectations of growth in the US putting pressure on the US currency before the end of the year.

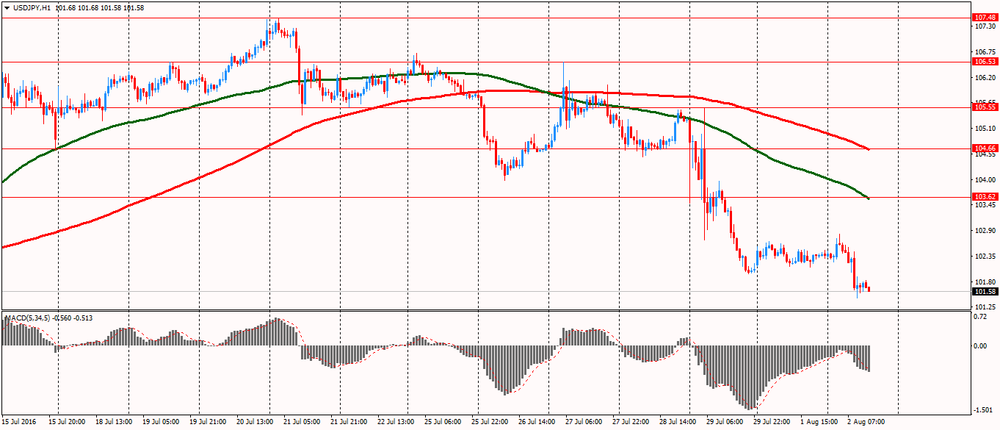

The yen has strengthened the position after Japanese Prime Minister Shinzo Abe announced fresh stimulus to revitalize the Japanese economy.

The program includes 13.5 trillion yen of financial measures, of which about 7.5 trillion yen account for direct costs of stimulus measures over the next two years.

On Monday, the Institute for Supply Management said its index of business activity in the manufacturing sector fell to 52.6 last month from June's 53.2. Analysts had expected the index to decline in July to 53.0.

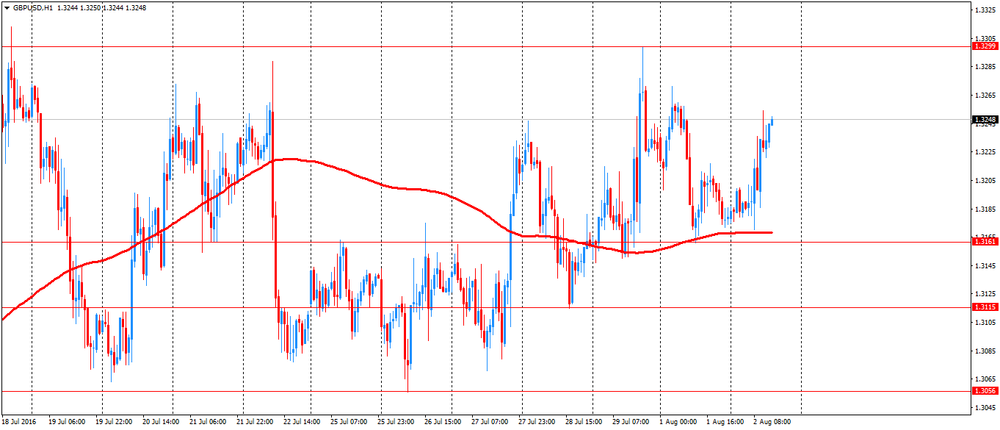

The pound rose against the dollar, despite the weak data on business activity in the construction sector. UK construction sector contracted less than expected in July, showed on Tuesday the results of a survey published by Markit.

Purchasing Managers' Index from Markit / Chartered Institute of Purchasing and Supply fell to 45.9 in July from 46.0 in June. According to forecasts, the index was expected to decline to 43.8.

The index has been below the neutral level of 50.0 for the second month in a row, reflecting a reduction in the sector.

The index signaled the fastest decline in production in the construction sector since June 2009. The companies said that the weaker order books continued to act as a brake on economic activity in July.

Uncertainty after the referendum on EU membership was the main factor that affected the business activity in July, especially in the sector of commercial construction, Markit said.

Respondents indicated increased risk aversion and reduced investment spending among customers, despite the large number of speculative inquiries in anticipation of lower charges, said Tim Moore, senior economist at Markit.

"While there is little evidence of an imminent turn in business conditions, environmental factors seem to soften the fall of the British business optimism among construction companies."

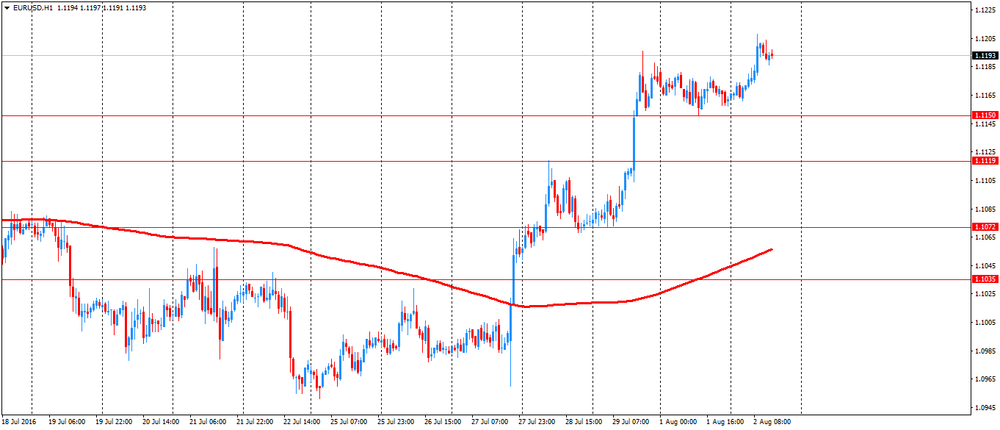

The euro rose against the US dollar, supported by data on producer prices. Eurozone producer prices rose for the second month in a row in June, according to Eurostat.

Industrial producer prices rose by 0.7 percent for the month in June, slightly faster than the 0.6 percent rise in May.

On an annual basis, producer prices fell at a slower pace of 3.1 percent in June, after falling 3.8 percent the previous month, which was revised from a 3.9 percent fall reported initially.

Excluding energy, producer prices rose by 0.2 percent for the month, while they fell by 1.0 percent from June 2015.

Energy prices fell by 8.7 percent annually in June, while they rose by 2.4 percent compared to the previous month.

EUR / USD: during the European session, the pair rose to $ 1.1208

GBP / USD: during the European session, the pair rose to $ 1.3254

USD / JPY: during the European session, the pair fell to Y101.44

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.