- Analytics

- News and Tools

- Market News

- Asian session review: The Australian dollar traded mixed

Asian session review: The Australian dollar traded mixed

The Australian dollar fell sharply, reaching a minimum of $ 0.7480 after the Reserve Bank of Australia lowered its benchmark interest rate by 25 bps to 1.5%, but in the course of trading regained lost ground.

According to data published last week, in the second quarter, inflation fell to 1.5%, well below the central bank's target range of 2% -3%. RBA worry that low inflation can affect the mood of companies and households. According to the current forecast of the central bank, inflation returns to the target range until mid-2018.

In August 2013, the Australian central bank set the rate at 2.5% - this was the lowest level in the last 60 years. Nevertheless, due to the slowdown in economic growth the central bank decided to lower it again in February of last year to 2.25%, and three months later there was a new slide - to historically record low of 2%. In May of this year, the Central Bank, fearing the threat of deflation, lowered the rate to 1.75%, and today - another quarter percentage point.

The deficit of foreign trade of Australia rose sharply and amounted to AUD $ -3,2 billion from A $ -2.42 billion in May. Analysts had forecast a deficit of A $ -2,0 billion.

The trade balance - the indicator published by the Australian Bureau of Statistics, and assessing the ratio between exports and imports of goods. Export performance is an important indicator of the rate of growth of the Australian economy, while import indicates the level of domestic demand. Reduced demand for exports from Australia, leads to an increase in the trade deficit, which has a negative impact on the Australian dollar.

Export dropped in June 1.0% compared to a 1.0% increase in May.

Imports increased by 2.0% in June as in May.

Building permits, published by the Australian Bureau of Statistics, decreased by -2.9% in June, below analyst expectations of 0.5%. Previous value of the index was revised from -5.2% to -5.4%. The annual rate of building permits fell to -5.9%, -9.2% prior to the year after the fall.

Permits for the construction of private homes fell 2.3%. The construction of apartments in the private sector decreased by 2.4%

The New Zealand Dollar was down against the US dollar on the back of falling oil prices. Published today, the quarterly report of the Reserve Bank of New Zealand showed that inflation expectations have remained stable, but low in the third quarter. The expectations about the pace of growth in consumer prices in the 24 months ahead in the third quarter was 1.65% versus 1.64% in the second quarter. Inflation expectations for the next 12 months were equal to 1.26% against 1.22% in the previous quarter.

The US dollar traded in a narrow range against the euro after Friday showed widespread fall as weak data exacerbated concerns about economic growth and the increase in US Federal Reserve interest rates this year.

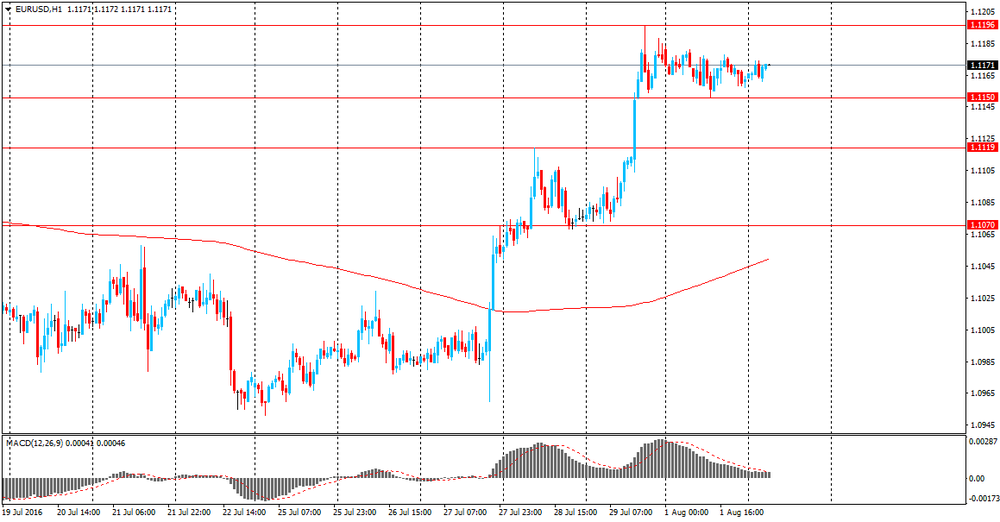

EUR / USD: during the Asian session, the pair was trading in the $ 1.1160-80 range

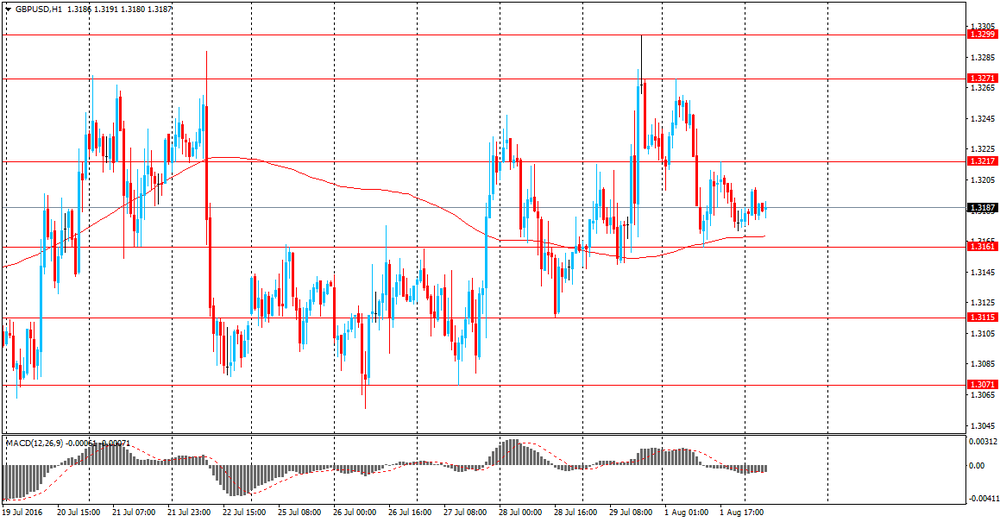

GBP / USD: during the Asian session, the pair was trading in the $ 1.3179-85 range

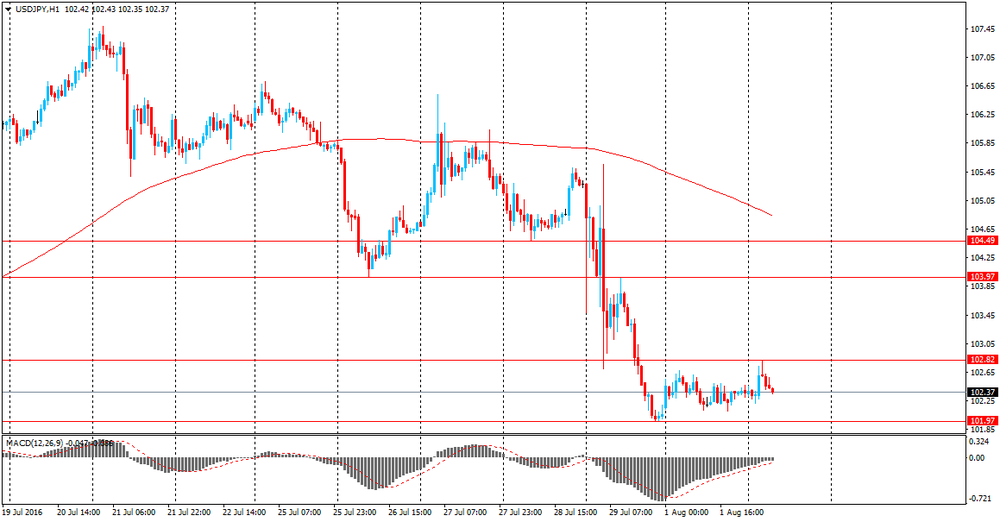

USD / JPY: during the Asian session, the pair was trading in Y102.00 - 102.05 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.