- Analytics

- News and Tools

- Market News

- Asian session review: tight ranges across the board

Asian session review: tight ranges across the board

During the Asian session, the US dollar traded in a narrow range against major currencies after widespread fall on Friday as weak data on economic growth have exacerbated doubts about the likely increase in US Federal Reserve interest rates this year.

The US Commerce Department announced that US economic growth stalled in the second quarter. According to seasonally adjusted data, gross domestic product grew by 1.2% annually in the second quarter. The last reading was well below the average forecast (+ 2.6%). We also add that economic growth for the first quarter was revised downward to + 0.8% from + 1.1%. The economy expanded by less than 2% for three consecutive quarters. Despite the fact that the recession was over seven years ago, the growth rate has not accelerated since. The average annual growth rate during the current business cycle remains the weakest since 1949.

The weakness of the economy has increased concerns about whether it will be able to transfer the increase in rates this year. On Wednesday, the US Federal Reserve left monetary policy unchanged.

Futures on interest rates on Friday indicate that investors see 12% chance of a rate hike in September, compared with 18% a day ago, according to CME Group.

The Australian dollar rose after the publication of positive data on the index of business activity in the manufacturing sector of China from Caixin. The index rose in July to 50.6, higher than analysts expectations of 48.7 and the previous value of 48.6. This is the first increase in the index for the last 17 months. New orders increased, but new export orders fell again. The unemployment rate rose, showing a significant loss of jobs. According to Markit Economics China's economy began to show signs of stabilization due to the gradual implementation of fiscal policy. However, the pressure on economic growth remain, and supportive fiscal and monetary policy should be continued.

Also, the Chinese Federation of Logistics and Supply were published data on the index of business activity in the service sector, according to which the index rose to 53.9 from 53.7 the previous value.

The index of activity in the manufacturing sector of the Australia, published by the Australian Industry Group, was 56.4 in July, higher than the previous value of 51.8. The group explores the results of a survey of 200 hundred producers in the aspect of assessment of business conditions including employment, production, orders, prices and stocks, as well as short-term planning. A reading above 50 is positive for the Australian dollar. New orders increased by 4.7 points, employment had grown to the highest level since December 2014. Sales increased by 6.5 points, which is the highest rate since September 2009. Inventories rose by 1.4 points. Exports increased by 9.6 points on the month to its highest level since March 2008

Sales of new homes in Australia in June increased by 8.2% after a decline of -4.4% in May. This indicator expresses the volume of new home sales in Australia. It evaluates the conditions of the housing market. Thus, the high value of the index is a positive factor for the Australian currency..

According to Australia's Housing Association new home sales rose in June after two months of decline. Sales of detached houses increased by 7.2%, while sales of apartments by 11.5%.

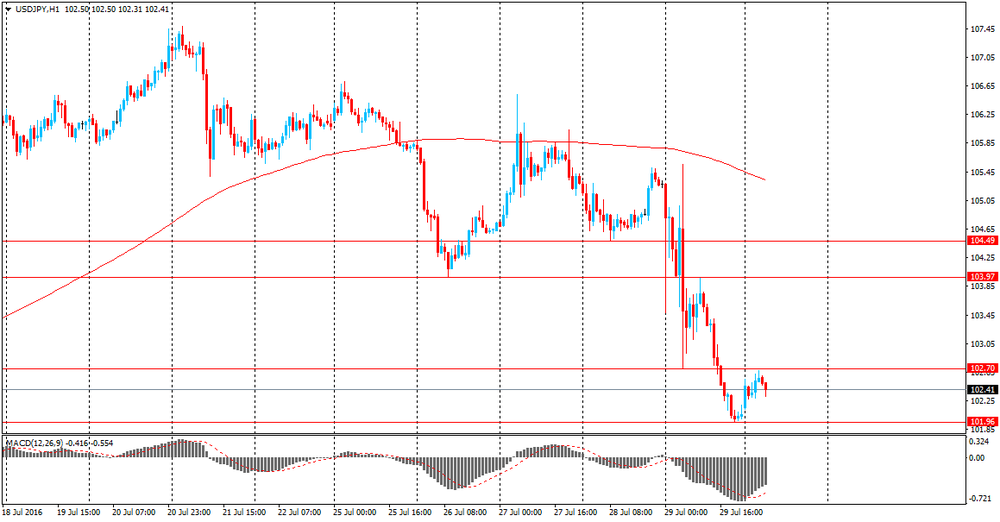

The yen weakened against the dollar as investors took profits after the Japanese currency on Friday rose sharply as the Bank of Japan decided on additional measures that fell short of investors' expectations. The central bank announced its intention to increase the purchase of ETF, but left interest rates and the amount of the bond purchase program unchanged.

It became known that the index of business activity in the manufacturing sector of Japan in July amounted to 49.3 points, which is higher than the previous value of 48.1 and economists' expectations of 49.0. However, this indicator is below 50 for the fifth month in a row on a background of weak demand. In addition, the strong yen is a negative impact on exports.

Production and new orders fell again, but at a slower pace. Slightly more positively proved the employment component, which has recently reached a historic high.

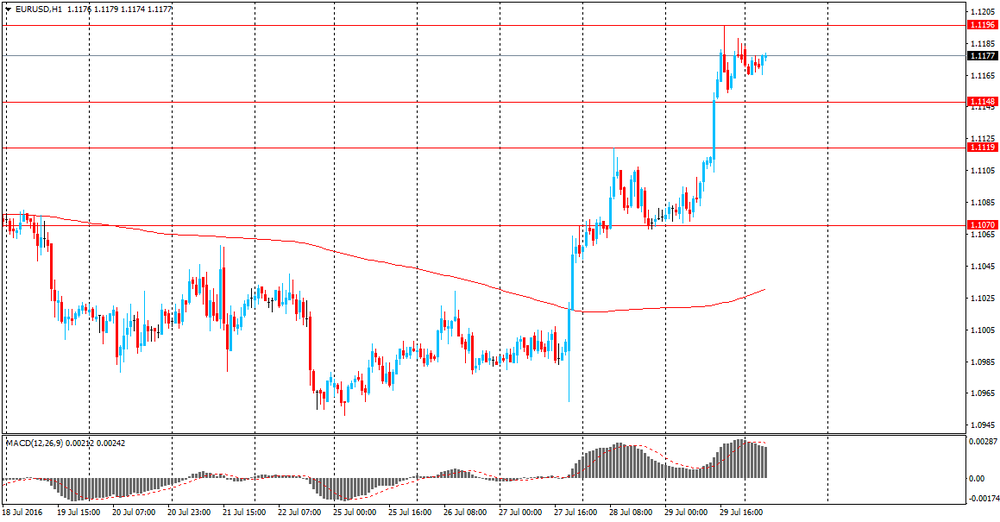

EUR / USD: during the Asian session, the pair was trading in the $ 1.1160-65 range

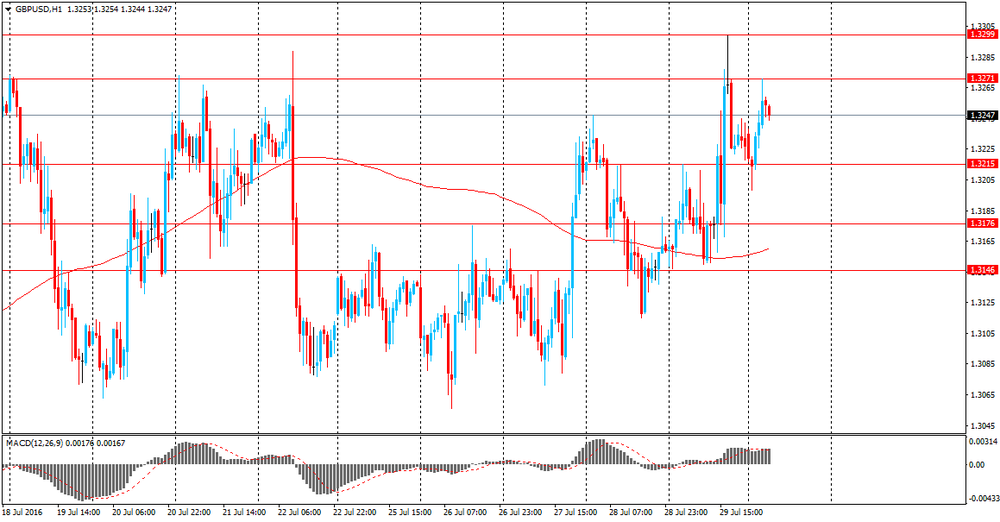

GBP / USD: during the Asian session, the pair was trading in the $ 1.3200-40 range

USD / JPY: during the Asian session, the pair was trading in Y102.15-50 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.