- Analytics

- News and Tools

- Market News

- Gold price little changed in a subdued session

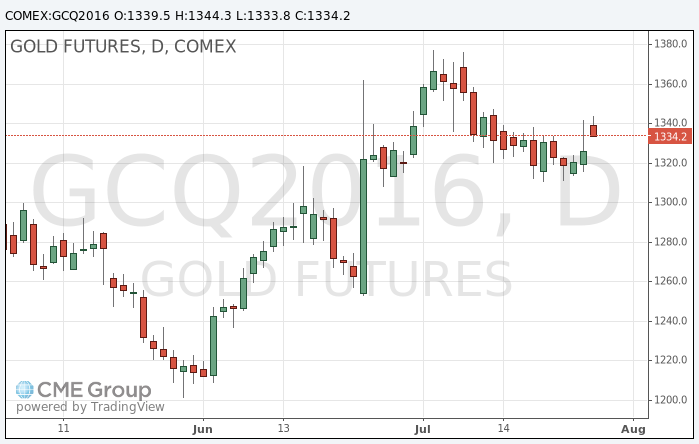

Gold price little changed in a subdued session

In the past few hours, the price of gold retreated from a two-week high reached after the Federal Reserve refrained from any hints of a rate hike at the next meeting in September.

On Wednesday, the Federal Reserve left interest rates unchanged and said that short-term risks to the US economic outlook declined. Nevertheless, the central bank did not give any indication regarding the rate increase in the near future.

Futures on the federal funds currently evaluating the likelihood of a rate hike in September to 18%, below 22% the day before. The probability of a hike in December is now 43% compared to 52% at the beginning of the week.

The precious metal is sensitive to higher interest rates in the United States. The gradual increase of the rate shall be less of a threat to the gold price than a series of sharp rises.

Daniel Brizeman, an analyst at Commerzbank, observes that the Fed decision not to change interest rates positively contributed to the rise in prices.

"The opportunity costs for gold remain low, - he said -. It is surprising that gold has not gone up even more."

"I think they (Fed) will wait a little longer to follow the events in Europe, before making a decision - says Bernard Dada, an analyst at Natixis -. If these events would be disastrous, then, I think they need more time to raise rates. "

Brizeman and Dada expect the next rate hike in December.

The Bank of Japan will announce its decision on monetary policy on Friday, with economists expecting further easing it. Softer monetary policy will mean that Japan's economic problems persist, prompting investors to buy safe-haven assets, including gold.

The cost of the August gold futures on COMEX fell to $ 1333.80 per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.