- Analytics

- News and Tools

- Market News

- Asian session review: yen rises

Asian session review: yen rises

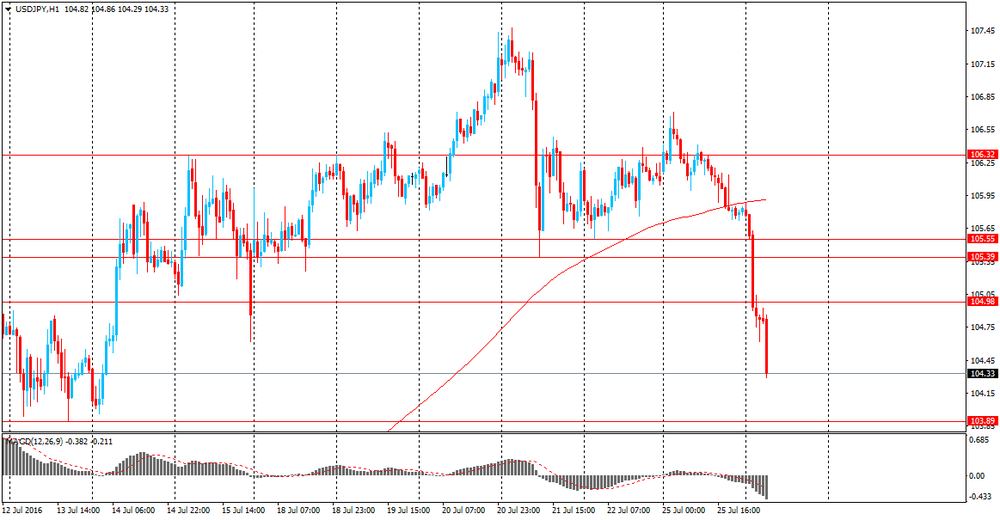

The US dollar fell against the yen below Y105,00 the first time from July 15. The growth of the yen this week, mainly caused by the uncertainty of the US Federal Reserve and the Bank of Japan meetings, which will be held later this week.

The message that the Japanese government is likely to announce a package of fiscal stimulus measures amounting to 6 trillion yen, calculated for a few years, have disappointed investors, who had hoped that the amount of stimulation will be close to 10 trillion yen.

In addition, the budget expenditures, apparently, will be funded by supplementary budget, rather than by the Bank of Japan. This confirms the fact that the central bank does not intend to resort to helicopter money".

Today begins a two-day meeting of the US Federal Reserve. Investors expect that the central bank will leave monetary policy unchanged, but the text of the bank statement will be closely examined for the future prospects of interest rates.

"I do not think they put something in motion at this meeting - said Mark McCormick of TD Securities -. I believe that Fed officials will take a wait and see attitude until the markets will be ready to tighten policy."

Investors are more optimistic about the outlook for interest rates, with the market now seen 48% chance the Fed's tightening policy in December. This has contributed to the growth of the dollar, because of the increase in borrowing costs, making it more attractive to investors.

The New Zealand Dollar little changed after the publication of important data on the trade balance. As reported by the New Zealand Bureau of Statistics, the trade balance in June was $ 127mln, which is lower than the previous value of $ 358mln, but slightly above analysts' expectations $ 125mln. In annual terms, there is a trade deficit of $ -3.310 billion after $ -3,633mlrd

The trade balance reflects the balance between exports and imports. A positive value reflects a balance surplus, a negative - the deficit.

According to BNZ senior economist Doug Steel, "given the negative factors in the form of low world commodity prices, especially for dairy products, and the strong New Zealand dollar, external trade in goods in New Zealand still looks good."

Exports of goods and services from New Zealand rose by $ 4.26 billion, down slightly from the previous value of $ 4.57 billion.

Imports in July also fell below the previous value and amounted to $ 4.13 billion after rising $ 4.22 billion in the previous month.

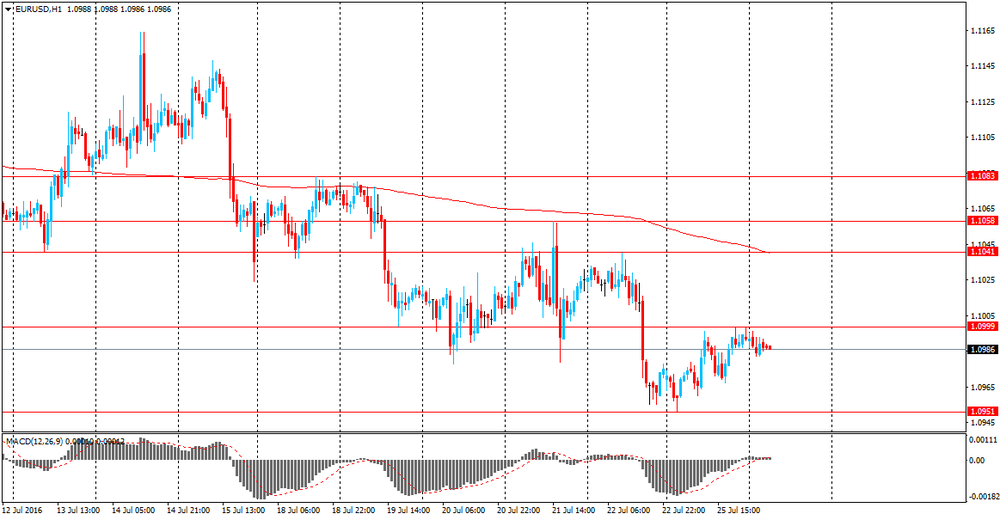

EUR / USD: during the Asian session, the pair is trading in the $ 1.0980-1.1010 range

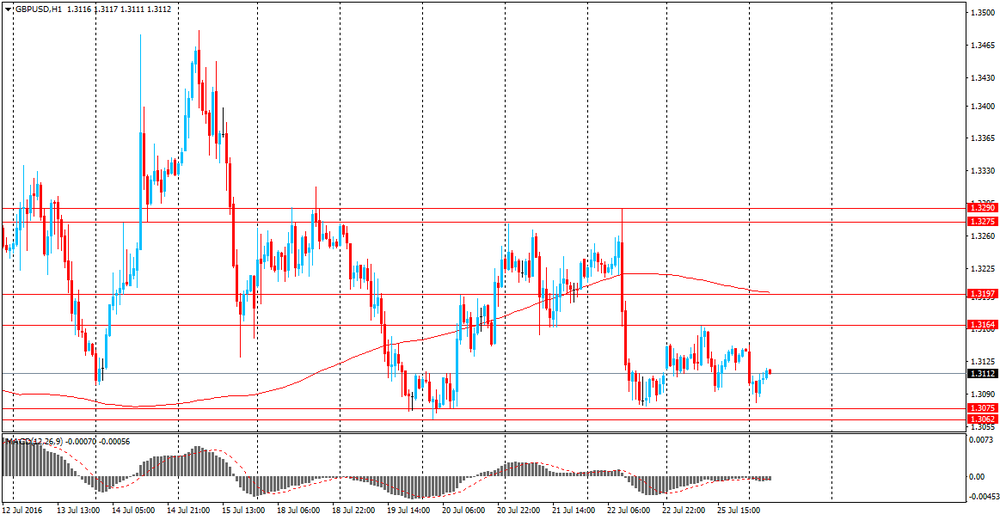

GBP / USD: during the Asian session, the pair is trading in the $ 1.3080-1.3110 range

USD / JPY: on Asian session the pair fell to Y104.40

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.