- Analytics

- News and Tools

- Market News

- Gold little changed while we expect central banks meetings this week

Gold little changed while we expect central banks meetings this week

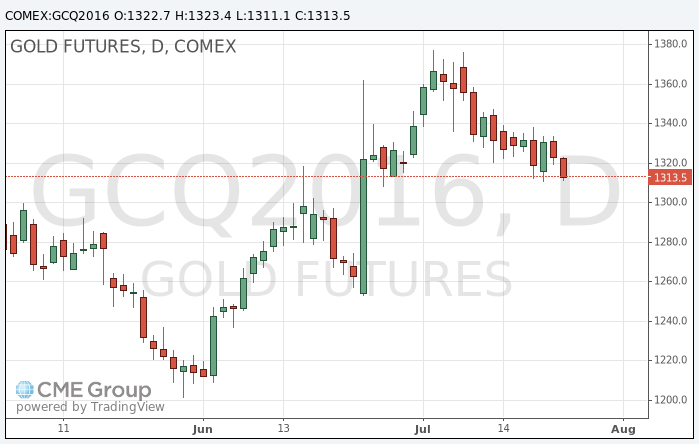

During today's trading the price of cold had limited activity, while investors eyed central bank meetings this week. The meeting of the Federal Reserve is scheduled for 26-27 July, and the Bank of Japan - July 28-29.

As predicted, the Fed will not change the interest rate at the end of its two-day meeting on Wednesday, but market participants will closely monitor the FOMC statement on monetary policy in the search for fresh guidance on the timing of interest rate increase in the next few months.

The market expects that Bank of Japan, on the contrary, will continue easing monetary policy at its meeting on Friday, further lowering rates and expanding the volume of asset purchases.

On Friday, prices lost $ 7.60, or 0.57%, as the renewed expectations of Fed rate hike this year boosted the US dollar, as investors prefer to invest in rising equity markets instead of buying safe assets.

For the week gold fell $ 4.40, or 0.26%, demonstrating a decline 2 weeks in a row.

Newly published encouraging US statistical data reinforced speculation that the Federal Reserve may raise interest rates before the end of the year. Currently federal funds futures estimate December 45% compared with less than 20% a week ago, and 9% at the beginning of the month.

On Friday, the USD index rose to 97.59, the highest since March 10. On Monday, the index kept at 97.47 against the background of differences of monetary policy.

Strengthening of the US dollar, as a rule, is putting pressure on gold, because gold drops appeal as an alternative asset and increases in the price of dollar-denominated commodities for holders of other currencies.

The precious metal was supported amid growing expectations that the world's central banks are stepping up monetary stimulus in the near future to counteract the negative economic consequences of Brexit.

For the year gold has risen in price by almost 25%, helped by concerns about global economic growth and expectations of monetary stimulus. Expectations of monetary stimulus tend to increase the demand for gold, as the precious metal is seen by investors as a safe store of value and inflation hedge.

Earlier, in July, prices have risen to more than two-year high of $ 1377.50 as fears about the global economy after the referendum in the UK led investors resort to safe assets.

The cost of the August gold futures on COMEX fell to $ 1311.10 per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.