- Analytics

- News and Tools

- Market News

- Australia’s non-mining recovery remains on track according to the June quarter NAB Business Survey

Australia’s non-mining recovery remains on track according to the June quarter NAB Business Survey

Australia's non-mining recovery remains on track according to the June quarter NAB Business Survey.

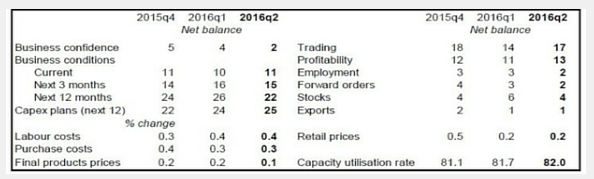

Leading indicators also suggest the outlook remains positive, although momentum has eased a little. Despite that, firms are continuing to suggest quite strong investment intentions for the next 12 months, consistent with the steady rise in capacity utilisation rates, while near-term employment intentions improved and longer-term employment intentions remained relatively solid. Inflation measures in the Survey remained subdued, which may point to another soft CPI outcome for Q2, while inflation expectations for the next 3 months point to a continuation of this trend.

The NAB Quarterly Business Survey provides valuable insight into Australian business, and offers a more in-depth probe into the conditions facing Australian business than the monthly survey, and also provides extra information about how firms perceive the outlook for their respective industries. Business conditions improved a little further in the June quarter, rising 1 point to +11 index points, which is well above the long-run average - largely supported by very high trading conditions and profits. According to NAB Group Chief Economist Alan Oster, "firms were still reporting business conditions consistent with an ongoing recovery in the non-mining sector". "There was a slight moderation in business confidence, but given the build-up of economic and political uncertainties since the start of the year, this is still a good result", said Mr Oster. "Additionally, the Monthly NAB Business Survey actually suggested business confidence lifted towards the end of the quarter."

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.