- Analytics

- News and Tools

- Market News

- European session review: the pound fell despite higher inflation

European session review: the pound fell despite higher inflation

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 UK Producer Price Index (m / m) June 0.2% 0.1% Revised to 0.2% 0.2%

8:30 UK producers selling prices index, y / y in June -0.6% -0.7% Revised to -0.5% -0.4%

8:30 UK producers purchase prices index m / m 2.2% Revised June from 2.6% 1.1% 1.8%

8:30 UK purchasing producer prices index, y / y in June -4.4% -3.9% Revised to -0.8% -0.5%

8:30 UK Retail Price Index m / m in June 0.3% 0.2% 0.4%

8:30 UK Retail Price Index y / y in June 1.4% 1.5% 1.6%

8:30 UK Consumer Price Index m / m in June 0.2% 0.1% 0.2%

8:30 UK consumer price index base value, y / y in June 1.2% 1.3% 1.4%

8:30 UK Consumer Price Index y / y in June 0.3% 0.4% 0.5%

9:00 Eurozone index of sentiment in the business environment from the ZEW Institute in July 20.2 -14.7

9:00 Germany Sentiment Index in the business environment of the institute ZEW July 19.2 9.1 -6.8

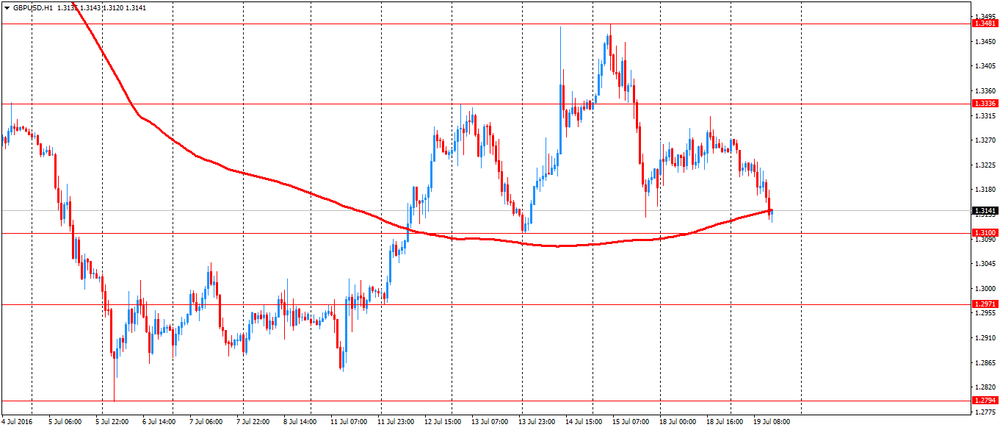

The British pound fell, although inflation data in the UK was higher than forecast. According to analysts, it signals the market belief that the Bank of England at its meeting scheduled for August 4, will resort to change the monetary policy.

Initially, the pound being able to overcome the barrier of $ 1.32, however, turned out to be a temporary increase.

The weakness of the pound, which is observed after Brexit, obviously, put upward pressure on inflation, but the economic stimululus by the Bank of England is still expected.

Markets are preparing for the possibility that the International Monetary Fund (IMF) will cut its economic forecast.

In the UK, inflation accelerated more than expected in June, showed the data of the Office for National Statistics on Tuesday.

Consumer prices rose 0.5 percent year on year in June, faster than the growth of 0.3 percent recorded in May. Inflation was expected to rise to 0.4 percent.

Core inflation, which excludes energy, food, alcoholic beverages and tobacco, rose to 1.4 percent from 1.2 percent in May.On a monthly basis, consumer prices rose 0.2 percent in June as in May, above expectations of a growth by 0.1 percent.

In another report ONS showed that the index of producer prices has decreased by 0.4 percent compared to the previous year.

On a monthly basis, the index for Producer Price rose by 0.2 percent for the second month in a row.

Purchase prices of manufacturers registered a slower annual decline of 0.5 percent after easing 4.4 percent in May. Economists had forecast a 0.8 percent drop in June.

On a monthly basis the index of purchase prices of manufacturers advanced 1.8 percent, compared with the growth of 2.2 percent in the previous month and an increase of 1.1 percent forecast.

On Monday, the pound jumped to session highs after a Bank of England official said he was not sure that he would support lowering the interest rate at the August meeting of the central bank.

Minutes published last Thursday clearly demonstrated the intention of the bank to ease monetary policy next month to counter the adverse economic impact of Brexit.

The Bank of England kept interest rates at 0.5%, which was a surprise to the markets.

At the same time, Moody's warned that the creditworthiness of the United Kingdom is under pressure after the decision to leave the EU.

Moody's reported that the medium-term prospects for the British economy may be reduced if it fails to reach a new trade agreement with Europe, but also noted that economic growth will slow down significantly in the near future.

The rating agency forecast UK growth in 2016 at 1.5% and nearly 1% in 2017.

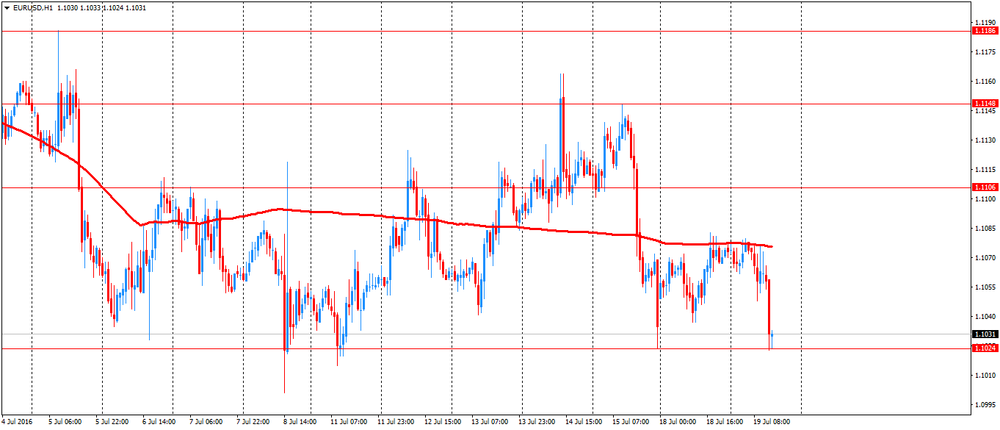

The euro fell against the US dollar after weak data from the ZEW institute. The indicator of economic sentiment in Germany fell in July to its lowest level in more than three years from Brexit fears and, consequently, uncertainty for the economy.

The index of sentiment in the business environment fell to -6.8 from 19.2 in June. The last reading was the lowest since November 2012 and well below the long-term average of 24.3 points.

"Brexit surprised the majority of financial market experts. The uncertainty about the consequences of the vote for the German economy is largely responsible for the significant decline in economic sentiment," said ZEW President Achim Wambach.

"In particular, concerns about export prospects and stability of the European banking and financial system, probably will fall heavily on the economic outlook."

The index of current conditions fell to 49.8 from 54.5. Economists expected the index to be 51.8.

The indicator of the current economic situation declined by 2.4 points to minus 12.4 points.

EUR / USD: during the European session, the pair fell to $ 1.1023

GBP / USD: during the European session, the pair fell to $ 1.3120

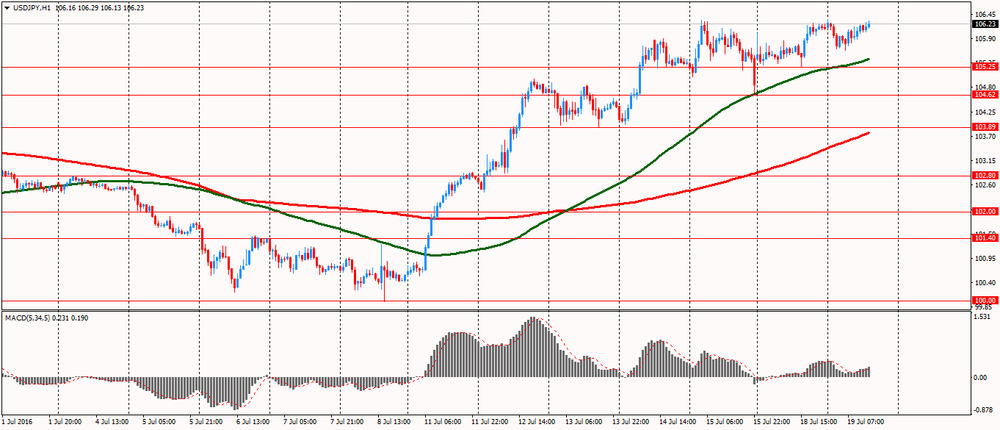

USD / JPY: during the European session, the pair rose to Y106.29

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.