- Analytics

- News and Tools

- Market News

- European session review: pound rose

European session review: pound rose

The following data was published:

(Time / country / index / period / previous value / forecast)

8:15 Speech UK member of the Committee on Monetary Policy Bank of England Martin Vila

10:00 Germany's Bundesbank Monthly Report

The British pound rose to session highs after Bank of England official Martin Weale said that he was not sure that he would support lowering the interest rate at the August meeting of the central bank.

Weale said that he would like to see a robust confirmation of the impact of Brexit before the rate cut next month.

"Uncertainty indicates that we should wait for more solid evidence before making any changes to the policy", - he said.

"Unlike the events of 2008, I have the feeling that there are no significant signs of financial panic."

The comments during a speech in London, in contrast with the majority of other officials of the Bank of England, responsible for the policy of the central bank.

Minutes had clearly demonstrated the intention of the bank to ease monetary policy next month to counter the adverse economic impact of Brexit.

The Bank of England kept interest rates at 0.5%, which was a surprise to the markets.

On Friday, the chief economist of BOE Andrew Haldane said the bank should respond "urgently and dramatically" in order to support the economy and build confidence.

However, the removal of financial constraints, not necessarily imply a reduction in the rate. Bank of England may also choose to increase the quantitative easing or launch new measures to stimulate lending.

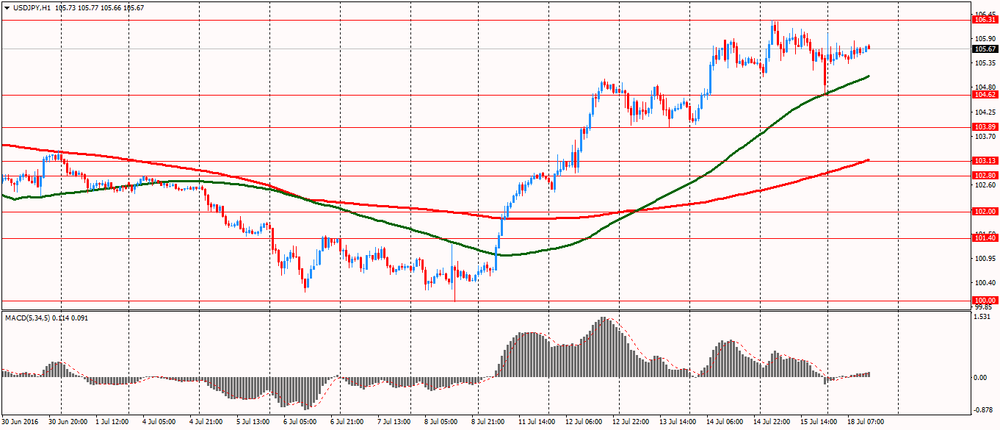

The yen weakened as the Turkish government regained control of the country after a failed coup attempt on Friday.

Initially, investors flocked to the yen on reports of a coup, but on Monday most of the transactions were closed.

On Sunday, the Turkish government announced the full restoration of control over the country and the economy after the collapse of an alleged military coup on Friday. Over the weekend, the government arrested some 6,000 military and judges, who are suspected of involvement in the failed coup.

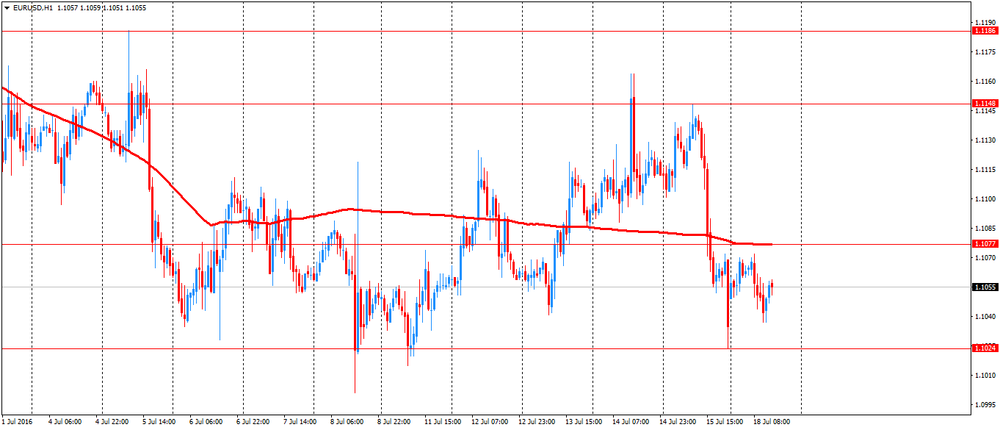

EUR / USD: during the European session, the pair fell to $ 1.1937, but then retreated slightly

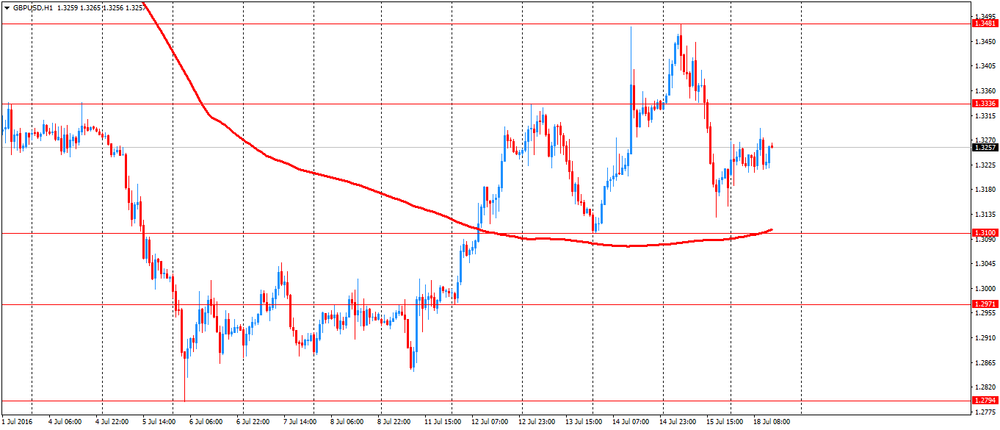

GBP / USD: during the European session, the pair rose to $ 1.3291

USD / JPY: during the European session, the pair rose to Y105.85

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.