- Analytics

- News and Tools

- Market News

- Asian session review: gaps after failed Turkish coup

Asian session review: gaps after failed Turkish coup

The New Zealand dollar fell after data on inflation in New Zealand. New Zealand Consumer Price Index in the second quarter rose 0.4%, after rising 0.2% in the first quarter. Analysts had expected an increase of 0.5%. The CPI year on year was below analysts forecast of 0.5% and 0.4%

According to the report rising gasoline prices and rising prices in housing market, was partially offset by lower prices for meat and domestic flights. Excluding gasoline prices, the consumer price index rose 0.2% in the second quarter. Prices for housing and communal services increased in the second quarter by 1.0%. Growth due to increased prices for new homes by 2.1%.

The most significant contribution to the reduction in the consumer price index was a reduction in the price of meat by 2.7% and the decline in prices for domestic flights by 9.9%. Prices for exported goods and services rose by 0.6%. Prices of non-tradable goods and services rose by 0.3%

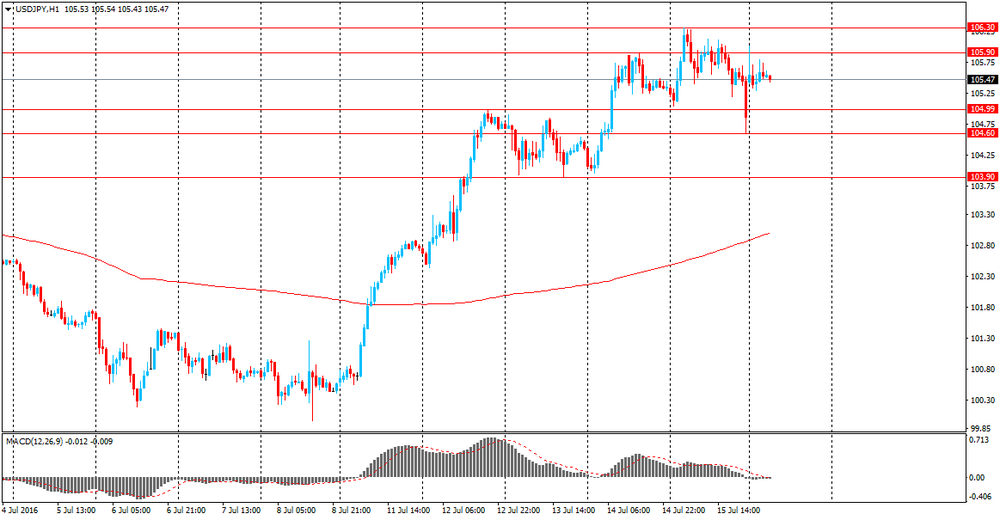

The US dollar strengthened against the Japanese yen during the Asian session, as a failed coup attempt in Turkey has led to buying of the dollar as a safe-haven currency. USD / JPY pair started a new week higher to Y105.70, also slightly stronger euro and the pound.

Turkish lira was able to recover a considerable part of the losses incurred on Friday, but analysts say caution about the future prospects of the currency. The coup, though failed, but pointed to a serious problem in Turkey, and the reaction of the Turkish authorities involves risks of increasing tensions in relations with the United States.

Earlier, the US dollar was supported by strong data on industrial production and retail sales. The data published by the Federal Reserve showed that industrial production in the US has grown strong by the end of June, exceeding the forecasts of experts and fully offset the decline in the previous month. The seasonally adjusted industrial production increased by 0.6% after falling 0.3% in May, which was revised in the direction of improvement from -0.4%. The last time a similar increase was recorded in July 2015. Economists had expected an increase of 0.2%. The report stated that in June there was a marked increase in vehicle production after the reduction in May. Mining - a category that includes the production of energy - increased for the second consecutive month, albeit only slightly. Total production in the manufacturing sector rose 0.4% in June, led by an increase in the production of automobiles and spare parts. Output in the utilities sector increased in June by 2.4% compared with the previous month, while mining rose 0.2%. In addition, data showed that the capacity utilization increased in June by 0.5 percentage points to 75.4%. Analysts had expected an increase to only 75%. Overall, industrial production fell by 0.7% in the 12 months to June. Production in the manufacturing sector increased by 0.4% per annum, and the yield in the field of communal services increased by 0.5%. Meanwhile, ore extraction increased by 10.5% compared to June 2015.

US retail sales showed strong growth in June, pointing to the strength of consumer spending, which ultimately should support for economic growth in the second half of this year. This was reported to the US Department of Commerce. According to data seasonally adjusted sales in retail stores and restaurants rose in June by 0.6% compared with the previous month, reaching $ 456.98 billion Meanwhile, sales in May were revised down -. To 0, 2% to 0.5%. Analysts had expected that sales will increase by only 0.1%. Excluding cars, retail sales rose by 0.7% compared to May, which was more than forecast (+0.4). Except for cars and gasoline, sales also rose by 0.7%. Compared with June 2015, the total volume of retail trade grew by 2.7%, which followed a 2.2% rise in May (revised from + 2.5%).

Now, investors' attention is directed, the European Central Bank, which on Thursday will the first referendum in the UK after a decision on monetary policy.

Economists say that the ECB is likely to refrain from further easing, but it can make changes to the bond buying program by expanding the list of available for the acquisition of assets.

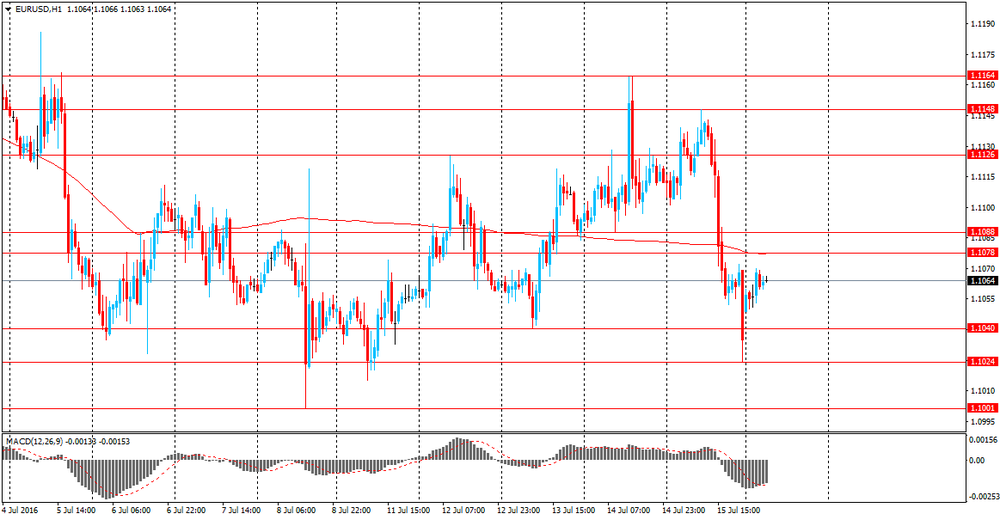

EUR / USD: during the Asian session, the pair was trading in the $ 1.1050-60 range

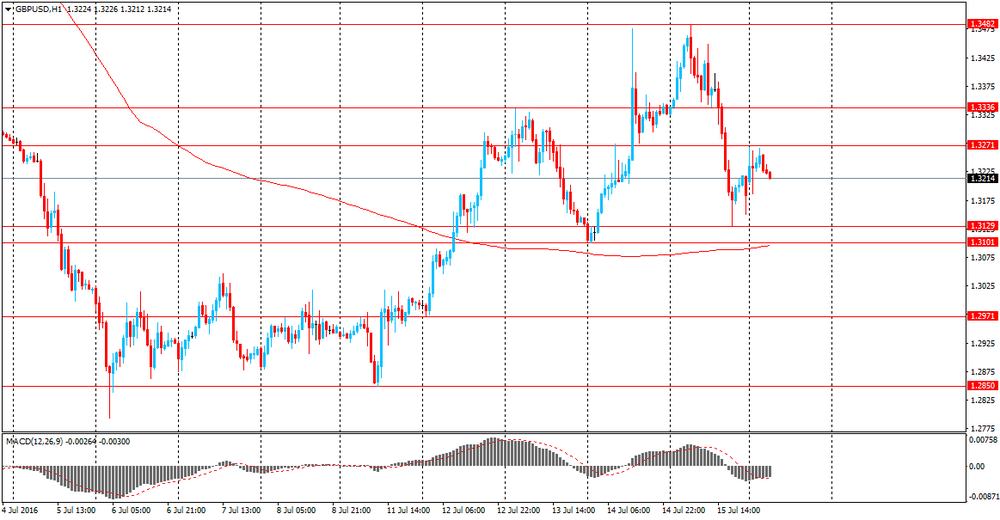

GBP / USD: during the Asian session, the pair is trading in $ 1.3190-1.3220 range

USD / JPY: during the Asian session, the pair was trading in Y105.30-60 range

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.