- Analytics

- News and Tools

- Market News

- Oil rose moderatly

Oil rose moderatly

Oil prices rose as more positive than expected Chinese economic data reinforced expectations for oil demand in the country.

Oil demand this year is stable due to relatively low prices on the world market against the backdrop of continuing oversupply. Oil traders are closely watching China, in order to understand whether the consumption growth is not slowing down against a background of doubt in the sustainability of economic growth in this country.

The growth of China's GDP in the 2nd quarter, as in the 1st quarter amounted to 6.7%. Economists believe that growth will be slightly less.

However, some analysts have pointed out that oil production in China continues to decline due to aging fields and reduced investment.

"Oil production in China is significantly less than the amount of its consumption, and the only way to compensate for this gap - to increase oil imports," - said Gao Jian of SCI International.

Concerns about unexpected supply disruptions in various regions of the world continue to support prices. Exxon Mobil Corp. reported that its unit in Nigeria has suspended oil exports due to some problems. Earlier, local rebels attacking oil facilities led to the production decline.

Meanwhile, Libyan oil exports remains well below historic highs due to the contradictions between the various regional groupings, despite a recent agreement to merge competing oil companies in the country. "In the short term supply of oil in Libya is unlikely to grow sufficiently to affect the world markets", - ClearView Energy Partners LLC. The company does not rule out that "for many years" may be necessary to restore Libya's substantial oil production.

Meanwhile, signs that the global oversupply is reducing more slowly than expected, caping price increases.

In the US, production goes down after low prices led producers to reduce investment in new drilling, but oil and petroleum products stocks worldwide are redundant.

In June, the global oil supply increased by 600,000 barrels per day to 96 million barrels a day, according to a recent report from the International Energy Agency (IEA).

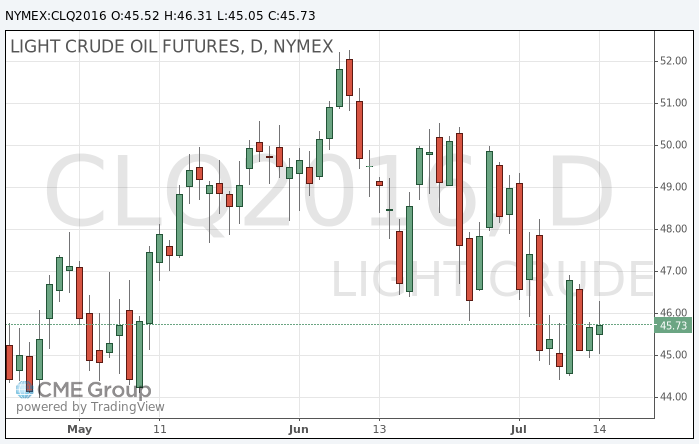

The cost of August futures for US light crude oil WTI rose to 46.31 dollars per barrel.

September futures price for Brent crude rose to 48.05 dollars a barrel on the London Stock Exchange ICE Futures Europe.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.