- Analytics

- News and Tools

- Market News

- Oil little changed for the day

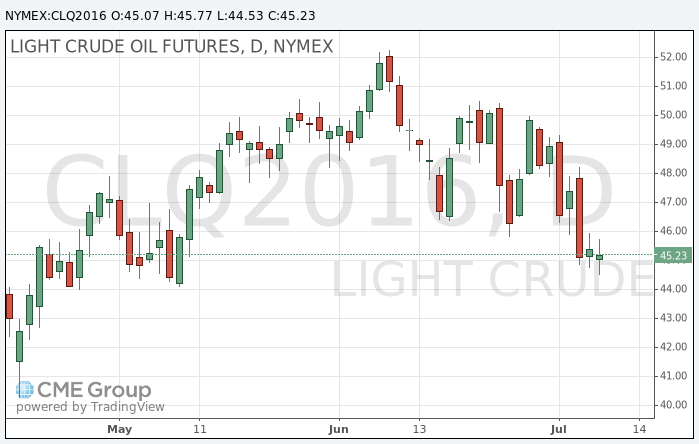

Oil little changed for the day

Earlier in the day, prices declined because market participants were worried about oversupply, which may worsen due to the end of oil supply disruptions from various regions of the world.

Last week the price of Brent crude oil lost 7.1%. Many observers believe that the elimination of supply disruptions is in the center of market attention.

As Bjarne Shildrop main raw analyst at SEB bank noticed, fast restoration of production in Canada and Nigeria after the interruption, as well as the prospects for the resumption of oil exports from Libya this week reinforce the bearish sentiment in the markets.

Although production in Nigeria is still low and the growth of production in Libya is something for the future, traders are showing caution, adds Shildrop.

On the demand side, Morgan Stanley pay attention to excess refinery production in the various regions of the world. If the market will form an excess supply of oil products, oil consumption this week can be reduced, which "will help restore balance in the oil market and oil prices."

Another factor influencing the price for this week may a increase in the number of drilling rigs in the United States. On Friday, Baker Hughes reported that the number of operating oil rigs in US last week increased by 10 units to 351 units.

The number of oil rigs in the United States is usually one of the indicators of activity in the oil industry. In October 2014 the number of drilling units peaked at 1609, but then it fell due to lower oil prices.

"Any data that the US oil producers are increasing production scare investors because global demand growth prospects are still unclear," - said Gao Jian of SCI International.

According to Gao, profit-taking in the oil market after Friday's rise in prices suggests that many investors are still not confident in the medium-term prospects for oil.

The cost of the August futures for US light crude oil WTI rose to 45.77 dollars per barrel.

September futures price for Brent crude rose to 47.10 dollars a barrel on the London Stock Exchange ICE Futures Europe.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.