- Analytics

- News and Tools

- Market News

- Asian session review: yen plummeted

Asian session review: yen plummeted

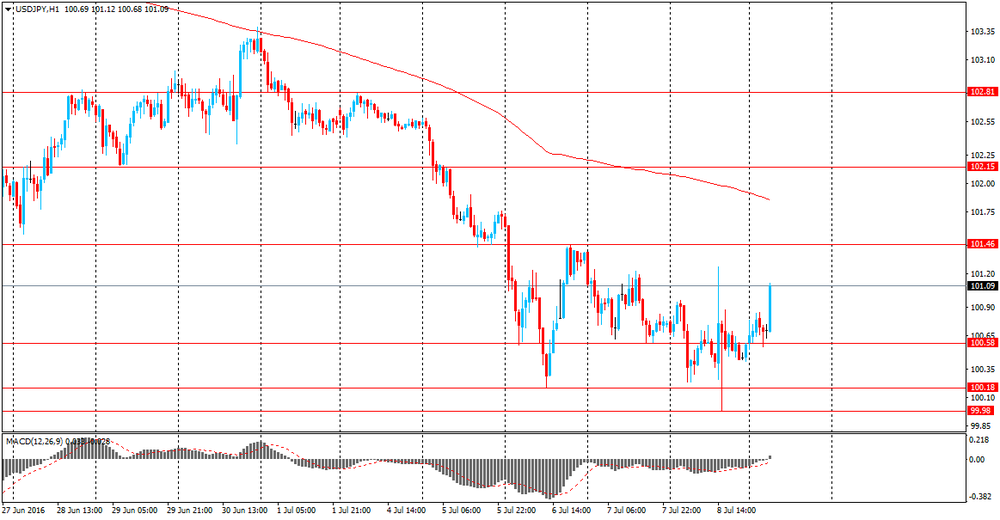

The yen fell sharply after today's press conference in which Japanese Prime Minister Shinzo Abe said that Japan preparing to take measures to stimulate the economy. Abe said that on July 12, he intends to instruct the Minister of economic recovery to prepare comprehensive economic measures to remedy the situation.

"In order to secure the support of domestic demand we implement complex bold economic measures" - Abe said.

The need for measures to stimulate the Japanese economy has been discussed for a long time, but all were waiting for the results of upper house election of the Japanese parliament, which took place this Sunday. The ruling coalition headed by Shinzo Abe received two thirds of the seats, the same number they already have in the lower house.

To some extent the yen was influenced by the negative data on orders for products of Japanese engineering. In May, orders for engineering products decreased by 1.4% after falling by -11.0% in April, while analysts had expected an increase of 2.6%. In annual terms, the orders also declined from -2.8% in April to -11.7% in May.

Report on new orders, published by the Cabinet of Ministers of Japan, reflects the total amount of orders for engineering products, placed in large companies. This formal contracts concluded between consumers and producers, for the supply of goods and services. This report is considered the best leading indicator of capital spending in the area of enterprise and a decline indicates a deterioration in business confidence and, therefore, is a negative for the economy of Japan.

As noted in the report orders for engineering products continued to decline in June amid rising yen as well as consequences of the April earthquake.

Also, according to a preliminary report published by the National Association of Machine Tool Japan, orders for machinery and equipment fell on June 19.9%, after declining by -24.7% in May. This indicator points to reflect commercial and general economic conditions in Japan.

US dollar since the beginning of the session strengthened slightly against the Australian and New Zealand dollars. The US Labor Department reported on Friday that the number of people employed in non-agricultural sectors increased by 287,000, the largest increase since October last year. The data for May were revised down to 11 000 to 38 000. The unemployment rate rose by two tenths of a percentage point to 4.9 per cent, as more people entered the labor force. Economists had forecast employment growth of 175,000, while it was expected that the unemployment rate will rise to 4.8 percent. The level of participation in the labor force increased by 0.1 percent to 62.7 percent. Meanwhile, the average hourly wage increased by only 2 cents, or 0.1 percent in June. Experts note that the most recent data on the labor market proves that the economy will recover growth after a weak first quarter, but a slow wage growth is likely to force the Fed policy makers to be cautious on the issue of raising rates. Prior to the publication of the report the futures interest rate the Fed pointed to a 19 percent chance of a rate hike in December, but now the probability of such a step was increased to 26 percent.

On Sunday, China published data on inflation. As it became known, the consumer price index published by the National Bureau of Statistics of China, fell by -0.1% in June, after falling -0.5% in May. Analysts had expected a decline to -0.3%. In annual terms, the consumer price index in China was 1.9%, above expectations of 1.8%, but lower than the previous value of 2.0%.

CPI growth in June was the slowest since January this year.

Food prices were up by + 4.6% after rising 5.9% in May. The target rate of inflation is around 3% on an annualized basis.

Also, China's National Bureau of Statistics said the producer price index, which measures the rate of inflation for manufacturers, dropped by -2.6% in June, after declining 2.8% in May. Analysts had expected a decline to -2.5%.

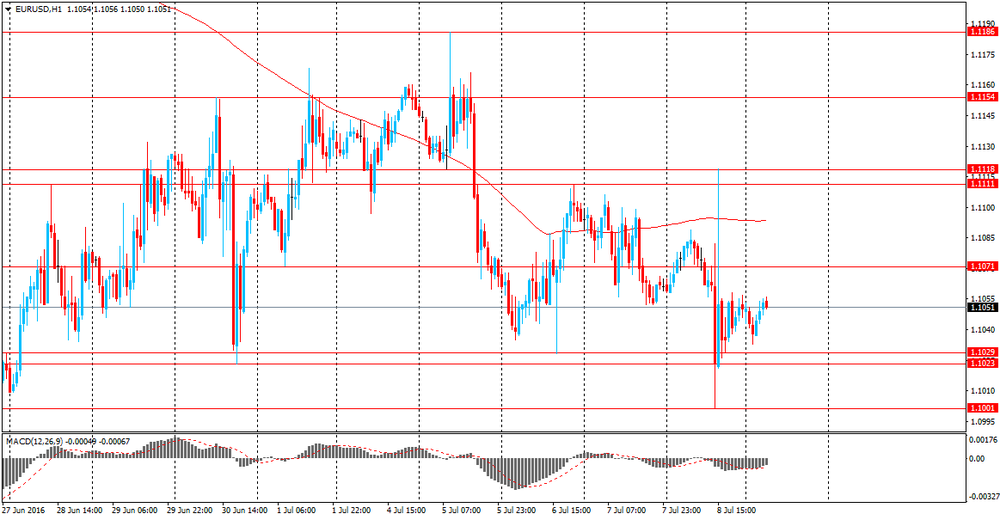

EUR / USD: during the Asian session, the pair was trading in the $ 1.1035-50 range.

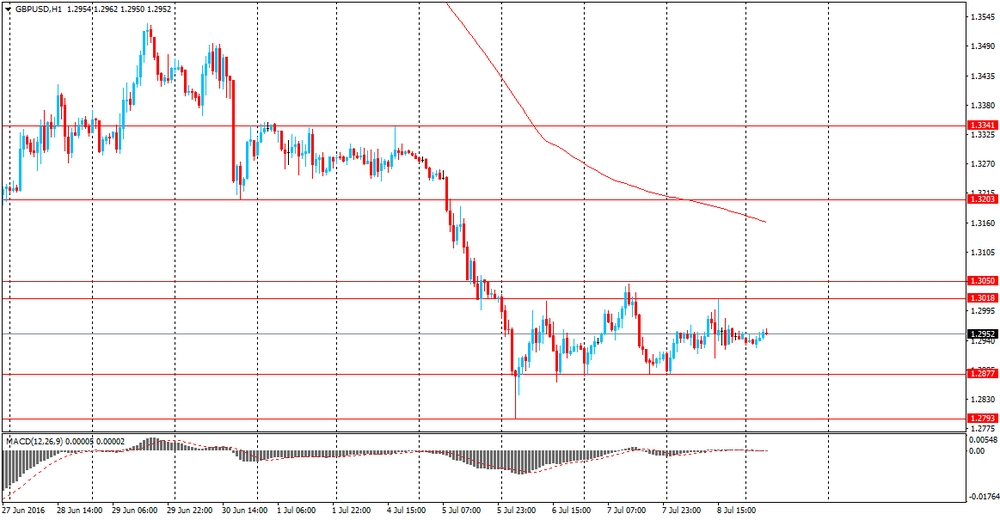

GBP / USD: during the Asian session, the pair is trading in $ 1.1.2925-80 range.

USD / JPY: rose to 101.92 from 100.59.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.