- Analytics

- News and Tools

- Market News

- Asian session review: US dollar lost some ground

Asian session review: US dollar lost some ground

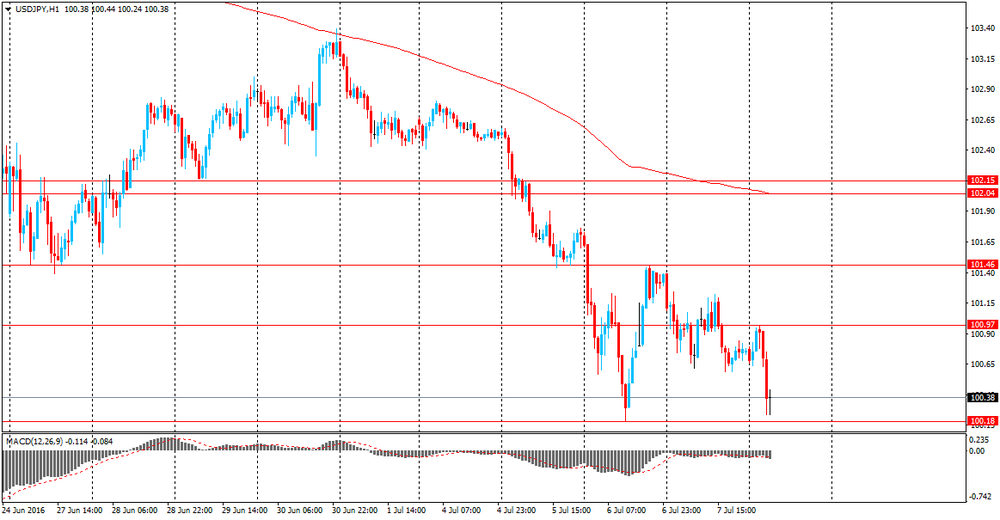

The yen began to rise again against the dollar, returning to support levels. US dollar fell to Y100,25, reaching the low of July 6 and then recovered to 100.36, on the news of the violent protests against the cruelty of the law enforcement agencies in Dallas.

On Thursday night in Dallas ten police officers had been shot - three of them are dead, seven wounded, it caused chaos in the city.

The balance of payments of Japan without regard to seasonal fluctuations amounted to ¥ 1 809.1 billion in May, higher than analysts' expectations of ¥ 1 750.0 billion. In April, the balance surplus amounted to ¥ 878.5 billion.

The balance of the current account - a figure published by the Ministry of Finance and reflect the balance of the current export and import of goods and services, with the addition of net investment income and current transfers. The current account surplus indicates that the flow of capital into Japan exceeds its outflow. The high value of the index is a positive factor for the Japanese currency.

The balance of foreign trade, published by the Customs Department of Japan, in May amounted to ¥ 39.9 billion lower than the previous value of ¥ 697.1 Bln. This indicator measures the balance between imports and exports. A positive value represents a trade surplus while a negative - trade deficit. Due to the high dependence on exports of Japan, the country's economy is highly dependent on the trade surplus. Confident demand for Japanese exports leads to a positive growth of the trade balance.

Also today, the Bank of Japan released a report on bank lending, which estimates the amount of all outstanding loans in the banking sector. As it became on an annualized basis in June bank lending increased by 2.0%, after rising 2.2% in May.

Also today, the Ministry of Health, Labour and Welfare of Japan, said that the level of wages in May fell by 0.2% after rising by 0.3%. Analysts had expected an increase of 0.5%.

Real cash incomes increased by 0.2% after rising 0.4% in May, in April. The April value was revised downward to 0.6%

Wage growth is one of the key tasks of the administration's policies of Prime Minister Shinzo Abe. Nominal wage growth in Japan fell in May for the first time since June 2015.

The US dollar fell against most major currencies in Asian trade, while traders waiting took profits before the NFP report. The June data on the number of workers is likely to recover after a disappointing May report. According to forecasts, the number of employees increased by 178 thousand., After rising a meager 38 thousand. Analysts say that the Fed has little reason to raise interest rates this year. Until recently, it had been widely expected that the Fed will raise interest rates at some point this summer. Nevertheless, given Brexit and the May employment data in the US, investors are skeptical that the Fed will raise rates this year.

The New Zealand dollar continued to rise against the background of the widespread weakening of the dollar, after Reserve Bank of New Zealand once again expressed concern about the state of the housing market.

Yesterday, deputy governor of the RBNZ Grant Spencer, speaking about the report on macro-prudential policy and the housing market, said that the bank is considering the possibility of expanding restrictions on lending to cool the housing market. He did not announce any new measures, but said that they could be adopted by the end of the year.

The Swiss franc rose against the background of increasing demand for safe-haven assets. According to the report of the State Secretariat for Economic Affairs (SECO) unemployment rate declined to 3.3% from the previous value of 3.5%. Analysts had expected the index at the same level.

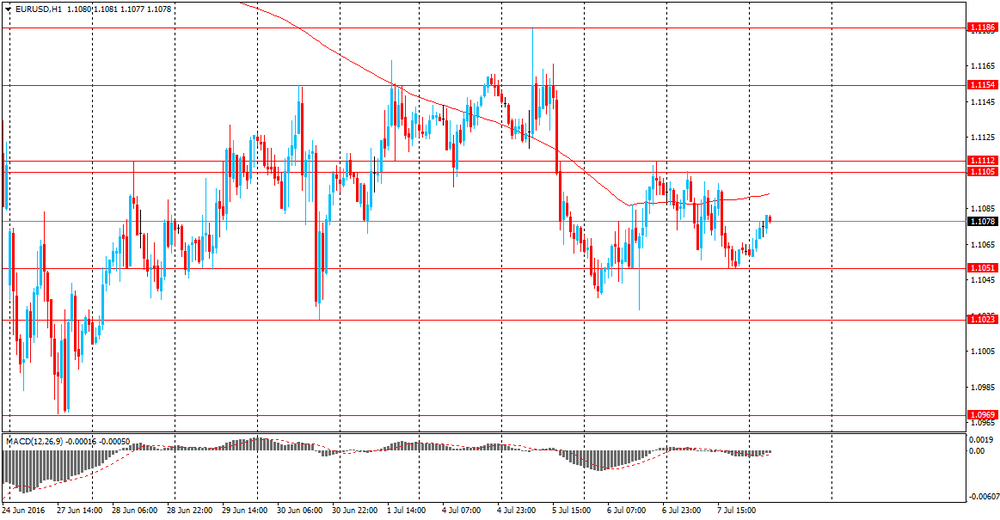

EUR / USD: during the Asian session, the pair was trading in the $ 1.1060-85 range.

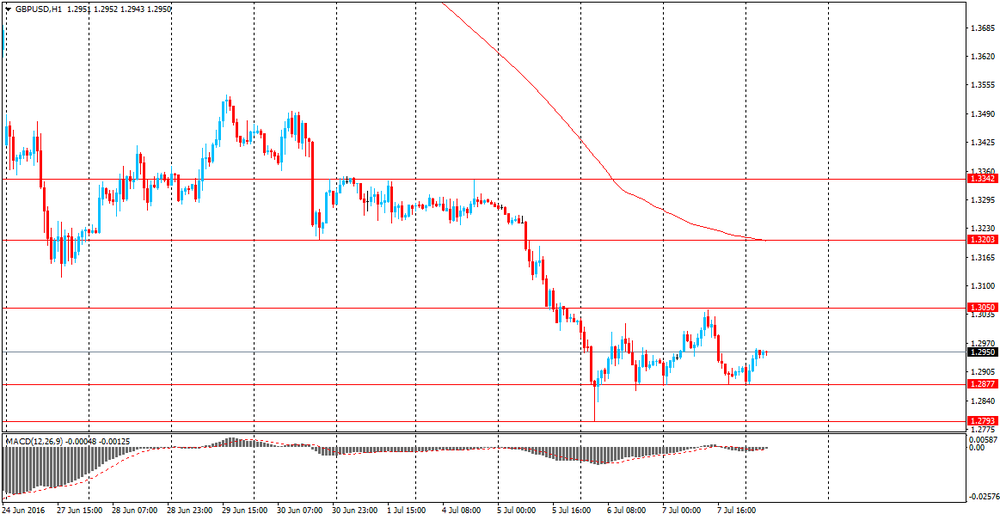

GBP / USD: during the Asian session, the pair is trading in the $ 1.1.2880-1.2945 range.

USD / JPY: during the Asian session, the pair was trading in Y100.25-100.40 range.

At 08:30 GMT the UK will release the total trade balance for May. At 12:30 GMT the United States and Canada will publish the employment reports for June.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.