- Analytics

- News and Tools

- Market News

- “Most important NFP of the year” - BofA Merrill

“Most important NFP of the year” - BofA Merrill

"In our view, Friday's US payrolls report will be watched even more keenly than usual as investors look for confirmation that the weak print last month was an outlier and not the start of a new, weaker trend.

Market expectations are for a significant bounce to 180k, matching our economists' estimates, but looking at historical data, we find some evidence of a tendency for consensus to over-estimate the size of the rebound following particularly disappointing payroll reports.

With Brexit spillovers keeping markets nervous, we believe the risks around Non-farm Payrolls (NFP) are asymmetric, especially following the broad risk rally we have seen up until Tuesday this week, with a miss in payrolls likely to see risk sentiment sharply affected. While a strong NFP report would moderate some negativity, we believe it would take a particularly strong print to meaningfully (and sustainably) move near-term Fed expectations forward, given post-Brexit global uncertainty.

Positioning for delight… or disappointment in FX - sell CAD

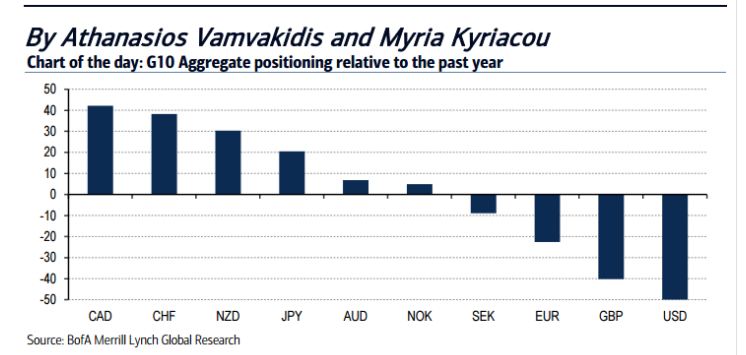

Positioning suggests disappointment from a weak NFP would be negative for CAD/JPY and NZD/JPY, while a strong number could support USD/CAD and USD/CHF.

On balance, being short CAD going into the NFP has the best risk-reward potential, in our view".

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.