- Analytics

- News and Tools

- Market News

- European session review: pound rose

European session review: pound rose

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Industrial Production (m / m) in May 0.5% Revised to 0.8% 0% -1.3%

France 6:45 Trade balance, bn May -5.2 -4.9 -2.8

7:15 Switzerland Consumer Price Index m / m in June 0.1% 0.1% 0.1%

7:15 Switzerland Consumer Price Index y / y in June -0.4% -0.5% -0.4%

7:30 UK House Price Index from Halifax, m / m in June from 0.9% Revised 0.6% 0.4% 1.3%

7:30 UK House Price Index from Halifax, 3m y / y in June 9.2% 7.7% 8.4%

8:30 UK Industrial Production m / m in May 2.1% Revised from 2% to 1% -0.5%

8:30 UK Industrial Production y / y in May from 2.2% Revised 1.6% 0.5% 1.4%

8:30 UK Manufacturing production m / m in May to 2.4% Revised 2.3% -1% -0.5%

8:30 UK Manufacturing production, y / y in May 0.8%

11:30 Eurozone ECB's report on the meeting dedicated to monetary policy

The pound rose from record lows against the US dollar after the release of positive manufacturing data in Great Britain, although concerns about Brexit consequences for the national economy continue to weigh.

The Office for National Statistics said that output in the UK manufacturing fell in May to a seasonally

The volume of industrial production decreased by 0.5 percent in May after the growth with 2.1 percent in April. It was the biggest drop in the past five months, but less than the expected decline of 1 percent.

In addition, manufacturing output fell by 0.5 percent, in contrast to an increase of 2.4 percent a month ago.

In annual terms, industrial production growth slowed to 1.4 percent in May, compared with 2.2 percent. Economists had forecast an increase of 0.5 percent.

Investors are now preparing for the meeting of the Bank of England next week, after the head of the central bank Governor Mark Carney signaled last week that it may take action during the summer, increasing expectations of the upcoming rate cut.

On Tuesday, the Bank of England warned of "representing the complexity of financial stability risks resulting after" Brexit and reduced requirements for the volume of capital reserves for banks.

Mark Carney said that this move implies "substantial changes" to help the economy to overcome the consequences of Britain leaving the EU.

At the same time, sentiment on the dollar slightly weakened after the June Fed meeting minutes released on Wednesday showed that officials of the US central bank decided that it is necessary to postpone the increase in interest rates, while evaluating British referendum consequences.

The minutes also stated that members of FOMC agreed to "reasonable wait for the new statistics before considering another rate hike".

Euro fell against the dollar after the release of weak data on industrial production in Germany. In May, industrial production in Germany fell by 1.3% compared with the previous month, according to the Ministry of Economics and Labour.

The decline os the index was the most significant since August 2014, on average the market is not expected to change. Industrial production decreased by 0.4% compared to May last year.

The April growth rate of industrial production in Germany was revised from 0.8% to 0.5% compared to March and from 1.2% to 0.8% in annual terms.

Construction output in May decreased by 0.9% compared with the previous month, the release of capital goods fell by 3.9%. Electricity generation increased by 3.9%, consumer goods production - by 0.5%.

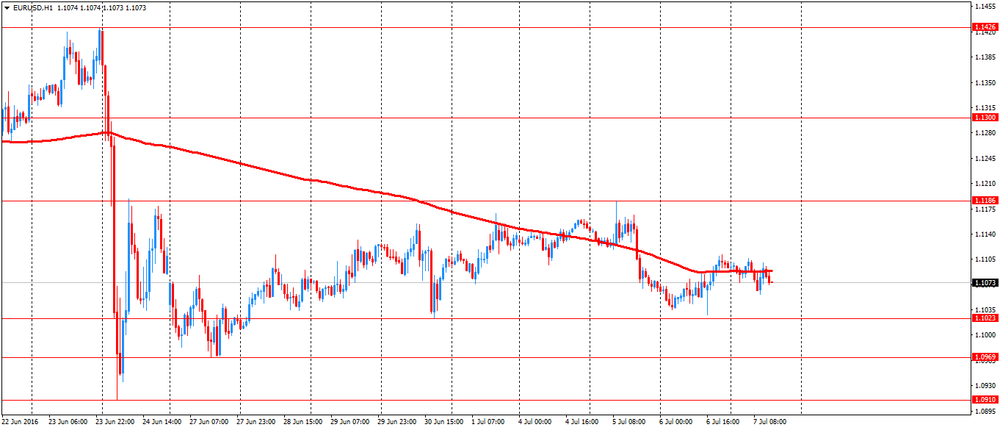

EUR / USD: during the European session, the pair fell to $ 1.1056

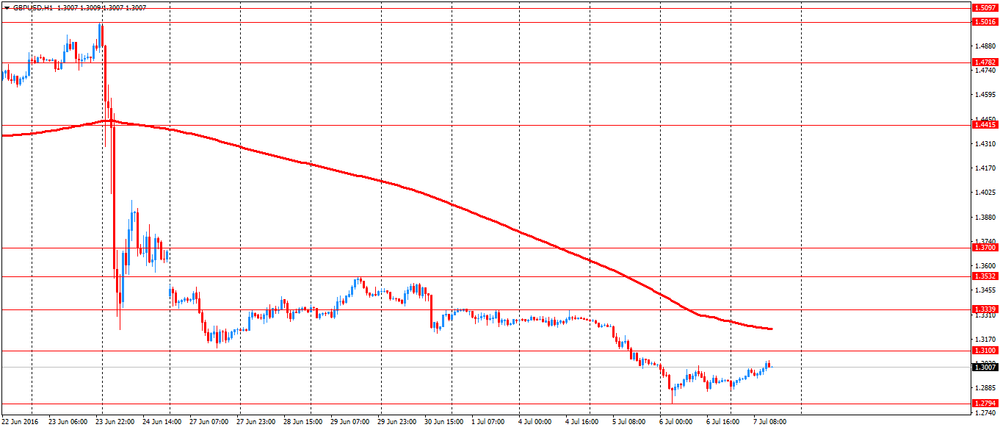

GBP / USD: during the European session, the pair has risen to $ 1.3046

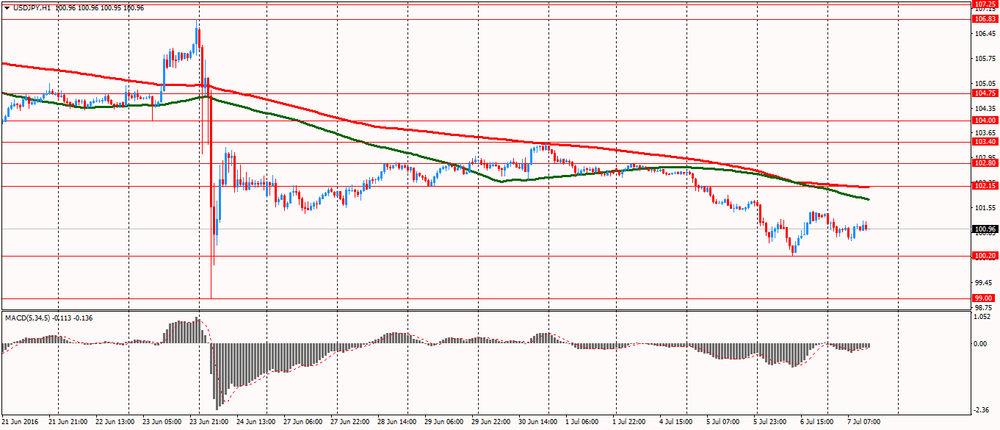

USD / JPY: during the European session, the pair fell to Y100.62 and then rose to Y101.19

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.