- Analytics

- News and Tools

- Market News

- European session review: the pound recovered slightly from new multi-year lows

European session review: the pound recovered slightly from new multi-year lows

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Factory Orders m / m in May -2.0% 1% 0%

7:30 Speech Australia RBA assistant head G. Debellya

8:00 It Eurozone ECB President M. Draghi

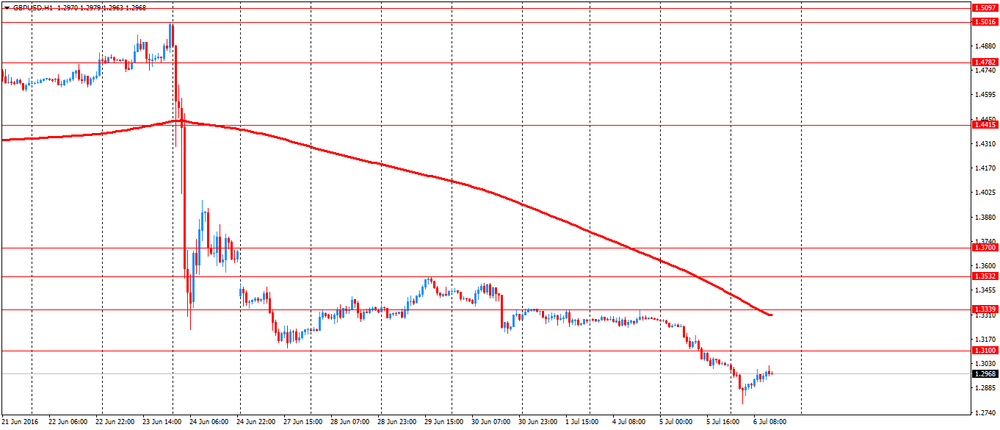

Gbp/Usd dropped significantly before the start of the current session, dropping below the level which was considered a strong support - $ 1.30, and reached the lowest level in 31 years $ 1.2794.

The pair then rebounded to $ 1.3014, but analysts do not rule out a new round of selling. The pound fell after three British investment fund, engaged in real estate, suspended early repayment. This has called into question the health of the housing market and the economy in general and the increased concern about the outflow from UK.

"The basis for the UK economic growth remains weak, given the approaching 7% deficit of the current account of the balance of payments, as well as the fact that foreign investors believe the country is mired in uncertainty," - says Simon Smith.

"At the moment, the pound recovered after declining the previous day, but whatever its growth will be relatively short-lived," - said Keith Jax from Societe Generale.

"Looks more likely that GBP / USD will trade in $ 1.20-1.25 range", - he added.

The pound came under selling pressure after the Bank of England warned of "representing the complexity of the financial stability risks resulting after Brexit and reduced requirements for the volume of capital reserves for banks.

The head of the Bank of England Governor Mark Carney said that this move implies "substantial changes" to help the economy overcome the consequences of Britain leaving the EU.

In its report on Financial Stability, issued twice a year, the Bank of England said that the threats which he feared after the referendum began to materialize. The pound fell to its lowest level in 31 years, and the financial sector stocks have fallen by 20%.

Last week, Carney has signaled that more stimulus may be needed this summer, strengthening expectations of a possible rate cut by the end of August.

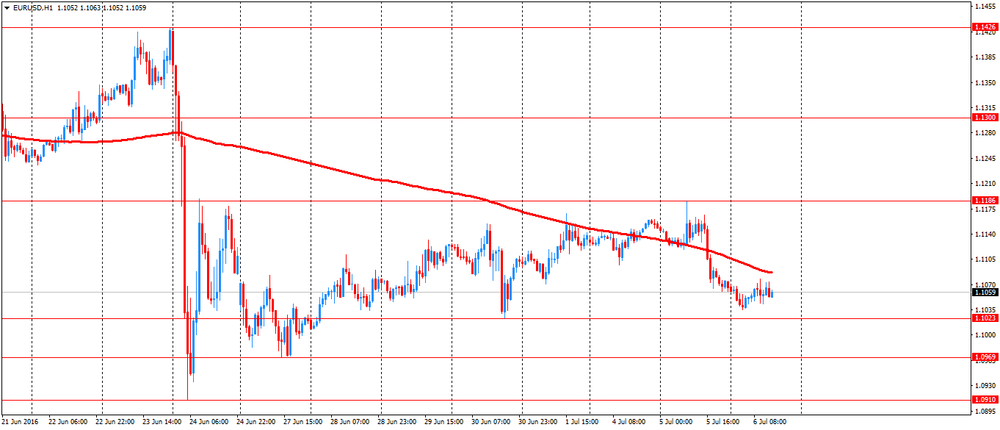

Euro stabilized against the dollar after a decline earlier in the day on the background data on factory orders in Germany. The volume of orders in Germany industry has not changed compared to the previous month, when the decline was 1.9% , data from the Ministry of Economy of Germany suggests. Forecasts indicated +1%.

Orders in May 2015 decreased by 0.2%, while experts predicted an increase of 0.9%.

The volume of orders received from Germany decreased by 1.9%. Export orders from outside the euro zone in the last month - 0.3%, while orders from other countries in the currency bloc jumped by 4%.

Demand for consumer goods decreased by 0.4%.

This year, business confidence and the German economy to suffer from the weak global economic growth and trade, restrained increase corporate profits and risks associated with Brexit. As stated by the head of the Bundesbank, Jens Weidmann last week, Brexit could further weaken the German economy.

In June, the Bundesbank cut its growth forecasts for the German economy in the years 2016 and 2017, to 1.7% and 1.4%, respectively, from 1.8% and 1.7%.

EUR / USD: during the European session, the pair has risen to $ 1.1078

GBP / USD: during the European session, the pair has risen to $ 1.3014

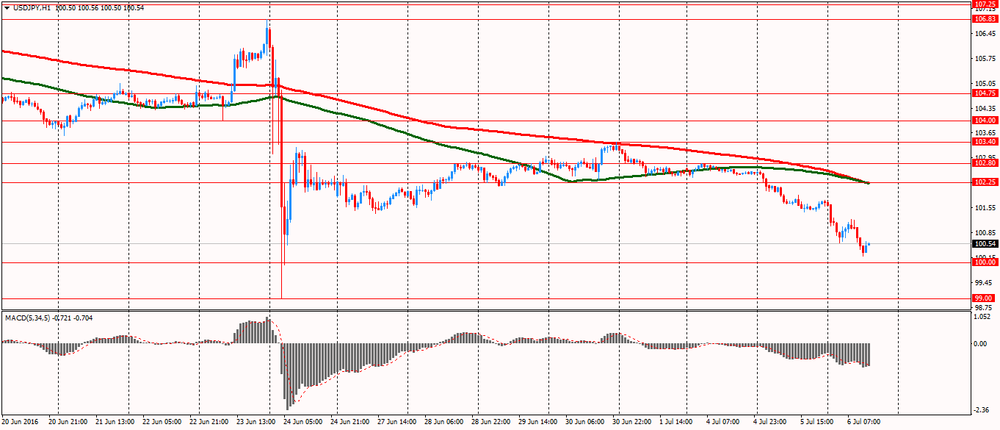

USD / JPY: during the European session, the pair fell to Y100.19

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.