- Analytics

- News and Tools

- Market News

- Goldman Sachs cuts Eur and Gbp forecasts

Goldman Sachs cuts Eur and Gbp forecasts

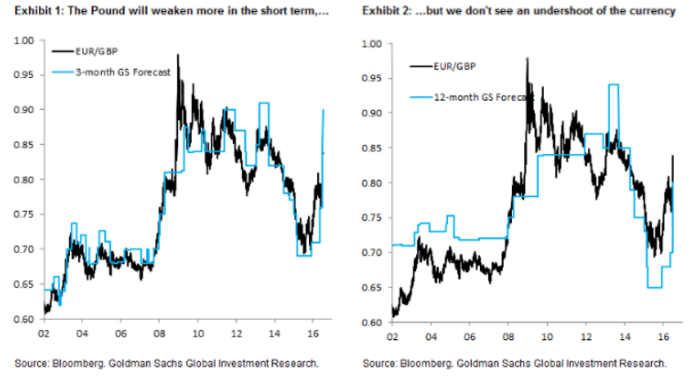

"Following the Brexit surprise, we revised our Sterling forecasts weaker, but - amid lots of doomsday scenarios for the Pound - resisted the temptation to forecast a free-fall. Now that markets have settled somewhat, we are switching to forecast a second leg of weakness for the Pound, as the Bank of England's policy response drives the currency weaker.

...The market is not discounting the easing effect of asset purchases, the persistence of easier monetary conditions in the UK, and the US-UK monetary policy divergence that we expect nearly as much as it should.

Next week, we expect the BoE to provide a further indication of the scope of the conventional and unconventional monetary policy measures we expect. This will be the catalyst for a further downward move in Sterling.

...Turning to the Euro, the negative growth spill-overs that our economists expect is a cumulative 0.5 percent over two years (compared with 2.75 percent for the UK). This slowdown implies downside risks to our already low inflation projections and puts additional pressure on the ECB to step up the pace of monetary accommodation.

Our economists expect an extension of the asset purchase programme through 2018 and a shift away from the ECB's capital key. The latter change could reduce market worries over Bund scarcity and, in our view, could lead to more EUR/$ weakness.

Our new EUR/GBP forecast is 0.90, 0.86 and 0.80 in 3-, 6- and 12-months (from 0.85, 0.82 and 0.78 previously), i.e. builds in more Sterling weakness in the near term. We also revise our EUR/$ forecast to 1.08, 1.04 and 1.00 in 3-, 6- and 12-months (from 1.12, 1.10 and 1.05 previously).

These changes imply a new path for GBP/$ of 1.20, 1.21 and 1.25 in 3-, 6- and 12-months, i.e. substantially more front-loaded downside than in our forecast in the immediate aftermath of the Brexit vote (1.32, 1.34 and 1.35)".

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.