- Analytics

- News and Tools

- Market News

- European session review: pound updated multi-year lows

European session review: pound updated multi-year lows

The following data was published:

(Time / country / index / period / previous value / forecast)

7:50 France Business activity index in the services sector (final data) June 51.6 49.9 49.9

Germany 7:55 PMI in the service sector (final data) June 55.2 53.2 53.7

8:00 Eurozone business activity index in the services sector (final data) June 53.3 52.4 52.8

8:30 UK PMI index for the services sector in June 53.5 52.7 52.3

9:00 Eurozone Retail Sales m / m in May 0.0% 0.4% 0.4%

9:00 Eurozone Retail sales, y / y in May 1.4% 1.6% 1.6%

UK 9:30 Report the Bank of England financial stability

10:00 UK BOE Speech Mark Carney

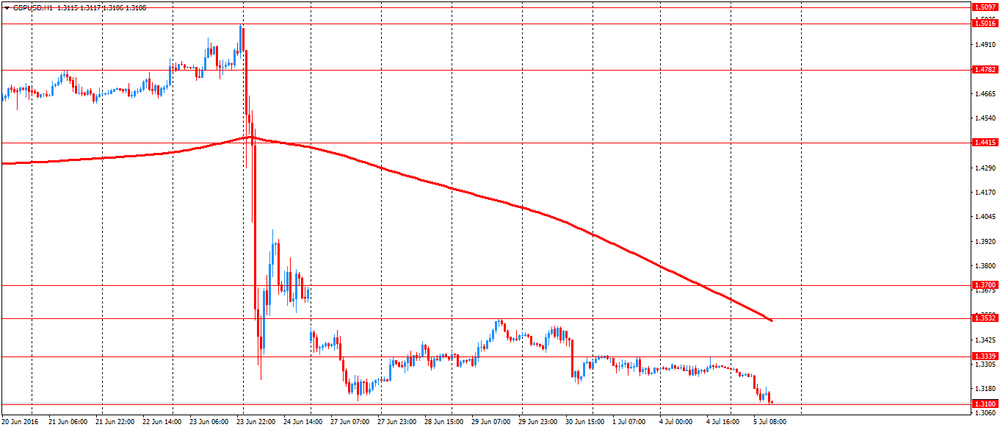

The British pound fell to a new 31-year low against the dollar after the Bank of England published the Financial Stability Report. The central bank said it sees risks reducing capital inflows after the referendum and believes that a sustained reduction in capital inflows will put further downward pressure on the pound.

All of the assets that are considered risky were hit by a new wave of fears as to the consequences of the UK's withdrawal from the European Union become clearer.

Most analysts believe that the pound will continue to fall.

Deutsche Bank analysts suggest that the GBP / USD pair will dropped by the end of the year to $ 1.15, while Morgan Stanley analysts believe that it will end the year in the range of $ 1.25 - $ 1.30.

"Apparently, the pound will continue to fall, given the risks associated with large current account deficit the UK balance of payments, and expectations of slowing economic growth and monetary easing from Bank of England", - said the head of foreign exchange strategy ABN AMRO Group.

UK imports more goods and services than it exports, and invests abroad more than it receives. This means that the country's economy depends on the willingness of investors from around the world to fill the deficit of the current account of balance of payments, which implies a constant demand for assets denominated in the pound. The attractiveness of these assets has declined in the eyes of some investors.

Also,economic data from UK put preasure on the pound. Increased activity in the UK services sector eased to 38-month low recorded in April, results of a survey by Markit showed.

Purchasing Managers' Index in the services sector by Markit / Chartered Institute of Purchasing and Supply fell to 52.3 in June from 53.5 in May. The index was lower than the expected level of 52.7.

A reading above 50.0 indicates growth in the sector compared to the previous month, but below 50.0 indicates contraction.

The period of data collection for the study was between 13 and 28 June, and 89 percent of the responses were received before June 24, when the British voted for withdrawal from the EU.

Chris Williamson, chief economist at Markit, said: "Studies of PMI indicates that the pace of UK economic growth slowed to just 0.2 percent in the second quarter, with a further loss of momentum in June, as the anxiety of Brexit intensified."

12-month outlook was the gloomiest since December 2012, the service providers said that the uncertainty associated with Brexit had a negative impact on new orders and workloads.

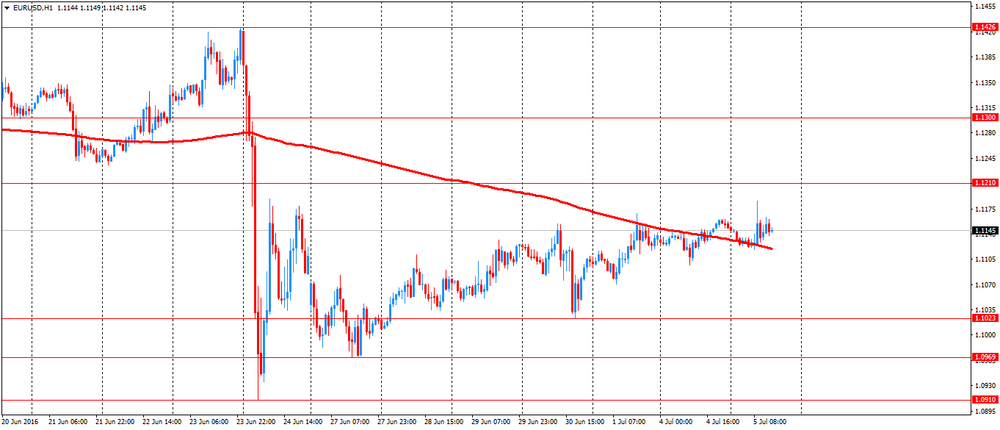

The euro rose against the dollar after a decline earlier in the day because of uncertainty about the future of the UK and Italian banks. The Italian Government is considering the possibility of recapitalization of banks in the country at the expense of budget funds. Such a measure likely will be opposed by the EU authorities.

The growth of the private sector in the euro area remained unchanged in June.

Composite Production index was 53.1 in June, as well as in May, but was above 52.8 preliminary evaluation. A reading above 50 indicates expansion.

In the second quarter the index fell to 53.1 from 53.2 in the previous quarter, and it was the lowest since the last quarter of 2014.

National PMI data showed strong expansion in Germany, Italy, Spain and Ireland. On the other hand, the French reported a decrease in output and new orders.

The rise in the German service sector weakened at the end of the second quarter. The final PMI index in the services sector fell to 13-month low of 53.7 from 55.2 in May. However, the reading was above 53.2 preliminary evaluation.

The composite PMI fell slightly to 54.4 from 54.5 in May. The initial assessment in June was 54.1.

In France, the services sector remained overall at the same level in June. The final PMI in the service sector fell to 49.9, according to a preliminary estimate, from 51.6 in May.

In addition, the euro zone retail sales rose for the second month in a row in May, according to Eurostat data released on Tuesday.

Retail sales rose 0.4 percent for the month in May, after rising 0.2 percent in April, which was revised with the same values.

Sales of non-food products except automotive fuel, increased by 0.7 percent for the month, while sales of food products, beverages and tobacco showed no changes.

In annual terms, retail sales growth accelerated to 1.6 percent in May, compared with 1.4 percent in the previous month. This was in line with economists' expectations.

Among the Member States, the highest monthly increase in the overall volume of retail trade was registered in Sweden, Estonia and Ireland, while the largest decrease was observed in Portugal, Romania and Denmark.

EUR / USD: during the European session, the pair fell to $ 1.1119 and then rose to $ 1.1186

GBP / USD: during the European session, the pair fell to $ 1.3104

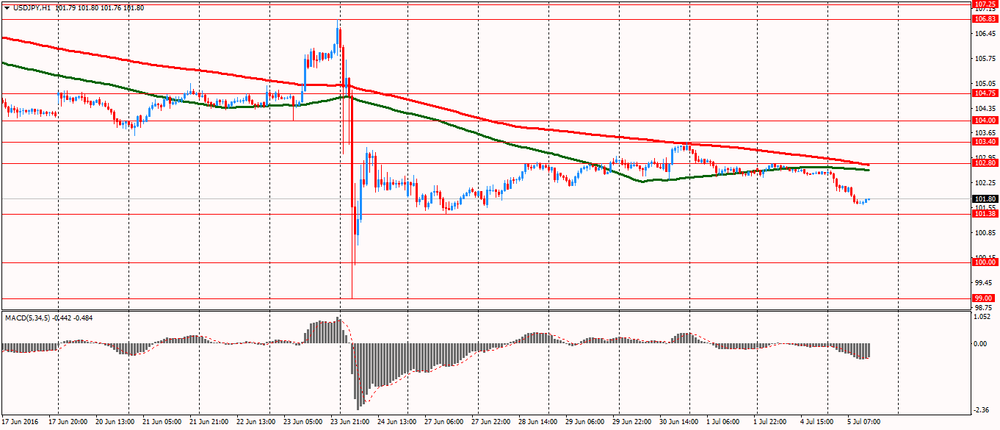

USD / JPY: during the European session, the pair fell to Y101.64

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.