- Analytics

- News and Tools

- Market News

- Eurozone services PMI better than forecasts but weakest since the end of 2014 - Markit

Eurozone services PMI better than forecasts but weakest since the end of 2014 - Markit

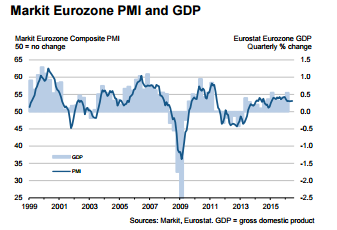

June saw the growth rate of eurozone economic output hold steady at a moderate pace. After rising slightly from the earlier flash estimate of 52.8, the final Markit Eurozone PMI Composite Output Index posted 53.1, unchanged from May. This left the average reading for the headline index for the second quarter a shade below that for the opening quarter (53.1 versus 53.2) and at its lowest level since the final quarter of 2014.

Manufacturing production registered its fastest growth in the year so far in June, and outperformed the service sector for the first time in three months. Service sector activity rose at the slowest pace in almost one-and-a-half years. National PMI data indicated solid expansions in Germany, Italy, Spain and Ireland during June. Growth accelerated in the latter three and German output rose at a pace almost identical to May's fourmonth high. All of these nations scaled up activity in response to faster inflows of new business.

France remained well behind the rest of the pack in June, with French companies seeing output and new orders edge back into contraction territory. The downturn in manufacturing production continued, while the trend in service sector activity slid slightly below the stagnation mark.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.