- Analytics

- News and Tools

- Market News

- The upturn in Germany’s service sector slowed

The upturn in Germany’s service sector slowed

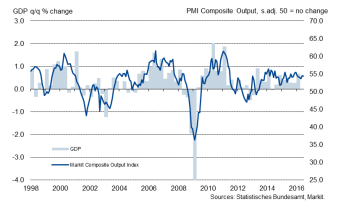

According to Markit, the upturn in Germany's service sector slowed at the end of the second quarter, with business activity and new order intakes both increasing at weaker rates. Nonetheless, companies raised their employment levels, while backlogs of work accumulated for the first time in three months. Moreover, charges rose only marginally and firms remained confident about their 12-month outlook for output.

June data signalled a slowing in the pace of output growth at German service providers, with the final seasonally adjusted Markit Germany Services Business Activity Index falling from May's 55.2 to a 13-month low of 53.7.

Transport & Storage firms noted a slight decrease in output, while particularly strong growth was reported by companies in the Financial Services sub-sector. Anecdotal evidence attributed the overall rise in activity to increased new business and the processing of backlogs. Meanwhile, total private sector output expanded in June at a pace that was little-changed from May. This was highlighted by the final Markit Germany Composite Output Index - which measures the combined output of the manufacturing and service sectors - posting 54.4, down a tick from 54.5 in the previous month.

Latest survey results pointed to a slowdown in new business growth placed with German service providers, with the June rise the weakest in just under a year. As was the case with output, companies in the Transport & Storage sub-sector reported a decline.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.