- Analytics

- News and Tools

- Market News

- Business activity returned to growth across Italy’s service sector

Business activity returned to growth across Italy’s service sector

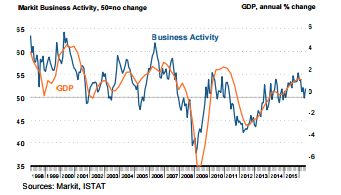

Business activity returned to growth across Italy's service sector at the end of the second quarter, after falling slightly and for the first time in 17 months during May. There was also positive news on the employment front, with job creation reaching the fastest in 2016 so far. However, survey data pointed to a squeeze on margins, as cost inflation accelerated to a 13-month high but prices charged decreased. The headline Markit Business Activity Index - which is based on a single question asking respondents to report on the actual change in business activity at their companies compared to one month ago - registered 51.9 in June, up from May's 49.8. That signalled a renewed upturn in service sector business activity, albeit with the rate of expansion being only moderate. Growth in incoming new business picked up to the fastest for four months in June, with a number of panel members commenting on new client wins amid a general strengthening of demand. Nevertheless, the amount of work-in-hand (both in progress and not yet started) at Italian services firms decreased for the tenth month in a row and at a faster rate than during May. One factor helping firms keep atop of workloads was rising staffing capacity. June saw the level of employment increase across Italy's services economy for the ninth straight month, with the pace of job creation reaching the fastest in the year to date.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.