- Analytics

- News and Tools

- Market News

- European session review: euro recovered in thin liquidity

European session review: euro recovered in thin liquidity

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 Eurozone indicator of investor confidence from Sentix July 9.9 1.7

8:30 UK index of business activity in the construction sector, m / m in June 51.2 50.5 46

9:00 Eurozone Producer Price Index m / m in May 0.3% 0.3% 0.6%

9:00 Eurozone Producer Price Index y / y in May -4.4% -4.1% -3.9%

The euro regained lost ground against the US dollar, returning to the opening levels. Initially, the euro decline was due to weaker data for nvestor confidence from Sentix. The survey results, published by the research group Sentix revealed that the mood among investors deteriorated significantly in July, reaching a 18-month low, which was associated with increased concerns about the economic impact of Brexit. It should be emphasized that the survey was conducted among 1056 investors from 30 June to 2 July.

According to the data, investors confidence indicator fell in June to 1.7 points versus 9.9 points prior. Analysts had expected the index to decline only to 5.0 points. The last reading was the lowest since January 2015.

"The outcome of the British referendum on membership in the EU has different effects on the global level in terms of economic expectations of investors abd mainly affected the euro zone abd therefore the euro zone economy is dangerously close to stagnation..", - Reported Sentix.

In addition, the sub-index measuring expectations dropped to -2.0 points from 10 points in June, reaching its lowest level since November 2014. Meanwhile, the index measuring the current state of the euro zone fell to 5.5 points from 9.8 points. The Sentix added that the European Central Bank is faced with huge pressure from the markets to act. The sub-index measuring expectations regarding monetary policy, rose to 30.5 points from 15 points.

The data also showed that the sentiment index in Germany - Europe's largest economy - fell to 18.4 from 20.7. Investors are also skeptical about the prospects for the German economy - the index measuring expectations fell to 2.7 from 7.9 in June.

A little later came the data on producer prices in the euro area, which have helped the single currency recover. Eurostat said that at the end of May, producer prices in the euro area increased by 0.6%. Analysts had expected growth only by 0.3%. Among the 28 EU countries was also recorded an increase of 0.6%. Recall that in April, prices fell by 0.3% in the euro area and by 0.1% in the EU28

In annual terms, the producer price index decreased by 3.9% in the euro area and by 3.7% in the EU. It was predicted that the index for the euro zone to fell by 4.1% after falling 4.4% in April.

The monthly change was due to the increase in prices in the energy sector (+ 1.7%), intermediate goods (+ 0.3%) and consumer non-durable goods (+ 0.1%). Meanwhile, the prices of capital goods and durable consumer goods remained unchanged. In general, rates in the energy industry increased by 0.2% in May.

The greatest increase compared with April was noted in Belgium (+ 2.7%), the Netherlands (+ 2.0%), Hungary (+ 1.6%) and Greece (+ 1.3%). Decrease was recorded in Latvia (-0.4%), Sweden (-0.2%) and Bulgaria (-0.1%).

The British pound is stable against the US dollar and still trading near 31-year lows, after data showed that construction sector activity in the UK unexpectedly fell in June to a seven-year low, adding to concerns over a slowdown in the British economy after Brexit referendum.

Today, US financial markets will be closed in celebration of Independence Day, resulting in reduced trading volumes.

Reported by Markit and the Chartered Institute of Purchasing and Supply showed that the index of business activity in the UK construction sector fell to a seasonally adjusted 46.0 from 51.2 in May.

Economists expected a decline to 50.5 in June.

Markit also indicated that the rate of decline was significantly lower than in the recession of 2008-2009.

The pound is under strong selling pressure after Britain shocked markets the decision to leave the European Union, causing uncertainty regarding the consequences for the economy and the world economy as a whole.

Pressure on the British currency strengthened after the Bank of England head Mark Carney indicated at the end of last week, that additional stimulus may be required, reinforcing expectations of future rate cuts.

EUR / USD: during the European session, the pair fell to $ 1.1097 and then rose to $ 1.1139

GBP / USD: trading in $ 1.3239 - $ 1.3307 range.

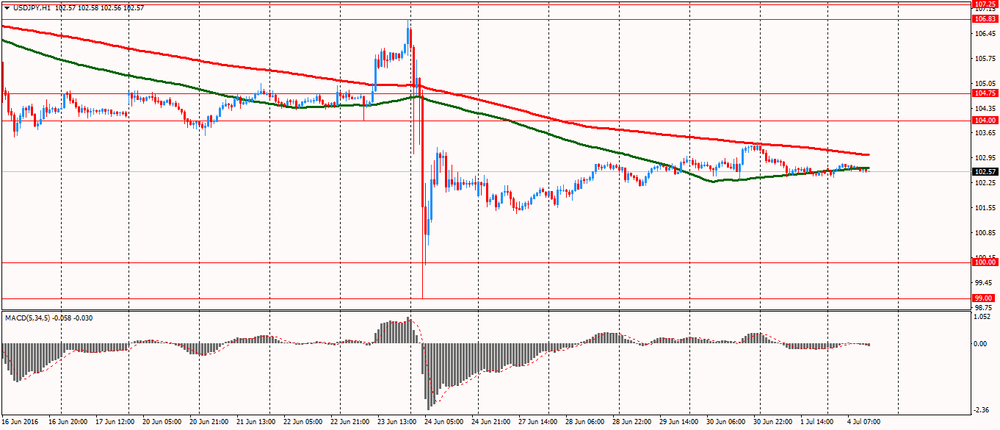

USD / JPY: fell to Y102.54.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.