- Analytics

- News and Tools

- Market News

- Goldman Sachs: we do not at this stage forecast a large under-shooting of the Pound

Goldman Sachs: we do not at this stage forecast a large under-shooting of the Pound

"We explain how we think about the Pound in the wake of the Brexit surprise.

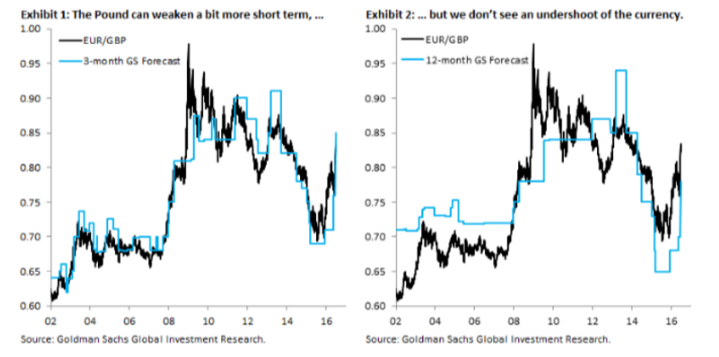

Following the "leave" vote, we revised our Sterling forecast substantially weaker, taking our view on EUR/GBP to 0.85, 0.82 and 0.78 in 3, 6 and 12 months, from 0.76, 0.74 and 0.70 previously. This forecast, together with our unchanged EUR/$ forecast of 1.12, 1.10 and 1.05 over the same period, implies GBP/$ at 1.32, 1.34 and 1.35 in 3, 6 and 12 months.

In other words, while we marked-to-market for the greater uncertainty and consequent hit to UK growth, we do not at this stage forecast a large under-shooting of the Pound, as exchange rates in emerging markets often do when there are adverse shocks.

The distinction with emerging markets is important. Emerging markets often have large current account deficits, much like the UK. Capital inflows then halt abruptly or even reverse on an adverse shock, a "sudden stop," and exchange rates tumble. This is not what is going on in the UK. In the wake of the Brexit vote, markets are functioning normally, capital is flowing in as well as out of the UK, and global risk markets are looking through what is a relatively minor shock for the global economy (the UK is less than 4 percent of world GDP).

The repercussions of recent events for the Pound are therefore not to be found in emerging market "sudden stops," but in the calmer realm of G10 growth shocks, where effects can still be sizeable, but nowhere near as large as "sudden stops."This is why our 3-month forecast for EUR/GBP allows for some modest further weakening in Sterling, with the cross going to 0.85 (Exhibit 1), but on a 12-month view we expect normalization, with EUR/GBP reverting to 0.78 (Exhibit 2). So think growth shock, not "sudden stop," and resist the temptation to extrapolate from EM to the UK".

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.