- Analytics

- News and Tools

- Market News

- Fade Any Near-Term Stabilisation Effort - Morgan Stanley

Fade Any Near-Term Stabilisation Effort - Morgan Stanley

"The vote to leave the EU has already and unsurprisingly prompted a significant market reaction, with the USD and JPY strengthening significantly, and GBP and EM currencies weakening substantially. While the risk of a policy response at multiple levels to stabilise markets is high, and has already led to a modest reversal of early losses, we believe the medium-term implications for growth, cross-border capital flows and risk taking more broadly mean that we are likely to see further USD and JPY strength and GBP, EM and commodity market weakness. As such, we would recommend fading any near-term stabilisation efforts.

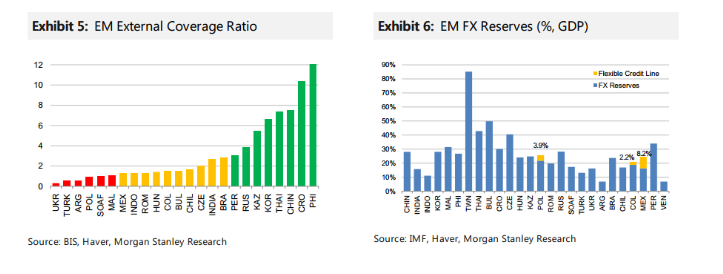

Pressure points: We see a number of pressure points that are likely to lead to further volatility in currency markets, with more USD and JPY strength and weakness in EM currencies.

First, the initial move lower in GBP, EUR, and other major and EM currencies has of course resulted in significant USD strength. This will likely create a self-reinforcing effect, with pressure likely to now emerge on CNY. Our RMB model suggests that the USD/CNY fixing will be 400pips higher, and this would create a second-round impact on regional peers such as KRW, TWD, THB and SGD.

Second, the market is quite likely to worry about the reverberations of this decision on the rest of Europe, with the risk that other countries may attempt to pursue a similar course of action. This could result in a tightening of financial conditions, retrenchment in the European banking sector, and a growth slowdown should concerns over a Euro breakup start to get priced back into the market. This would naturally spill over into global growth concerns.

Third, global monetary firepower to cope with another global economic downturn is relatively limited. Not only will this raise the odds of markets turning risk-negative, but it also allows for a more significant differentiation between those markets where we see scope for a monetary response and those where we do not. Economies where policy rates are still relatively elevated and there are no concerns about the currency reaction to easing are likely to see their currencies weaken. This is largely in the low-yielding Asia block, versus JPY and to some extent EUR".

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.