- Analytics

- News and Tools

- Market News

- Don't Buy EUR/USD at current levels - Credit Agricole

Don't Buy EUR/USD at current levels - Credit Agricole

eFXnews quoting a very clear Credit Agricole recommendation. Take it with a pinch of salt

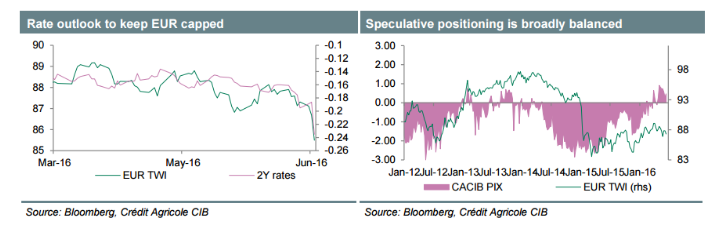

We expect the single currency to remain subject to downside risks. This is especially true as the latest UK-related development is likely to increase political uncertainty in the EU further and as more muted growth prospects should keep the ECB in a position to consider additional policy action if needed. As reiterated by ECB President Draghi this week, downside risks to growth and inflation remain significant and uncertainty high. At the same time he stressed that more can be done if needed. Although it remains too early to expect the central bank to consider further policy measures, there is no scope of rising rate expectations anytime soon. In an environment of EU specific risk aversion, we believe too that the EUR should remain positively correlated with risk aversion.

As a result of the above outlined conditions we advise against buying the EUR, especially against currencies such as the USD. It may be true that increased global growth uncertainty should prevent the Fed from tightening monetary policy anytime soon.

However, at the same time the USD is behaving more as a safe haven currency in the current environment. In terms of data next week's main focus will be on preliminary June CPI, which is unlikely to confirm improving price developments.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.