- Analytics

- News and Tools

- Market News

- European session: one of the most volatile sessions for the pound in modern history

European session: one of the most volatile sessions for the pound in modern history

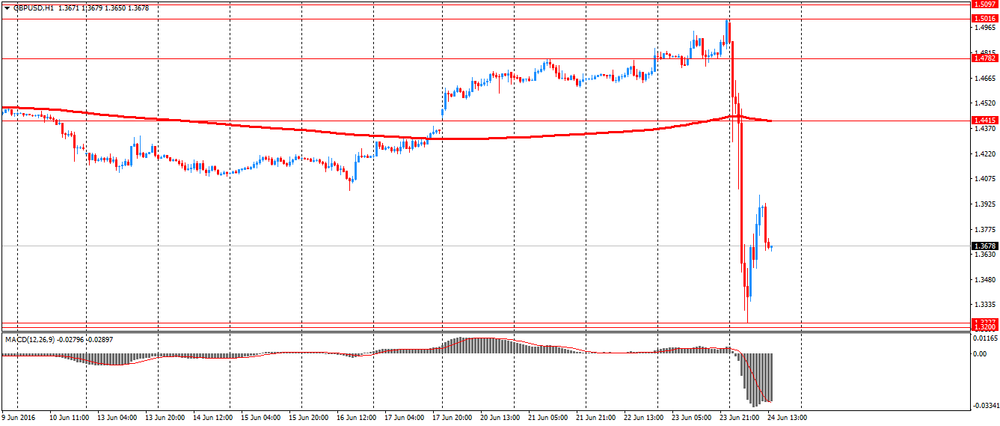

The pound sterling is experiencing one of the most volatile session in modern history, and reached the lowest level since 1985, as the British voted for withdrawal from the EU, triggering a flight to safer assetsas the yen, gold and the dollar.

Scotland and London by an overwhelming majority voted in favor of EU membership, but Wales and the rest of the United Kingdom voted in favor of Brexit.

The turnout at the referendum was 72% (more than 30 million people).

The head of the Bank of England Governor Mark Carney said that the central bank is ready to provide additional funds in the amount of 250 billion pounds ($ 345.93 billion) to support the financial markets after the British decision.

He also said that in the coming weeks, the regulator will consider the possibility of adopting additional measures of support.

Earlier, the Bank of England said it would take all necessary steps to ensure monetary and financial stability after the referendum.

"The Bank of England is closely monitoring the situation," - said in a statement the regulator.

According to BOE the decision to withdraw from the EU can cause a severe blow to the British economy and push up inflation due to a sudden fall in the value of sterling.

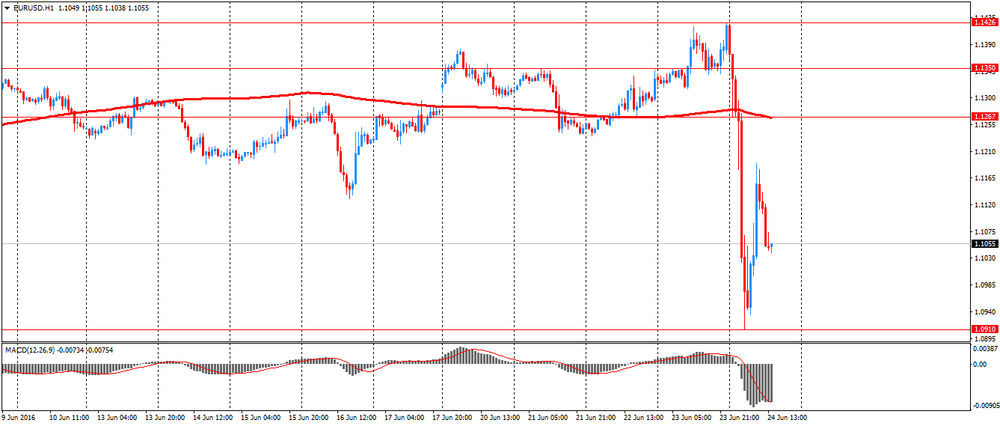

Euro fell more than 3% against the dollar, the Swiss franc has appreciated along with the yen, however, swings made traders wary of intervention by the G7.

The pound fell more than 10% to $ 1.3227, the lowest level since September 1985.

Eur/gbp rose 6.1% to 83.12, reaching a peak of more than two years.

However, euro came under pressure as investors feared that Brexit provoke secessionism in other European countries.

The euro fell 3.7% against the dollar to $ 1.0910, the lowest level since March.

The collapse of the European currency pushed the dollar index up by 2.9%. If the trend continues, it will be the highest one-day growth since 1978.

Along with the increasing concerns for Brexit demand for safer yen jumped, which surged against the euro and the dollar.

The dollar fell to 99.00 yen, having lost 6.7%, and then slightly recovered to 102.40. Dropped below 100 yen for the first time since the end of 2013.

The euro fell to 109.45 yen, the first time since the end of 2012.

Switzerland's central bank confirmed that intervened in the currency market to weaken the Swiss franc after Britain decided to withdraw from the EU.

Usually SNB declined to comment if is active or not in the currency market, but sometimes confirmes the moves.

EUR / USD: fell to $ 1.0911 and then rebounded to $ 1.1189

GBP / USD: fell to $ 1.3227 and then rebounded to $ 1.3979

USD / JPY: fell to Y98.99, and then recovered to Y103.25

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.