- Analytics

- News and Tools

- Market News

- European session: The calm before the storm

European session: The calm before the storm

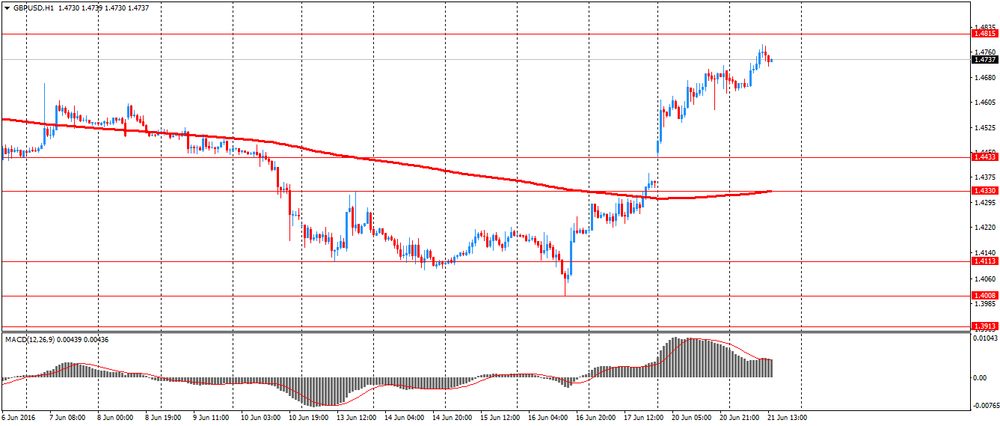

The British pound continued to rise at the begining of the session but now is underway a retracement due to a new survey which shows 44% leave, 45% remain.

Two polls on Monday indicated that the remain camp has restored a number of losses in the run-up to the referendum. The probability of a "remain" vote on Thursday rose to 78% after falling below 60% last week, according to the latest Betfair data. "Polls seem to indicate a growing support for" remain ", but the fact is that we do not know anything for sure until we see the results," - said Kёsuke Suzuki from Societe Generale.

Economic data also provided support for the pound. UK budget deficit narrowed in May, data released by the Office for National Statistics on Tuesday. Net borrowing of the public sector (PSNB) decreased by 0.4 billion pounds last year to 9.7 billion pounds in May. However, it was higher than the forecast level of 9.4 billion pounds.

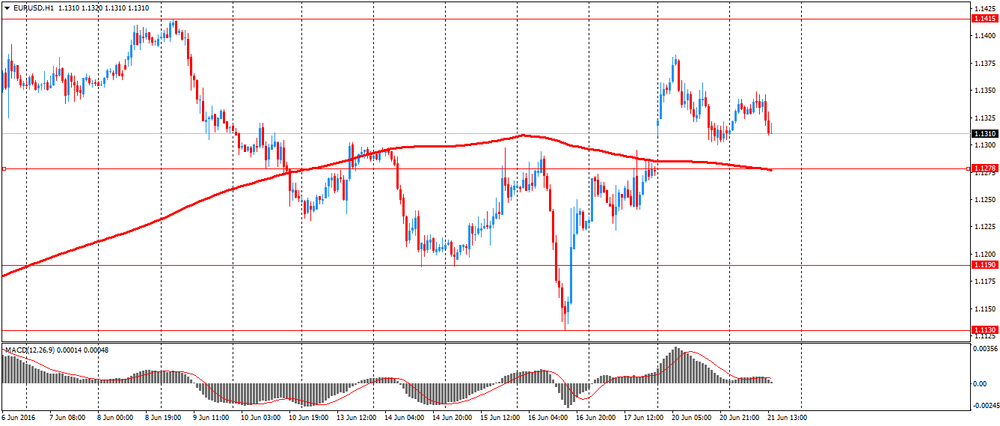

The euro rose against the dollar after the release of strong data regarding the sentiment in the business environment of the ZEW Institute in Germany, but then fell back to the opening price. The indicator of economic confidence in Germany has strengthened sharply in June. The index of economic sentiment unexpectedly rose to 19.2 from 6.4 in the previous month. Forecasts showed 4.7 points in June. In addition, the current situation index rose by 1.4 points to 54.5 in June. Forecast was 53.0.

"Improving economic sentiment indicates that the financial market experts have expressed confidence in the stability of the German economy," said ZEW President Achim Wambach. "However, the general economic conditions remain difficult. In addition to the weak global economic dynamics, referendum on EU membership in the UK, which causes uncertainty," said Wambach.

The indicator of economic sentiment in the euro zone rose by 3.4 points to 20.2 points in June. Meanwhile, the current situation indicator fell by 0.8 points to minus 10.0 points.

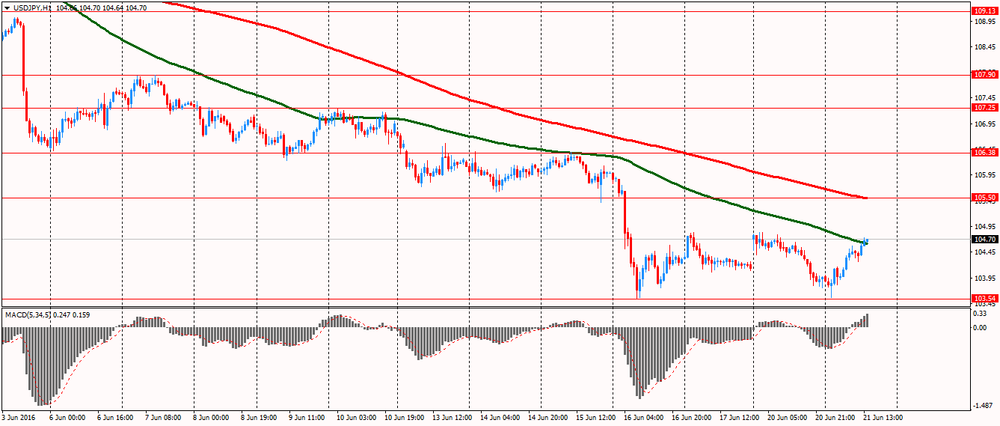

The US dollar was steady. Speech by US Federal Reserve Janet Yellen is expected at 14:00 GMT in the Senate Banking Committee. On Wednesday, she will present a semi-annual report to the US Senate. On Thursday, Yellen will present this report to the House of Representatives.

"Yellen may underline concerns about the US economy, which will put pressure on the dollar", - says chief strategist at SMBC Friend Securities Toshihiko Matsuno.

The yen depreciated vs the US dollar and the euro after a significant strengthening over the past few days. Over the previous seven sessions the yen gained 3% on the back of strong demand for "safe haven" assets amid fears of possible exit of Great Britain from the European Union.

EUR / USD: during the European session, the pair rose to $ 1.1349, and then fell to $ 1.1309

GBP / USD: during the European session, the pair rose to $ 1.4782 then the poll came and now we are 100 pips lower in a very sharp move. Imagine what will happen when the exit-polls will be published.

USD / JPY: during the European session, the pair rose to Y104.74© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.