- Analytics

- News and Tools

- Market News

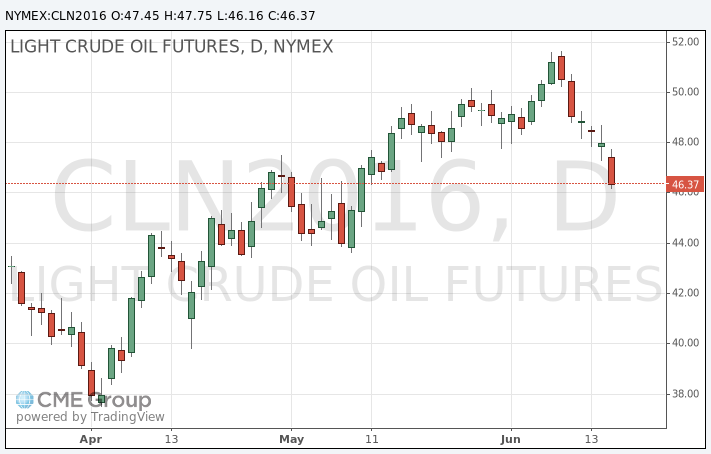

- Oil at one-month low

Oil at one-month low

Oil prices slumped 3 percent to hit a one-month low on Thursday, sliding a sixth straight day for the longest bear run since January, as the dollar's rally on fears of Britain's exit from the EU hammered commodities priced in the currency.

Also weighing on the oil complex were uninspiring drawdown data on U.S. crude inventories in spite of peak summer driving demand in the United States.

Brent crude futures' front-month contact was down at $47.20 per barrel.

Brent has lost about $5 a barrel, or nearly 10 percent, since the six-day slide began on June 9. Prior to that, it hit an eight-month high of nearly $53.

The front-month in U.S. crude's West Texas Intermediate (WTI) futures fell to $46.16 a barrel.

The dollar was up 0.7 percent, on track to its largest one-day gain in two months, as equity and other global markets were gripped by fear that Britain will vote in a week to leave the European Union, triggering economic slowdown on the continent and beyond.

"It is mainly risk aversion ahead of the Brexit vote next week, so we see some profit-taking on recent long positions ahead of this event," said Hans van Cleef, senior energy economist at ABN Amro in Amsterdam.

The dollar was also underpinned by hints from the Federal Reserve on Wednesday that there may be two U.S. rate hikes this year despite slower-than-expected growth. A stronger dollar makes oil and other commodities priced in the greenback less appealing to holders of the euro and other currencies.

U.S. crude inventory drawdowns over the last month have not provided much support to oil prices.

The U.S. Energy Information Administration said domestic crude inventories USOILC=ECI fell 933,000 barrels last week, less than half the 2.3-million-barrel decrease forecast.

On Thursday, market intelligence firm Genscape reported a decline of 76,317 barrels in stockpiles at the Cushing, Oklahoma delivery point for WTI futures during the week to June 14, traders who saw the data said. In the previous week to June 7, Genscape reported a drawdown of 299,058 barrels at Cushing.

"With investor positions already at a record high since the beginning of the year, they might want to reduce some of the risks," said Abhishek Deshpande, lead oil analyst at Natixis.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.