- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the Bank of England's interest rate decision

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the Bank of England's interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (MoM) May -1.9% Revised From -2.5% -1.1%

01:30 Australia New Motor Vehicle Sales (YoY) May 2.8% Revised From 2.4% 1.7%

01:30 Australia RBA Bulletin

01:30 Australia Unemployment rate May 5.7% 5.7% 5.7%

01:30 Australia Changing the number of employed May 0.9 Revised From 10.8 15 17.9

02:30 Australia RBA Assist Gov Lowe Speaks

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275 275

06:30 Japan BOJ Press Conference

07:30 Switzerland SNB Interest Rate Decision -0.75% -0.75% -0.75%

07:30 Switzerland SNB Monetary Policy Assessment

07:30 Switzerland SNB Press Conference

08:00 Eurozone ECB Economic Bulletin

08:30 United Kingdom Retail Sales (MoM) May 1.9% Revised From 1.3% 0.2% 0.9%

08:30 United Kingdom Retail Sales (YoY) May 5.2% Revised From 4.3% 3.9% 6%

09:00 Eurozone Harmonized CPI May 0% 0.3% 0.4%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May -0.2% -0.1% -0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) May 0.7% 0.8% 0.8%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

11:00 United Kingdom Bank of England Minutes

11:00 United Kingdom Asset Purchase Facility 375 375 375

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to rise by 6,000 to 270,000 last week.

The U.S. consumer price inflation is expected to remain unchanged at 1.1% year-on-year in May.

The U.S. consumer price index excluding food and energy is expected to increase to 2.2% year-on-year in May from 2.1% in April.

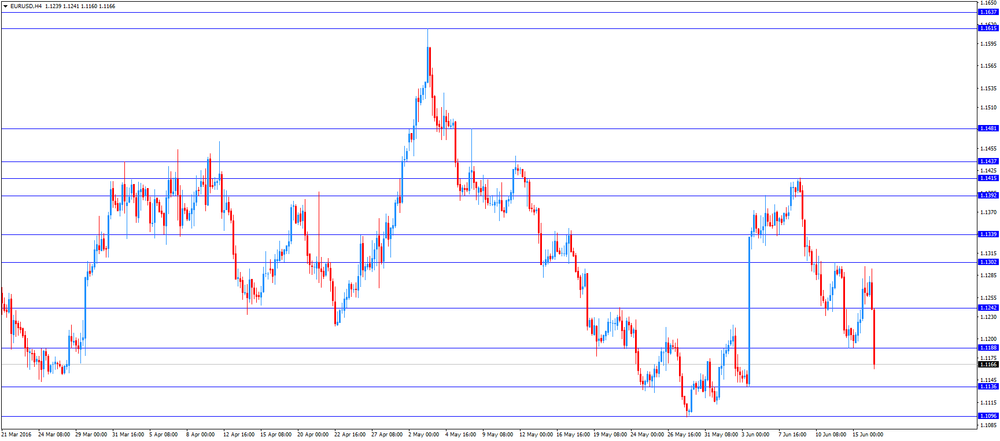

The euro traded lower against the U.S. dollar. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.4% in May, exceeding expectations for a 0.3% gain, after a flat reading in April.

On a yearly basis, Eurozone's final consumer price inflation increased to -0.1% in May from -0.2% in April, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in May, rents increased by 0.07%, tobacco rose by 0.07%, fuel prices for transport declined by 0.53%, heating oil prices decreased by 0.20%, while gas prices were down by 0.13%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 0.8% in May from 0.7 in April, in line with the preliminary reading.

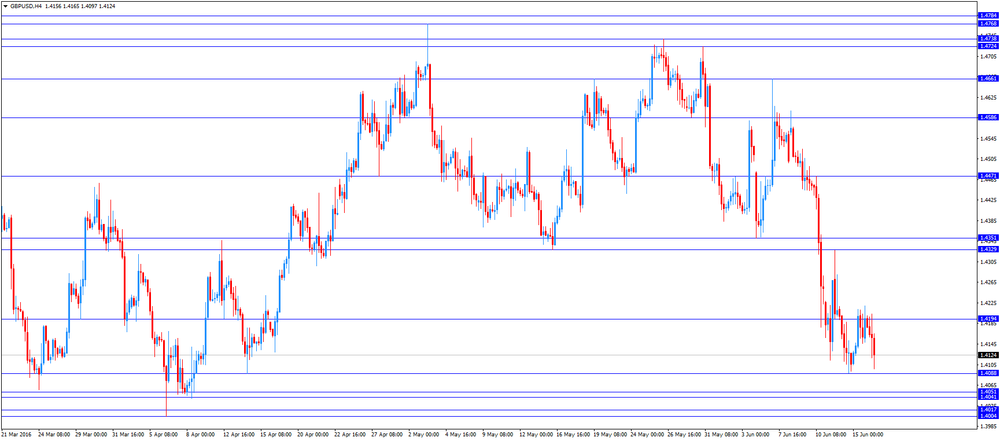

The British pound traded lower against the U.S. dollar after the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected. All members voted to keep the central bank's monetary policy unchanged.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 0.9% in May, exceeding expectations for a 0.2% gain, after a 1.9% rise in April. April's figure was revised up from a 1.3% increase.

The increase was mainly driven by a rise in clothing and footwear.

Food sales were up 1.1% in May, while non-food store sales increased 0.7%.

On a yearly basis, retail sales in the U.K. jumped 6.0% in May, beating forecasts of a 3.9% increase, after a 5.2% rise in April. April's figure was revised up from a 4.3% gain.

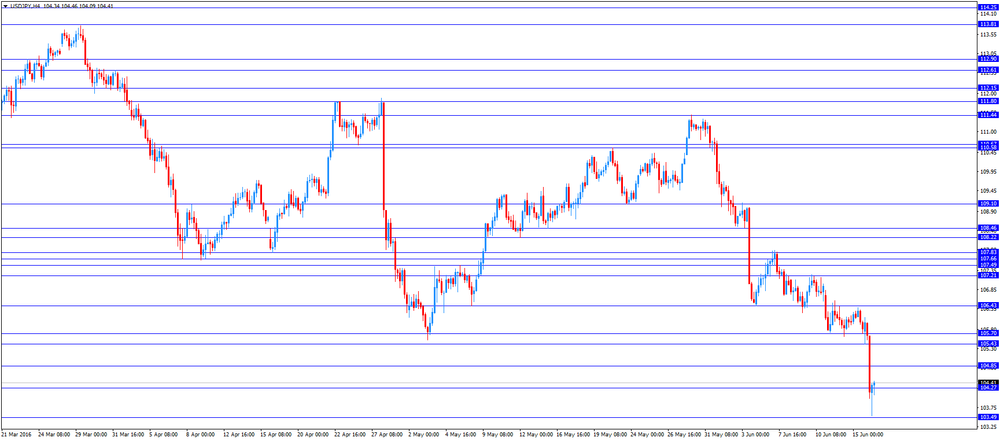

The Swiss franc traded lower against the U.S. dollar. The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market if needed. The SNB noted that the Swiss franc was still significantly overvalued.

EUR/USD: the currency pair declined to $1.1160

GBP/USD: the currency pair fell to $1.4097

USD/JPY: the currency pair rose to Y104.46

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases April 17.17

12:30 U.S. Current account, bln Quarter I -125.3 -125

12:30 U.S. Philadelphia Fed Manufacturing Survey June -1.8

12:30 U.S. Initial Jobless Claims June 264 270

12:30 U.S. CPI, m/m May 0.4% 0.3%

12:30 U.S. CPI, Y/Y May 1.1% 1.1%

12:30 U.S. CPI excluding food and energy, m/m May 0.2% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y May 2.1% 2.2%

14:00 U.S. NAHB Housing Market Index June 58 59

20:00 United Kingdom BOE Gov Mark Carney Speaks

22:30 New Zealand Business NZ PMI May 56.5

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.